Eutelsat Mergers and Acquisitions Presentation Deck

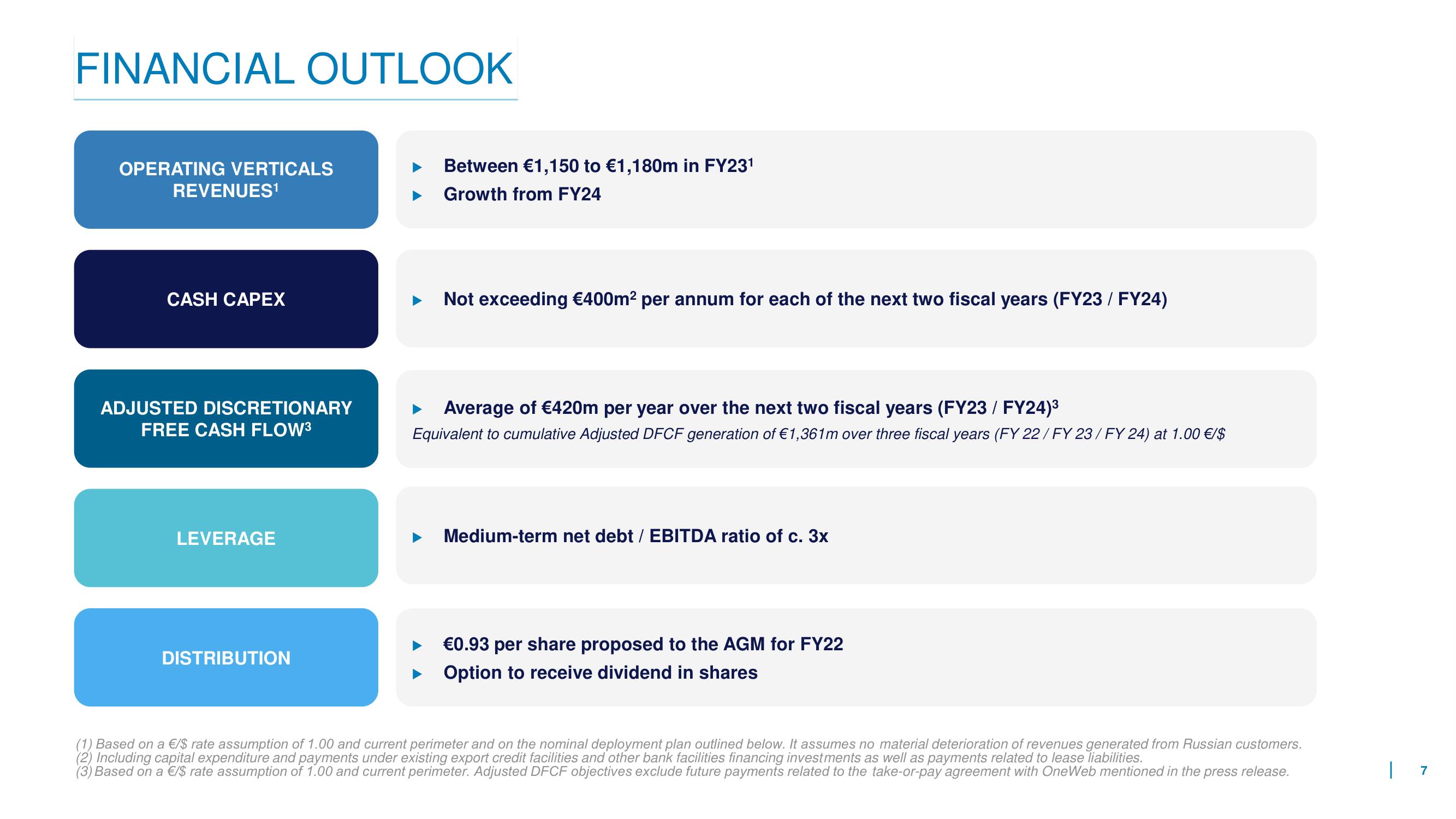

FINANCIAL OUTLOOK

OPERATING VERTICALS

REVENUES¹

CASH CAPEX

ADJUSTED DISCRETIONARY

FREE CASH FLOW³

LEVERAGE

DISTRIBUTION

Between €1,150 to €1,180m in FY23¹

Growth from FY24

Not exceeding €400m² per annum for each of the next two fiscal years (FY23 / FY24)

Average of €420m per year over the next two fiscal years (FY23 / FY24)³

Equivalent to cumulative Adjusted DFCF generation of €1,361m over three fiscal years (FY 22/FY 23/FY 24) at 1.00 €/$

Medium-term net debt / EBITDA ratio of c. 3x

€0.93 per share proposed to the AGM for FY22

Option to receive dividend in shares

(1) Based on a €/$ rate assumption of 1.00 and current perimeter and on the nominal deployment plan outlined below. It assumes no material deterioration of revenues generated from Russian customers.

(2) Including capital expenditure and payments under existing export credit facilities and other bank facilities financing investments as well as payments related to lease liabilities.

(3) Based on a €/$ rate assumption of 1.00 and current perimeter. Adjusted DFCF objectives exclude future payments related to the take-or-pay agreement with One Web mentioned in the press release.

| 7View entire presentation