AG Direct Lending SMA

ANGELO

AG GORDON

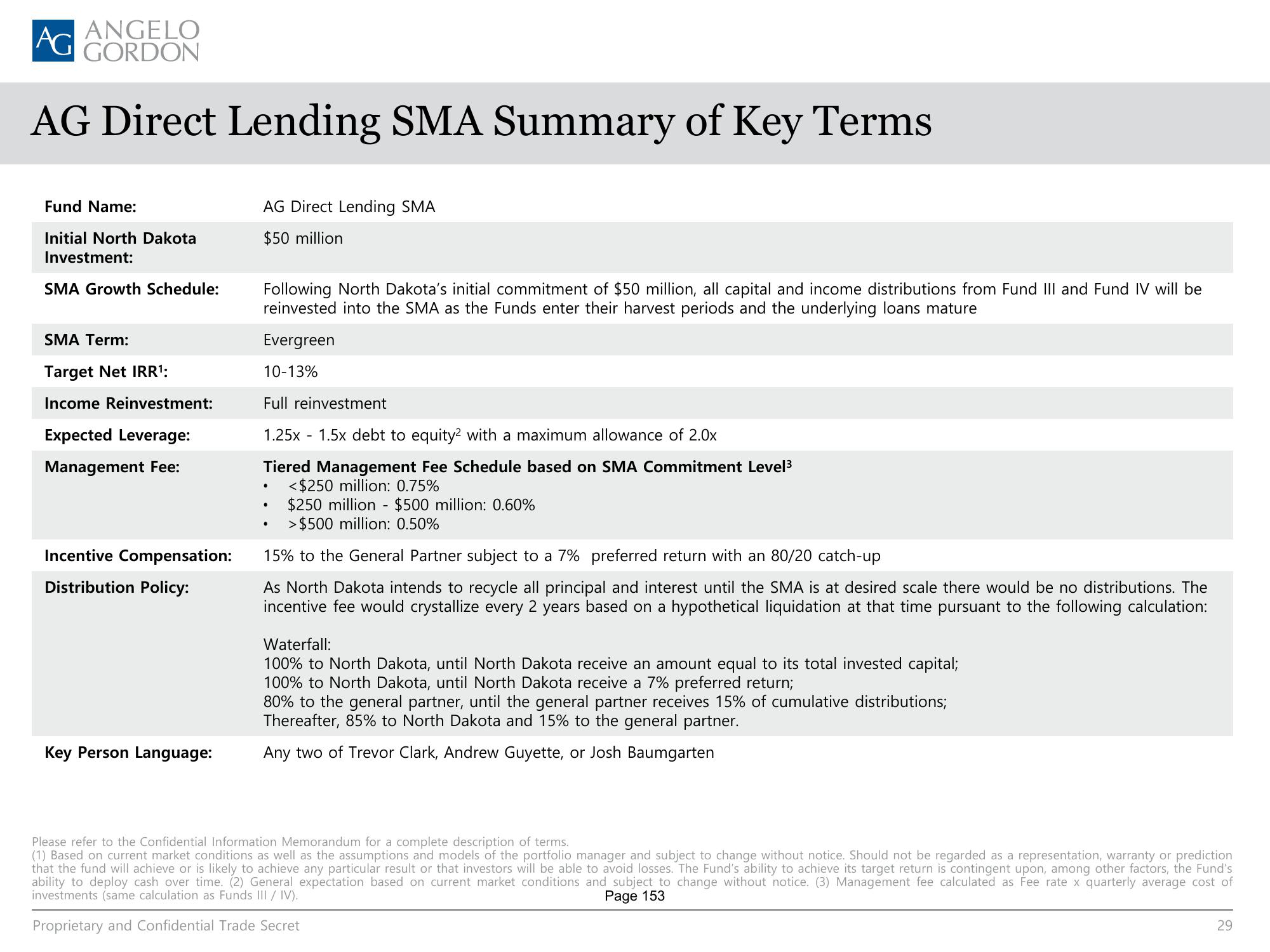

AG Direct Lending SMA Summary of Key Terms

Fund Name:

Initial North Dakota

Investment:

SMA Growth Schedule:

SMA Term:

Target Net IRR¹:

Income Reinvestment:

Expected Leverage:

Management Fee:

Compensation:

Distribution Policy:

In

Key Person Language:

AG Direct Lending SMA

$50 million

Following North Dakota's initial commitment of $50 million, all capital and income distributions from Fund III and Fund IV will be

reinvested into the SMA as the Funds enter their harvest periods and the underlying loans mature

Evergreen

10-13%

Full reinvestment

1.25x1.5x debt to equity2 with a maximum allowance of 2.0x

Tiered Management Fee Schedule based on SMA Commitment Level³

<$250 million: 0.75%

●

$250 million $500 million: 0.60%

>$500 million: 0.50%

15% to the eneral Partner subject to a 7% preferred retu with an 80/20 catch-up

As North Dakota intends to recycle all principal and interest until the SMA is at desired scale there would be no distributions. The

incentive fee would crystallize every 2 years based on a hypothetical liquidation at that time pursuant to the following calculation:

•

Waterfall:

100% to North Dakota, until North Dakota receive an amount equal to its total invested capital;

100% to North Dakota, until North Dakota receive a 7% preferred return;

80% to the general partner, until the general partner receives 15% of cumulative distributions;

Thereafter, 85% to North Dakota and 15% to the general partner.

Any two of Trevor Clark, Andrew Guyette, or Josh Baumgarten

Please refer to the Confidential Information Memorandum for a complete description of terms.

(1) Based on current market conditions as well as the assumptions and models of the portfolio manager and subject to change without notice. Should not be regarded as a representation, warranty or prediction

that the fund will achieve or is likely to achieve any particular result or that investors will be able to avoid losses. The Fund's ability to achieve its target return is contingent upon, among other factors, the Fund's

ability to deploy cash over time. (2) General expectation based on current market conditions and subject to change without notice. (3) Management fee calculated as Fee rate x quarterly average cost of

investments (same calculation as Funds III / IV).

Page 153

Proprietary and Confidential Trade Secret

29View entire presentation