J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

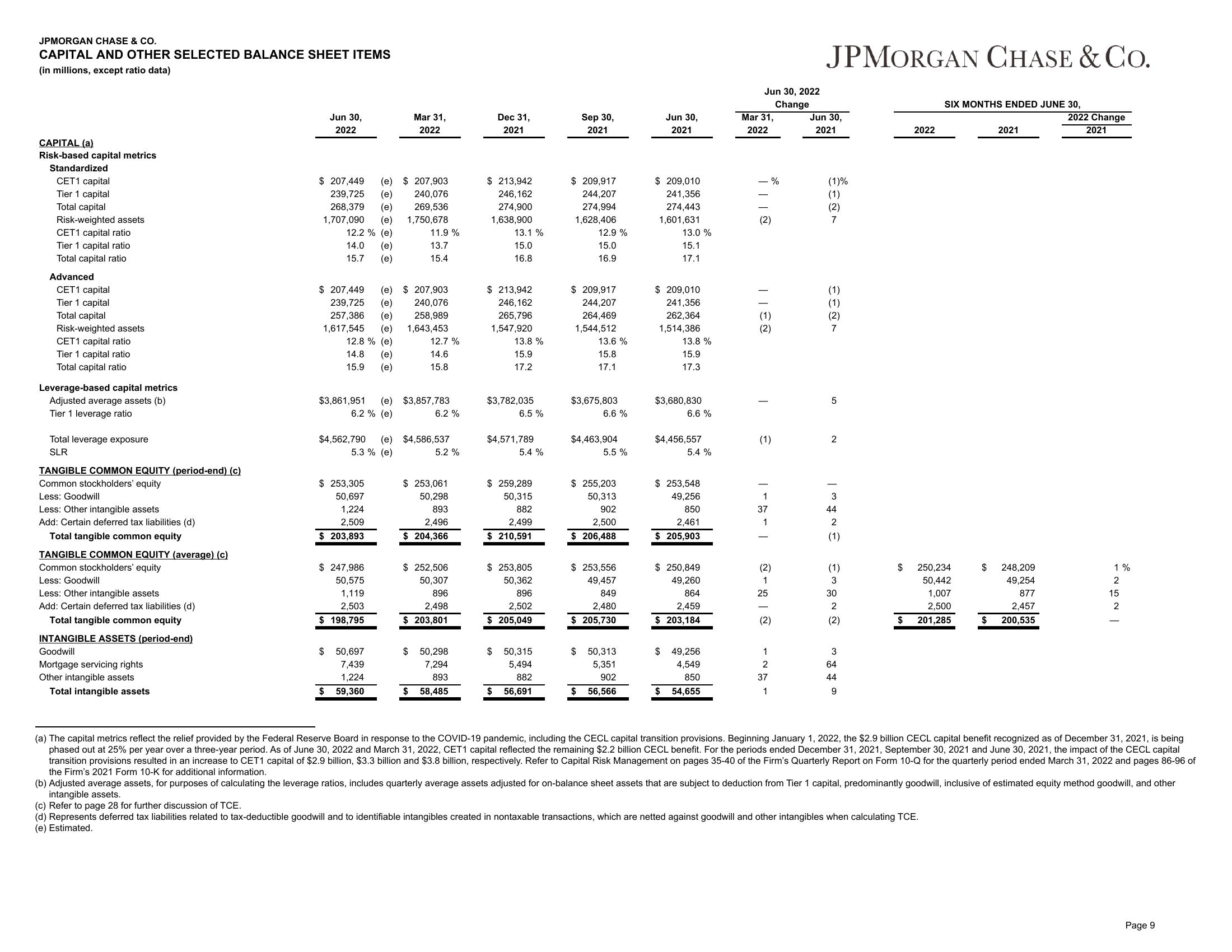

CAPITAL AND OTHER SELECTED BALANCE SHEET ITEMS

(in millions, except ratio data)

CAPITAL (a)

Risk-based capital metrics

Standardized

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Advanced

CET1 capital

Tier 1 capital

Total capital

Risk-weighted assets

CET1 capital ratio

Tier 1 capital ratio

Total capital ratio

Leverage-based capital metrics

Adjusted average assets (b)

Tier 1 leverage ratio

Total leverage exposure

SLR

TANGIBLE COMMON EQUITY (period-end) (c)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (d)

Total tangible common equity

TANGIBLE COMMON EQUITY (average) (c)

Common stockholders' equity

Less: Goodwill

Less: Other intangible assets

Add: Certain deferred tax liabilities (d)

Total tangible common equity

INTANGIBLE ASSETS (period-end)

Goodwill

Mortgage servicing rights

Other intangible assets

Total intangible assets

Jun 30,

2022

$ 207,449 (e) $207,903

239,725 (e)

240,076

269,536

268,379 (e)

1,707,090 (e) 1,750,678

12.2% (e)

14.0 (e)

15.7 (e)

$ 207,449 (e) $207,903

239,725 (e) 240,076

257,386 (e) 258,989

1,617,545 (e) 1,643,453

12.8 % (e)

14.8 (e)

15.9 (e)

Mar 31,

2022

$ 253,305

50,697

1,224

2,509

$ 203,893

$3,861,951 (e) $3,857,783

6.2 % (e)

6.2 %

$247,986

50,575

1,119

2,503

$ 198,795

$

11.9%

13.7

15.4

$4,562,790 (e) $4,586,537

5.3% (e)

50,697

7,439

1,224

$ 59,360

12.7 %

14.6

15.8

5.2 %

$ 253,061

50,298

893

2,496

$ 204,366

$ 252,506

50,307

896

2,498

$ 203,801

$ 50,298

7,294

893

$ 58,485

Dec 31,

2021

$ 213,942

246,162

274,900

1,638,900

13.1 %

15.0

16.8

$ 213,942

246,162

265,796

1,547,920

13.8 %

15.9

17.2

$3,782,035

6.5%

$4,571,789

5.4 %

$ 259,289

50,315

882

2,499

$ 210,591

$ 253,805

50,362

896

2,502

$ 205,049

$ 50,315

5,494

882

$ 56,691

Sep 30,

2021

$209,917

244,207

274,994

1,628,406

12.9 %

15.0

16.9

$ 209,917

244,207

264,469

1,544,512

13.6 %

15.8

17.1

$3,675,803

6.6%

$4,463,904

5.5 %

$ 255,203

50,313

902

2,500

$206,488

$ 253,556

49,457

849

2,480

$ 205,730

$ 50,313

5,351

902

$ 56,566

Jun 30,

2021

$ 209,010

241,356

274,443

1,601,631

13.0 %

15.1

17.1

$209,010

241,356

262,364

1,514,386

13.8%

15.9

17.3

$3,680,830

6.6 %

$4,456,557

5.4 %

$ 253,548

49,256

850

2,461

$ 205,903

$ 250,849

49,260

864

2,459

$203,184

$ 49,256

4,549

850

$ 54,655

Jun 30, 2022

Change

Mar 31,

2022

| ||

(2)

1130

I

%

(1)

1

37

1

(2)

1

25

(2)

1

2

37

1

JPMORGAN CHASE & CO.

Jun 30,

2021

(1)%

(1)

(2)

7

(1)

(1)

(2)

7

5

2

N NO WÊ EN #w/

44

(1)

30

3

64

44

9

2022

$

SIX MONTHS ENDED JUNE 30,

$ 250,234

50,442

1,007

2,500

201,285

2021

$ 248,209

49,254

877

2,457

$ 200,535

2022 Change

2021

INGNO

(a) The capital metrics reflect the relief provided by the Federal Reserve Board in response to the COVID-19 pandemic, including the CECL capital transition provisions. Beginning January 1, 2022, the $2.9 billion CECL capital benefit recognized as of December 31, 2021, is being

phased out at 25% per year over a three-year period. As of June 30, 2022 and March 31, 2022, CET1 capital reflected the remaining $2.2 billion CECL benefit. For the periods ended December 31, 2021, September 30, 2021 and June 30, 2021, the impact of the CECL capital

transition provisions resulted in an increase to CET1 capital of $2.9 billion, $3.3 billion and $3.8 billion, respectively. Refer to Capital Risk Management on pages 35-40 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2022 and pages 86-96 of

the Firm's 2021 Form 10-K for additional information.

(b) Adjusted average assets, for purposes of calculating the leverage ratios, includes quarterly average assets adjusted for on-balance sheet assets that are subject to deduction from Tier 1 capital, predominantly goodwill, inclusive of estimated equity method goodwill, and other

intangible assets.

(c) Refer to page 28 for further discussion of TCE.

(d) Represents deferred tax liabilities related to tax-deductible goodwill and to identifiable intangibles created in nontaxable transactions, which are netted against goodwill and other intangibles when calculating TCE.

(e) Estimated.

Page 9View entire presentation