J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

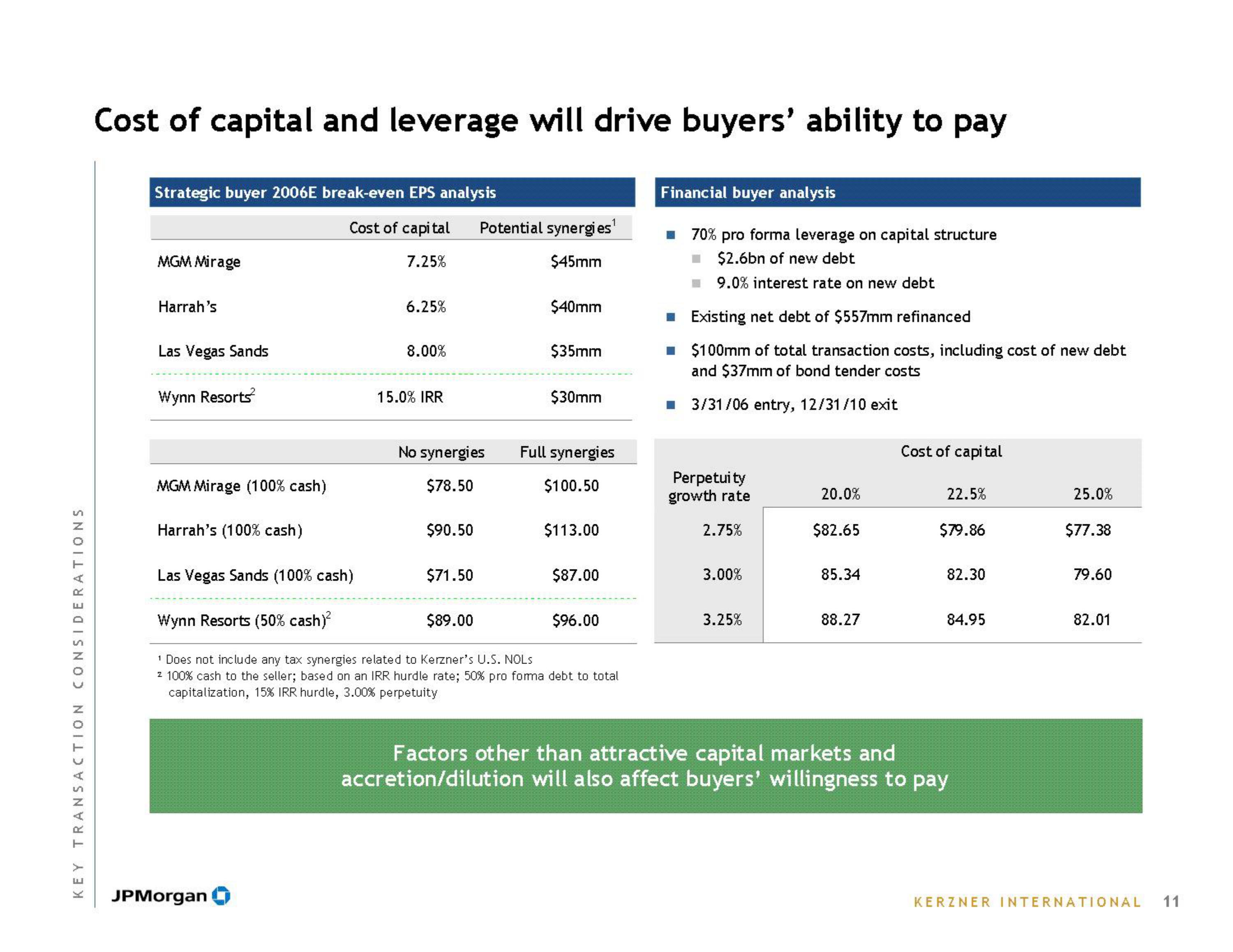

Cost of capital and leverage will drive buyers' ability to pay

Strategic buyer 2006E break-even EPS analysis

MGM Mirage

Harrah's

Las Vegas Sands

Wynn Resorts

MGM Mirage (100% cash)

Harrah's (100% cash)

Las Vegas Sands (100% cash)

Wynn Resorts (50% cash)²

Cost of capital Potential synergies¹

7.25%

$45mm

JPMorgan

6.25%

8.00%

15.0% IRR

No synergies

$78.50

$90.50

$71.50

$89.00

$40mm

$35mm

$30mm

Full synergies

$100.50

$113.00

$87.00

$96.00

¹ Does not include any tax synergies related to Kerzner's U.S. NOLS

2 100% cash to the seller; based on an IRR hurdle rate; 50% pro forma debt to total

capitalization, 15% IRR hurdle, 3.00% perpetuity

Financial buyer analysis

■ 70% pro forma leverage on capital structure

■ $2.6bn of new debt

9.0% interest rate on new debt

■ Existing net debt of $557mm refinanced

■ $100mm of total transaction costs, including cost of new debt

and $37mm of bond tender costs

■ 3/31/06 entry, 12/31/10 exit

Perpetuity

growth rate

2.75%

3.00%

3.25%

20.0%

$82.65

85.34

88.27

Cost of capital

22.5%

$79.86

82.30

84.95

Factors other than attractive capital markets and

accretion/dilution will also affect buyers' willingness to pay

25.0%

$77.38

79.60

82.01

KERZNER INTERNATIONAL 11View entire presentation