Talkspace Results Presentation Deck

Reconciliation of Net Income to Adjusted EBITDA

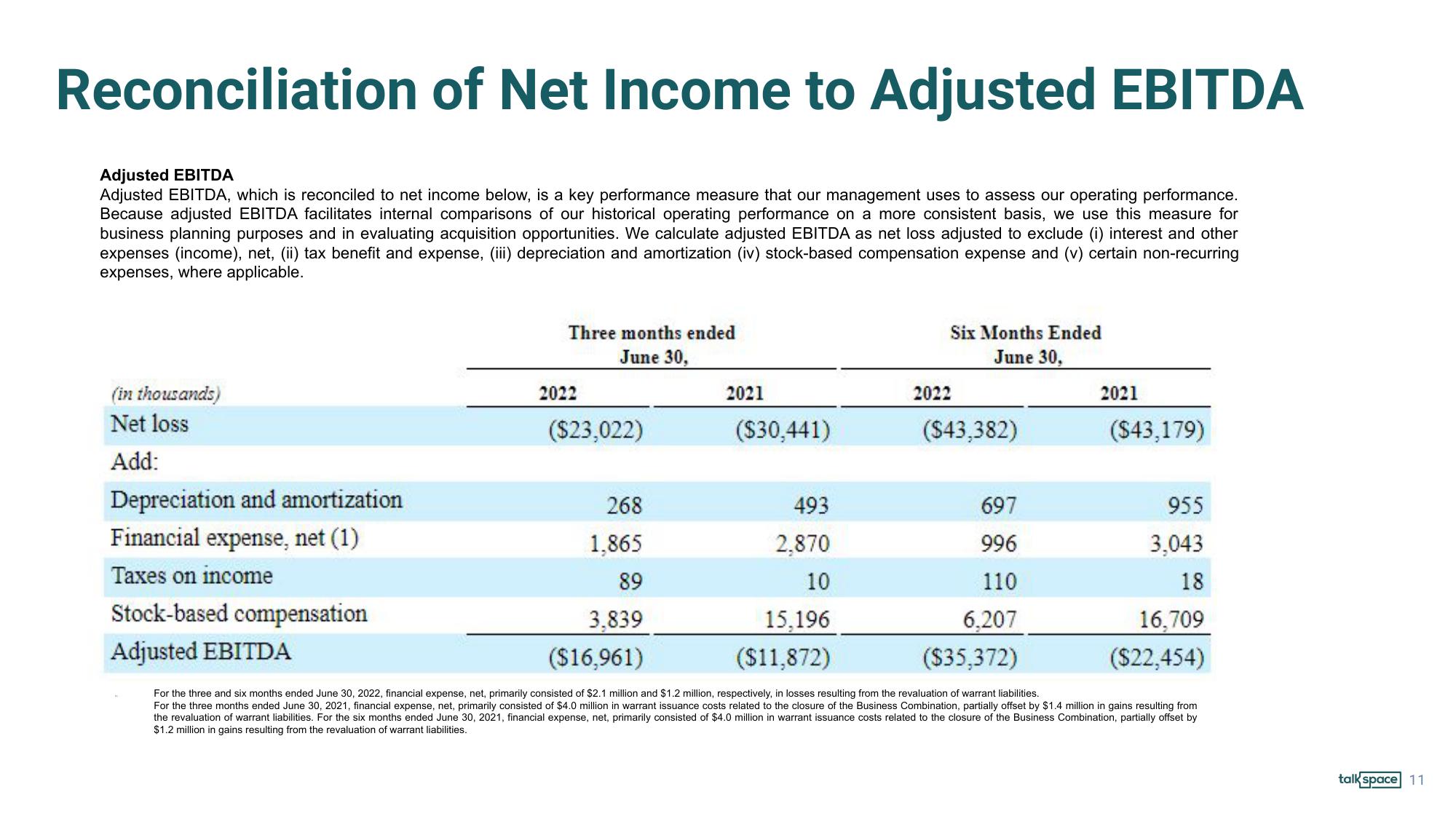

Adjusted EBITDA

Adjusted EBITDA, which is reconciled to net income below, is a key performance measure that our management uses to assess our operating performance.

Because adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for

business planning purposes and in evaluating acquisition opportunities. We calculate adjusted EBITDA as net loss adjusted to exclude (i) interest and other

expenses (income), net, (ii) tax benefit and expense, (iii) depreciation and amortization (iv) stock-based compensation expense and (v) certain non-recurring

expenses, where applicable.

(in thousands)

Net loss

Add:

Depreciation and amortization

Financial expense, net (1)

Taxes on income

Three months ended

June 30,

Stock-based compensation

Adjusted EBITDA

2022

($23,022)

2021

($30,441)

493

2,870

10

Six Months Ended

June 30,

2022

($43,382)

2021

($43,179)

268

697

1,865

996

89

110

3,839

6,207

15,196

($11,872)

($16,961)

($35,372)

For the three and six months ended June 30, 2022, financial expense, net, primarily consisted of $2.1 million and $1.2 million, respectively, in losses resulting from the revaluation of warrant liabilities.

For the three months ended June 30, 2021, financial expense, net, primarily consisted of $4.0 million in warrant issuance costs related to the closure of the Business Combination, partially offset by $1.4 million in gains resulting from

the revaluation of warrant liabilities. For the six months ended June 30, 2021, financial expense, net, primarily consisted of $4.0 million in warrant issuance costs related to the closure of the Business Combination, partially offset by

$1.2 million in gains resulting from the revaluation of warrant liabilities.

955

3,043

18

16,709

($22,454)

talk space 11View entire presentation