Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

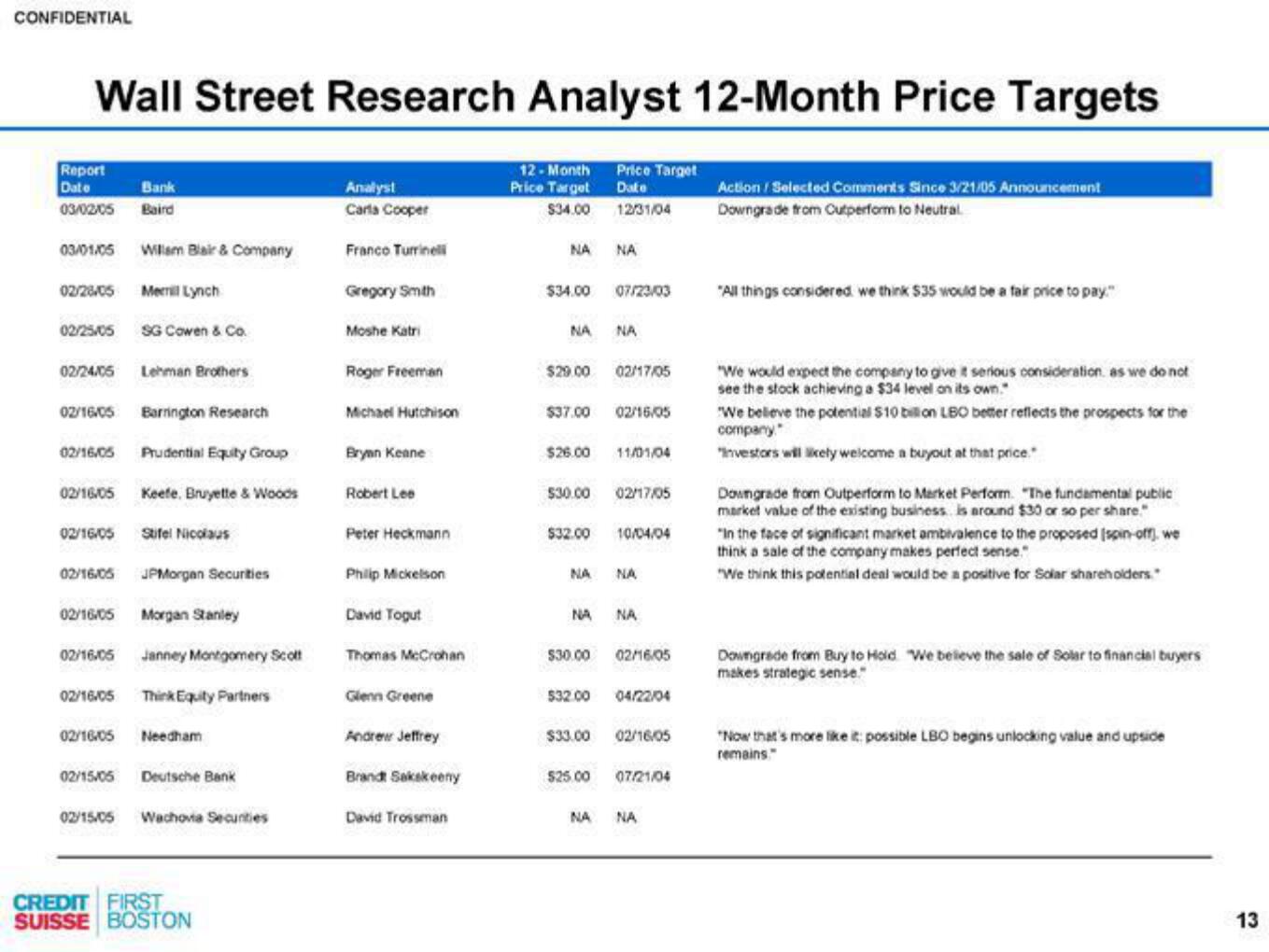

Wall Street Research Analyst 12-Month Price Targets

12-Month Price Target

Price Target Date

$34.00

12/31/04

Report

Date

Bank

03/02/05 Baird

03/01/05 Willem Blair & Company

02/28/05 Merrill Lynch

02/25/05

02/24/05 Lehman Brothers

SG Cowen & Co.

02/16/05 Barrington Research

02/16/05

02/16/05

Prudential Equity Group

Keefe, Bruyette & Woods

02/16/05 Stifel Nicolaus

02/16/05 JPMorgan Securities

02/16/05 Morgan Stanley

02/16/05 Janney Montgomery Scott

02/16/05 Think Equity Partners

02/16/05 Needham

02/15/05 Deutsche Bank

02/15/05 Wachovia Secunties

CREDIT FIRST

SUISSE BOSTON

Analyst

Carla Cooper

Franco Turrinell

Gregory Smith

Moshe Katri

Roger Freeman

Michael Hutchison

Bryan Keane

Robert Lee

Peter Heckmann

Philip Mickelson

David Togut

Thomas McCrohan

Glenn Greene

Andrew Jeffrey

Brandt Sakskeeny

David Trossman

NA

$34.00

NA

$29.00

$37.00

$26.00

$30.00

$32.00

NA

NA

$30.00

$32.00

$33.00

$25.00

NA

NA

07/23/03

NA

02/17/05

02/16/05

11/01/04

02/17/05

10/04/04

NA

NA

02/16/05

04/22/04

02/16/05

07/21/04

NA

Action/ Selected Comments Since 3/21/05 Announcement

Downgrade from Outperform to Neutral.

"All things considered we think $35 would be a fair price to pay."

"We would expect the company to give it serious consideration, as we do not

see the stock achieving a $34 level on its own."

We believe the potential $10 billion LBC better reflects the prospects for the

company

"Investors will likely welcome a buyout at that price."

Downgrade from Outperform to Market Perform. "The fundamental public

market value of the existing business is around $30 or so per share."

"In the face of significant market ambivalence to the proposed [spin-off), we

think a sale of the company makes perfect sense."

"We think this potential deal would be a positive for Solar shareholders.

Downgrade from Buy to Hold "We believe the sale of Solar to financial buyers

makes strategic sense."

"Now that's more like it possible LBO begins unlocking value and upside

remains.

13View entire presentation