Citi Investment Banking Pitch Book

WACC Calculation

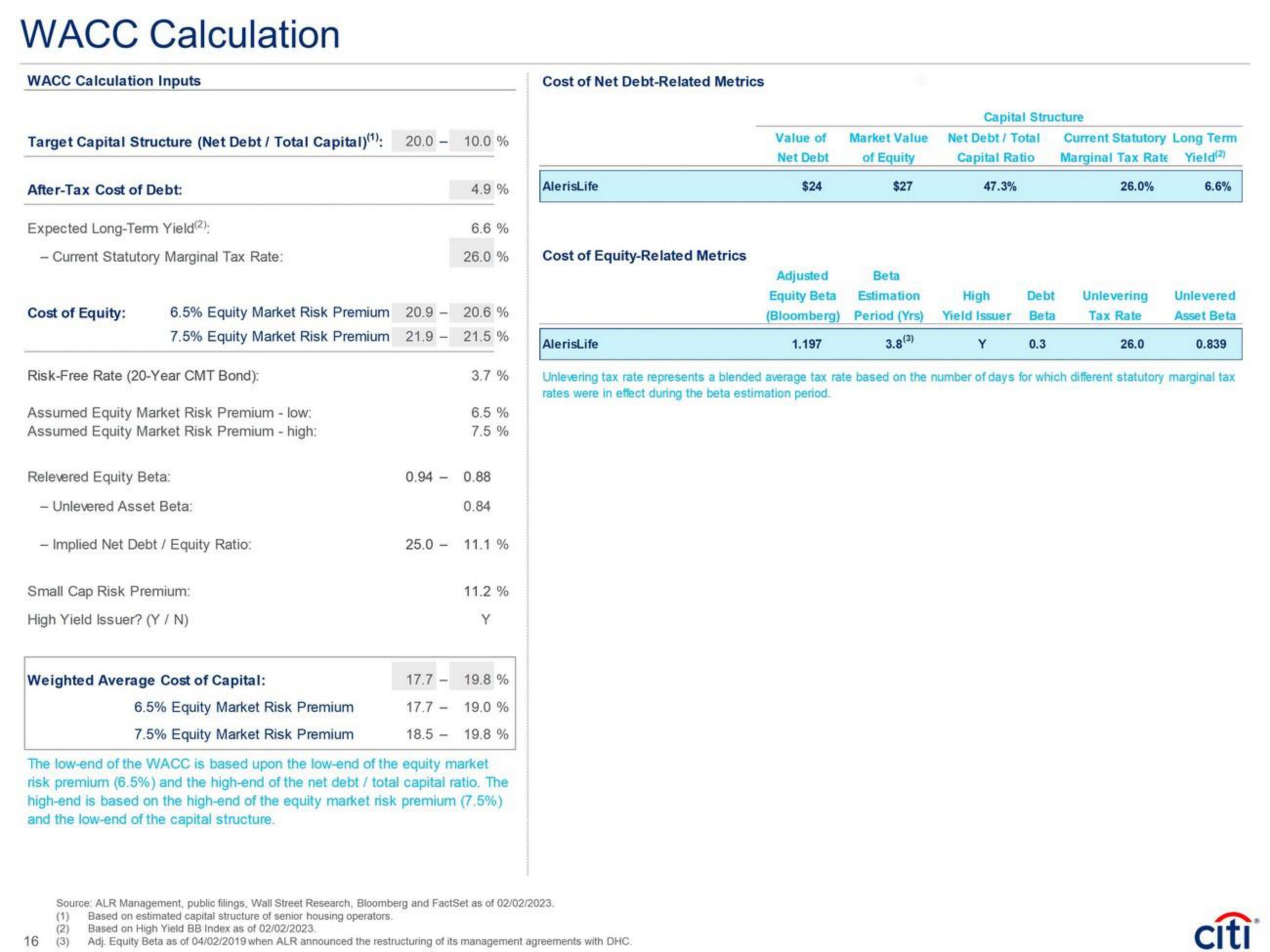

WACC Calculation Inputs

Target Capital Structure (Net Debt / Total Capital)(¹): 20.0 10.0 %

After-Tax Cost of Debt:

Expected Long-Term Yield(2):

- Current Statutory Marginal Tax Rate:

Cost of Equity:

Risk-Free Rate (20-Year CMT Bond):

Assumed Equity Market Risk Premium - low:

Assumed Equity Market Risk Premium - high:

6.5% Equity Market Risk Premium 20.9 -

7.5% Equity Market Risk Premium 21.9 -

Relevered Equity Beta:

- Unlevered Asset Beta:

- Implied Net Debt / Equity Ratio:

Small Cap Risk Premium:

High Yield Issuer? (Y/N)

16

0.94-

(1)

(2)

(3)

4.9 %

6.6 %

26.0 %

20.6 %

21.5 %

3.7 %

6.5 %

7.5%

0.88

0.84

25.0 11.1 %

11.2 %

Weighted Average Cost of Capital:

17.7

17.7

18.5

6.5% Equity Market Risk Premium

7.5% Equity Market Risk Premium

The low-end of the WACC is based upon the low-end of the equity market

risk premium (6.5%) and the high-end of the net debt / total capital ratio. The

high-end is based on the high-end of the equity market risk premium (7.5%)

and the low-end of the capital structure.

Y

19.8 %

19.0 %

19.8 %

Cost of Net Debt-Related Metrics

AlerisLife

Cost of Equity-Related Metrics

AlerisLife

Source: ALR Management, public filings, Wall Street Research, Bloomberg and FactSet as of 02/02/2023.

Based on estimated capital structure of senior housing operators.

Based on High Yield BB Index as of 02/02/2023.

Adj. Equity Beta as of 04/02/2019 when ALR announced the restructuring of its management agreements with DHC.

Value of

Net Debt

$24

Adjusted

Equity Beta

(Bloomberg)

1.197

Market Value

of Equity

$27

Beta

Estimation

Period (Yrs)

3.8 (3)

Capital Structure

Net Debt / Total

Capital Ratio

47.3%

High

Yield Issuer

Y

Debt

Beta

0.3

Current Statutory Long Term

Marginal Tax Rate Yield(2)

26.0%

Unlevering

Tax Rate

26.0

6.6%

Unlevered

Asset Beta

0.839

Unlevering tax rate represents a blended average tax rate based on the number of days for which different statutory marginal tax

rates were in effect during the beta estimation period.

cítiView entire presentation