Spirit Mergers and Acquisitions Presentation Deck

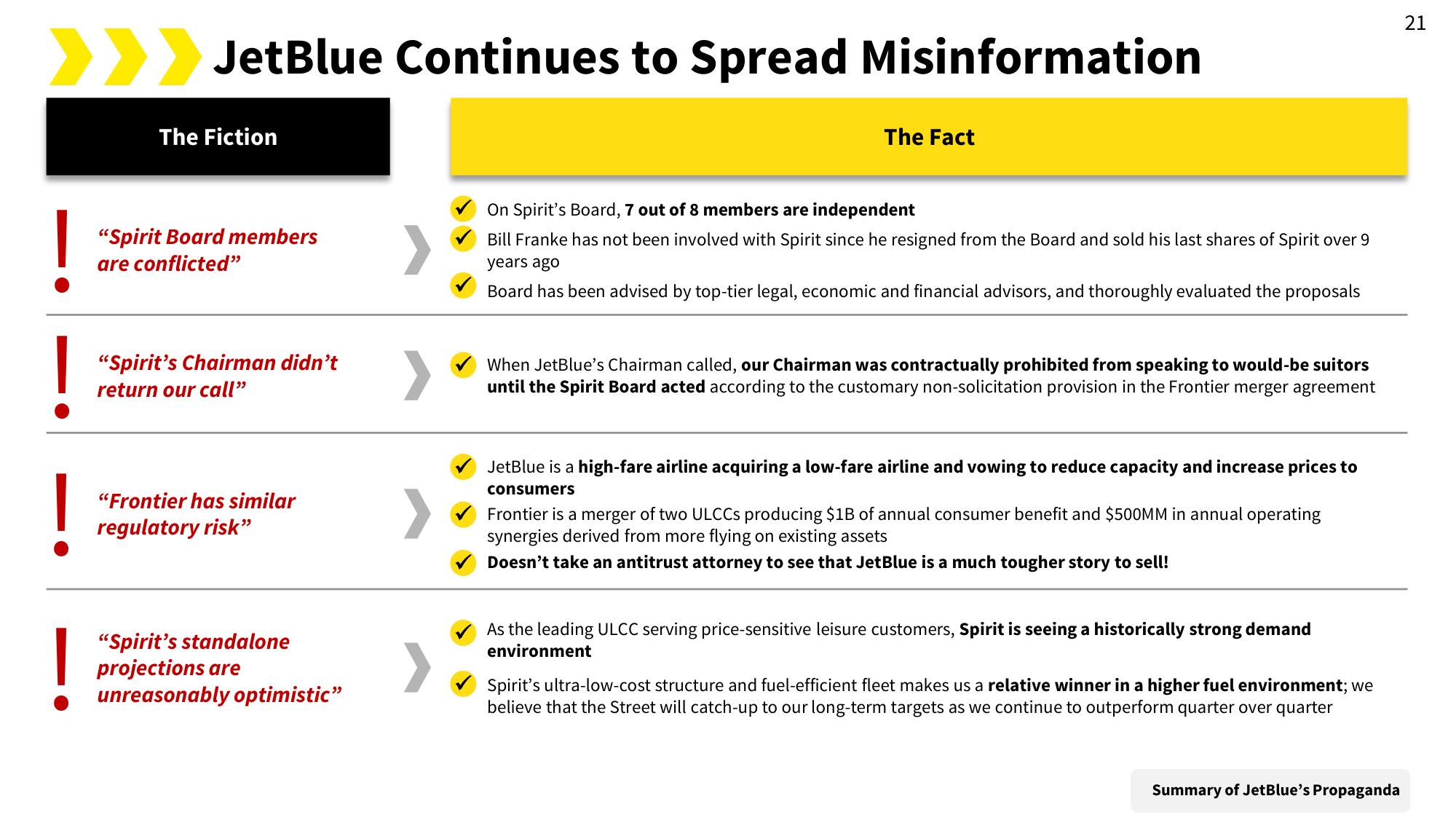

> JetBlue Continues to Spread Misinformation

!

!

!

The Fiction

"Spirit Board members

are conflicted"

"Spirit's Chairman didn't

return our call"

"Frontier has similar

regulatory risk"

"Spirit's standalone

projections are

unreasonably optimistic"

The Fact

On Spirit's Board, 7 out of 8 members are independent

Bill Franke has not been involved with Spirit since he resigned from the Board and sold his last shares of Spirit over 9

years ago

Board has been advised by top-tier legal, economic and financial advisors, and thoroughly evaluated the proposals

When JetBlue's Chairman called, our Chairman was contractually prohibited from speaking to would-be suitors

until the Spirit Board acted according to the customary non-solicitation provision in the Frontier merger agreement

JetBlue is a high-fare airline acquiring a low-fare airline and vowing to reduce capacity and increase prices to

consumers

Frontier is a merger of two ULCCS producing $1B of annual consumer benefit and $500MM in annual operating

synergies derived from more flying on existing assets

Doesn't take an antitrust attorney to see that JetBlue is a much tougher story to sell!

As the leading ULCC serving price-sensitive leisure customers, Spirit is seeing a historically strong demand

environment

Spirit's ultra-low-cost structure and fuel-efficient fleet makes us a relative winner in a higher fuel environment; we

believe that the Street will catch-up to our long-term targets as we continue to outperform quarter over quarter

Summary of JetBlue's Propaganda

21View entire presentation