Trian Partners Activist Presentation Deck

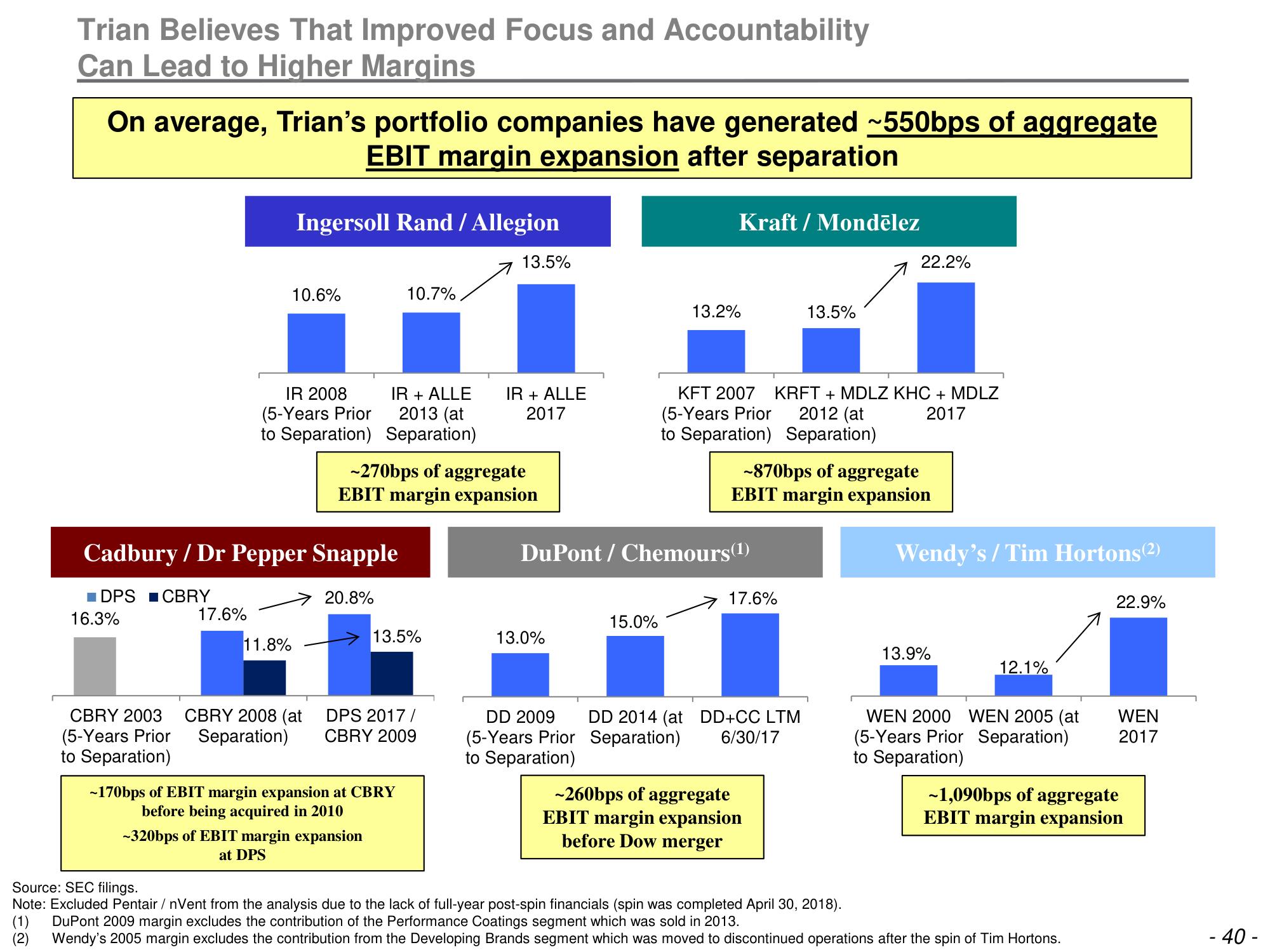

Trian Believes That Improved Focus and Accountability

Can Lead to Higher Margins

On average, Trian's portfolio companies have generated ~550bps of aggregate

EBIT margin expansion after separation

CBRY 2003

(5-Years Prior

to Separation)

17.6%

Ingersoll Rand / Allegion

10.6%

IR 2008

(5-Years Prior

to Separation)

11.8%

Cadbury / Dr Pepper Snapple

20.8%

■ DPS CBRY

16.3%

IR + ALLE

2013 (at

Separation)

0.7%

-270bps of aggregate

EBIT margin expansion

-320bps of EBIT margin expansion

at DPS

13.5%

CBRY 2008 (at DPS 2017/

Separation) CBRY 2009

-170bps of EBIT margin expansion at CBRY

before being acquired in 2010

13.5%

IR + ALLE

2017

13.0%

Kraft / Mondēlez

15.0%

13.2%

DuPont / Chemours (1)

KFT 2007 KRFT + MDLZ KHC + MDLZ

(5-Years Prior 2012 (at

2017

to Separation) Separation)

-870bps of aggregate

EBIT margin expansion

17.6%

13.5%

DD 2009 DD 2014 (at DD+CC LTM

(5-Years Prior Separation) 6/30/17

to Separation)

22.2%

-260bps of aggregate

EBIT margin expansion

before Dow merger

Wendy's / Tim Hortons (2)

13.9%

12.1%

WEN 2000 WEN 2005 (at

(5-Years Prior Separation)

to Separation)

22.9%

Source: SEC filings.

Note: Excluded Pentair /nVent from the analysis due to the lack of full-year post-spin financials (spin was completed April 30, 2018).

(1) DuPont 2009 margin excludes the contribution of the Performance Coatings segment which was sold in 2013.

(2) Wendy's 2005 margin excludes the contribution from the Developing Brands segment which was moved to discontinued operations after the spin of Tim Hortons.

WEN

2017

~1,090bps of aggregate

EBIT margin expansion

- 40 -View entire presentation