Baird Investment Banking Pitch Book

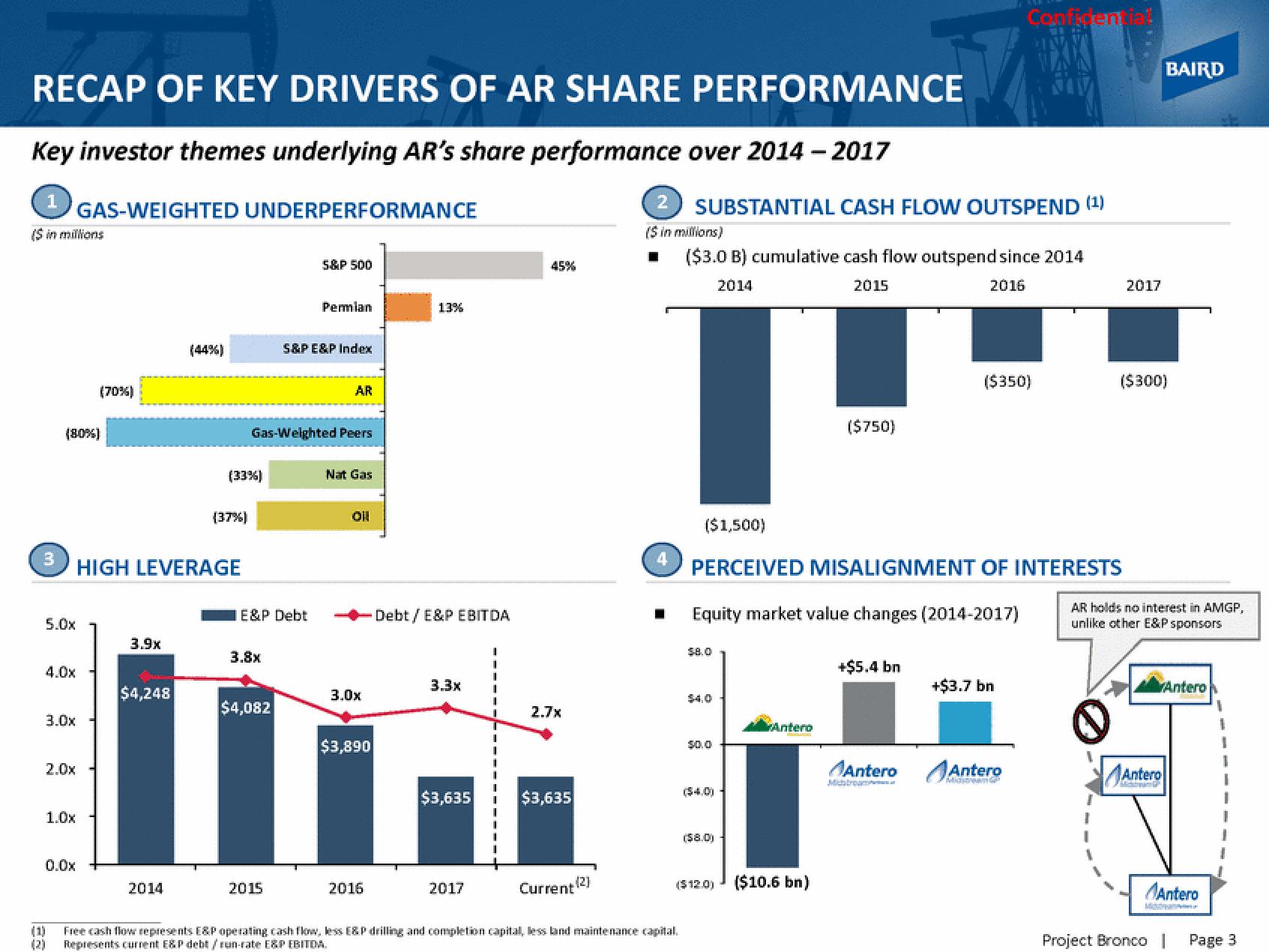

RECAP OF KEY DRIVERS OF AR SHARE PERFORMANCE

Key investor themes underlying AR's share performance over 2014 - 2017

1

($ in millions

3

5.0x

(80%)

4.0x

3.0x

2.0x

1.0x

GAS-WEIGHTED UNDERPERFORMANCE

0.0x

(70%)

3.9x

$4,248

(44%)

HIGH LEVERAGE

2014

(33 %)

(37%)

E&P Debt

3.8x

Gas-Weighted Peers

$4,082

5&P 500

2015

Permian

S&P E&P Index

AR

Nat Gas

Oll

3.0x

$3,890

2016

13%

Debt / E&P EBITDA

3.3x

$3,635

2017

45%

2.7x

$3,635

(2]

Current

2

($ in millions)

($3.0 B) cumulative cash flow outspend since 2014

2014

2015

2016

4

SUBSTANTIAL CASH FLOW OUTSPEND (¹)

(1)

Free cash flow represents E&P operating cash flow, less E&P drilling and completion capital, less land maintenance capital.

(2) Represents current E&P debt/run-rate E&P EBITDA.

☐ Equity market value changes (2014-2017)

$4,0

$0.0

($1,500)

PERCEIVED MISALIGNMENT OF INTERESTS

($4.0)

($8.0)

($12.0)

($750)

Antero

($10.6 bn)

+$5.4 bn

Antero

Confidential

($350)

Michstrom

+$3.7 bn

Antero

2017

($300)

BAIRD

AR holds no interest in AMGP,

unlike other E&P sponsors

Antero

Antero

Antero

Project Bronco |

Page 3View entire presentation