Pershing Square Activist Presentation Deck

II. Pershing's View of McDonald's

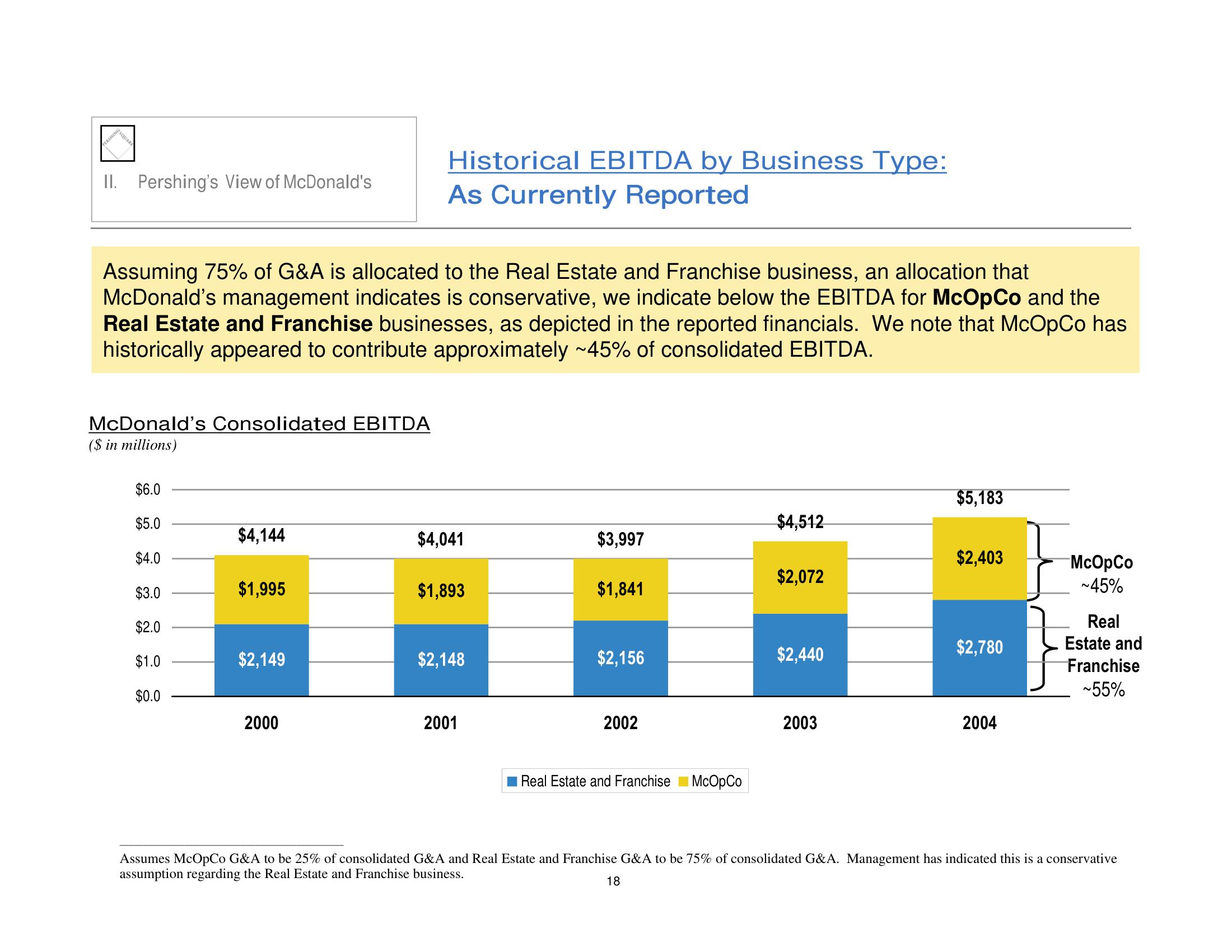

Assuming 75% of G&A is allocated to the Real Estate and Franchise business, an allocation that

McDonald's management indicates is conservative, we indicate below the EBITDA for McOpCo and the

Real Estate and Franchise businesses, as depicted in the reported financials. We note that McOpCo has

historically appeared to contribute approximately ~45% of consolidated EBITDA.

McDonald's Consolidated EBITDA

($ in millions)

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

$0.0

$4,144

$1,995

$2,149

Historical EBITDA by Business Type:

As Currently Reported

2000

$4,041

$1,893

$2,148

2001

$3,997

$1,841

$2,156

2002

Real Estate and Franchise McOpCo

$4,512

18

$2,072

$2,440

2003

$5,183

$2,403

$2,780

2004

McOpCo

~45%

Real

Estate and

Franchise

~55%

Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A. Management has indicated this is a conservative

assumption regarding the Real Estate and Franchise business.View entire presentation