HSBC Results Presentation Deck

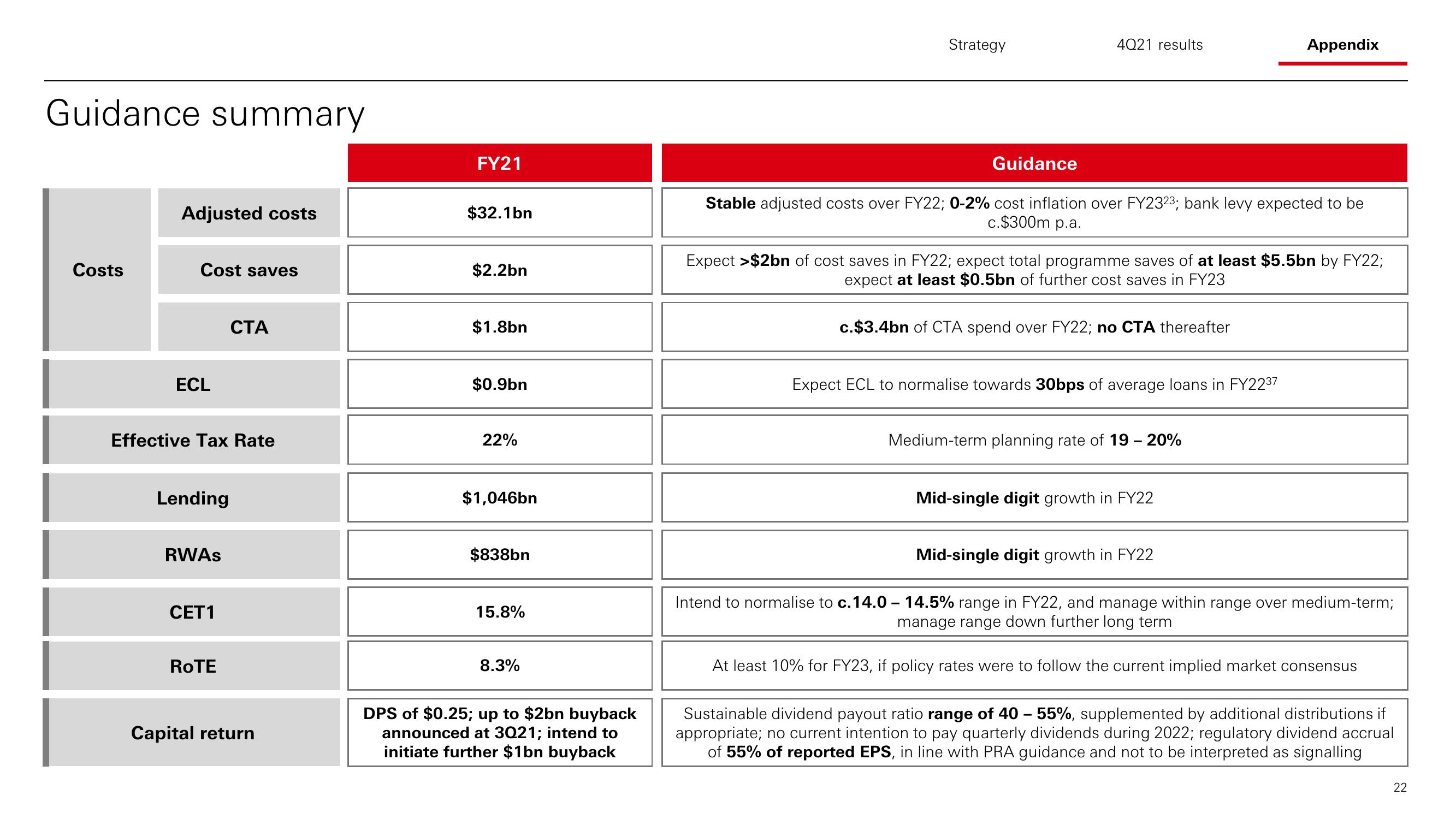

Guidance summary

Costs

Adjusted costs

Cost saves

ECL

Effective Tax Rate

Lending

RWAS

CET1

CTA

ROTE

Capital return

FY21

$32.1bn

$2.2bn

$1.8bn

$0.9bn

22%

$1,046bn

$838bn

15.8%

8.3%

DPS of $0.25; up to $2bn buyback

announced at 3021; intend to

initiate further $1bn buyback

Strategy

Guidance

4021 results

Stable adjusted costs over FY22; 0-2% cost inflation over FY2323; bank levy expected to be

c.$300m p.a.

Expect >$2bn of cost saves in FY22; expect total programme saves of at least $5.5bn by FY22;

expect at least $0.5bn of further cost saves in FY23

c.$3.4bn of CTA spend over FY22; no CTA thereafter

Expect ECL to normalise towards 30bps of average loans in FY2237

Medium-term planning rate of 19 - 20%

Appendix

Mid-single digit growth in FY22

Mid-single digit growth in FY22

Intend to normalise to c.14.0 14.5% range in FY22, and manage within range over medium-term;

manage range down further long term

At least 10% for FY23, if policy rates were to follow the current implied market consensus

Sustainable dividend payout ratio range of 40 - 55%, supplemented by additional distributions if

appropriate; no current intention to pay quarterly dividends during 2022; regulatory dividend accrual

of 55% of reported EPS, in line with PRA guidance and not to be interpreted as signalling

22View entire presentation