dLocal Investor Day Presentation Deck

Share of TPV

Share of revenues

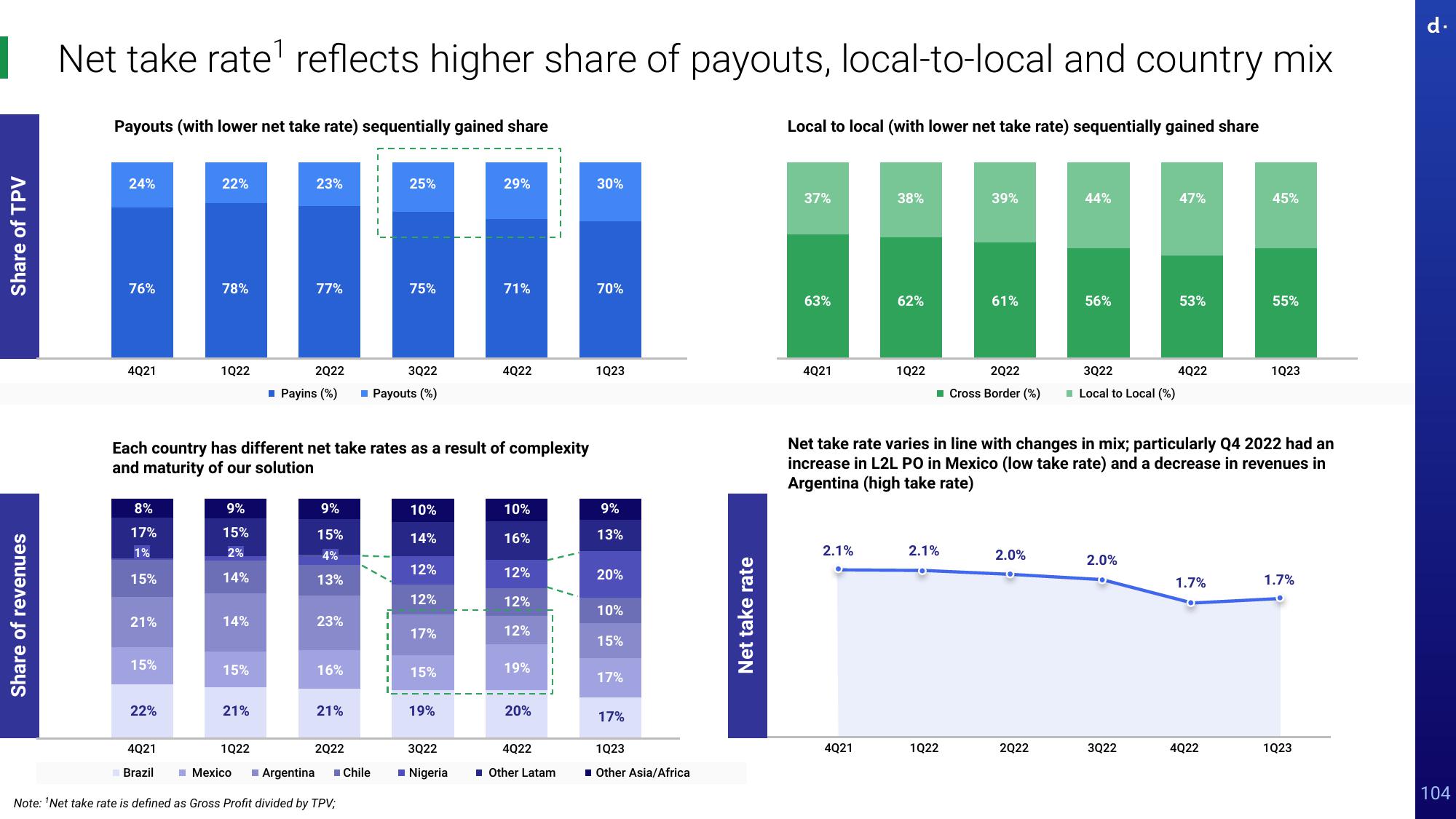

Net take rate¹ reflects higher share of payouts, local-to-local and country mix

Payouts (with lower net take rate) sequentially gained share

24%

76%

4Q21

8%

17%

1%

15%

21%

15%

22%

22%

4Q21

Brazil

78%

1Q22

9%

15%

2%

14%

14%

15%

Each country has different net take rates as a result of complexity

and maturity of our solution

21%

1Q22

Mexico

23%

77%

Argentina

2Q22

3Q22

■ Payins (%) ■ Payouts (%)

9%

15%

4%

13%

23%

16%

21%

2Q22

25%

Note: ¹Net take rate is defined as Gross Profit divided by TPV;

75%

Chile

10%

14%

12%

12%

17%

15%

19%

29%

3Q22

■ Nigeria

71%

4Q22

10%

16%

12%

12%

12%

19%

20%

4Q22

T

Other Latam

30%

70%

1Q23

9%

13%

20%

10%

15%

17%

17%

1Q23

■ Other Asia/Africa

Net take rate

Local to local (with lower net take rate) sequentially gained share

37%

63%

4Q21

2.1%

38%

4Q21

62%

1Q22

39%

2022

■ Cross Border (%)

2.1%

61%

1Q22

2.0%

44%

2022

56%

3Q22

■Local to Local (%)

Net take rate varies in line with changes in mix; particularly Q4 2022 had an

increase in L2L PO in Mexico (low take rate) and a decrease in revenues in

Argentina (high take rate)

2.0%

47%

3Q22

53%

4Q22

1.7%

45%

4Q22

55%

1Q23

1.7%

1Q23

d.

104View entire presentation