LSE Investor Presentation Deck

Post Trade

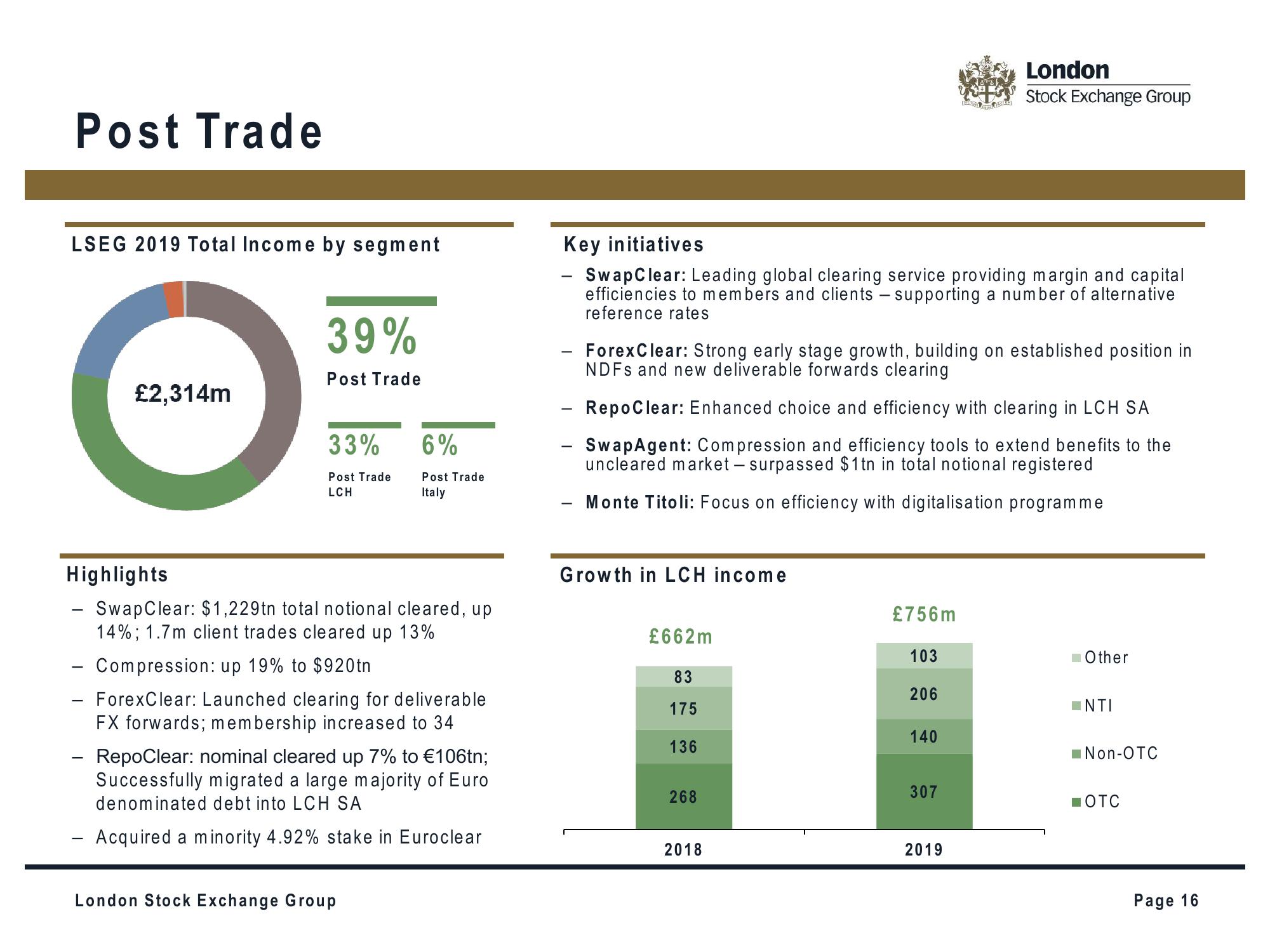

LSEG 2019 Total Income by segment

£2,314m

39%

Post Trade

33%

Post Trade

LCH

6%

Post Trade

Italy

Highlights

SwapClear: $1,229tn total notional cleared, up

14%; 1.7m client trades cleared up 13%

Compression: up 19% to $920tn

ForexClear: Launched clearing for deliverable

FX forwards; membership increased to 34

RepoClear: nominal cleared up 7% to €106tn;

Successfully migrated a large majority of Euro

denominated debt into LCH SA

- Acquired a minority 4.92% stake in Euroclear

London Stock Exchange Group

Key initiatives

SwapClear: Leading global clearing service providing margin and capital

efficiencies to members and clients - supporting a number of alternative

reference rates

-

-

-

ForexClear: Strong early stage growth, building on established position in

NDFs and new deliverable forwards clearing

RepoClear: Enhanced choice and efficiency with clearing in LCH SA

SwapAgent: Compression and efficiency tools to extend benefits to the

uncleared market - surpassed $1tn in total notional registered

Monte Titoli: Focus on efficiency with digitalisation programme

Growth in LCH income

£662m

83

175

136

268

2018

£756m

103

206

140

London

Stock Exchange Group

307

2019

Other

INTI

Non-OTC

OTC

Page 16View entire presentation