SoftBank Investor Presentation Deck

SVF1

PROGRESS & HIGHLIGHTS

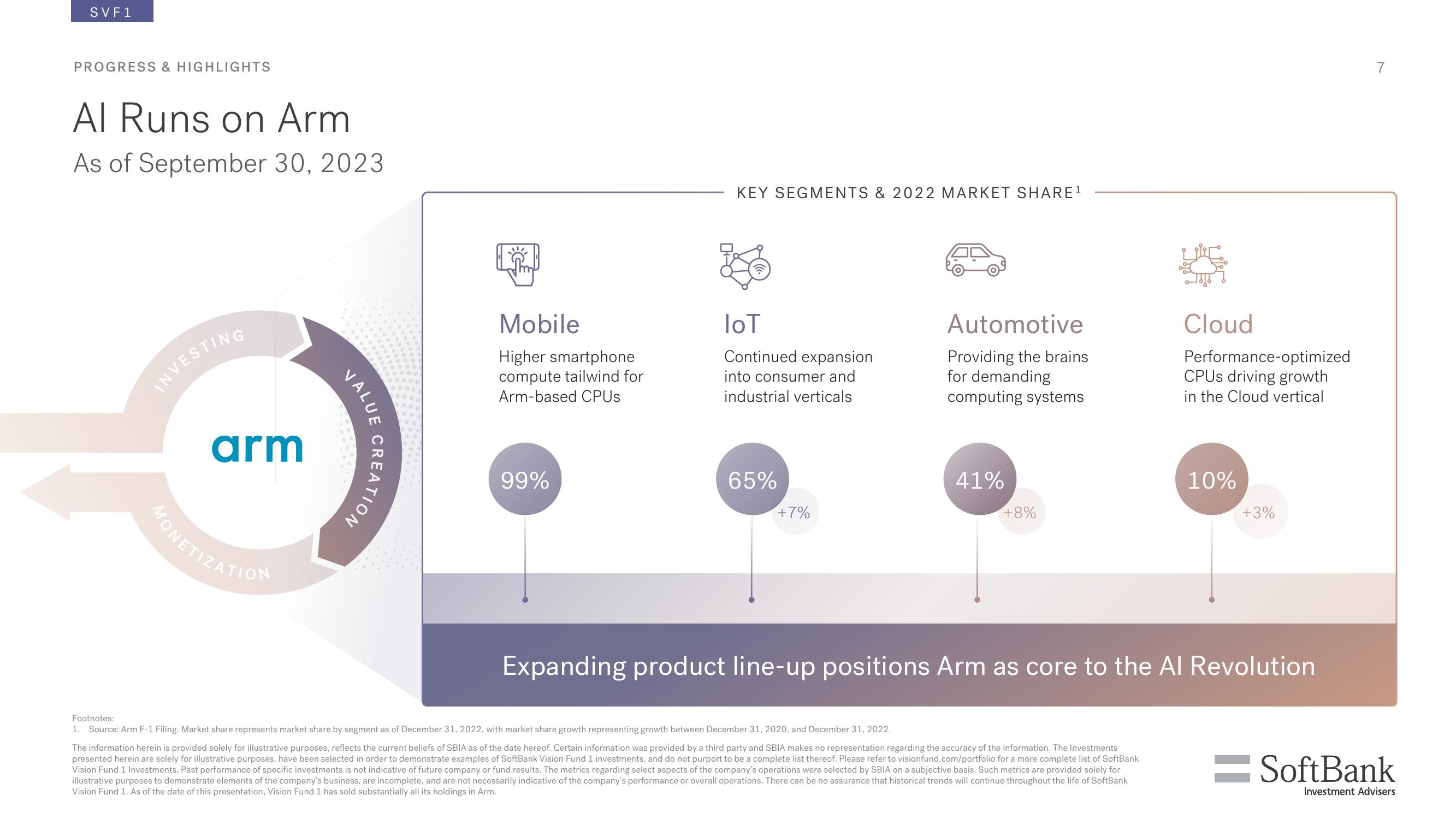

Al Runs on Arm

As of September 30, 2023

INVESTING

arm

MONETIZATION

VALU

CREATION

Im

Mobile

Higher smartphone

compute tailwind for

Arm-based CPUs

99%

KEY SEGMENTS & 2022 MARKET SHARE ¹

IoT

Continued expansion

into consumer and

industrial verticals

65%

+7%

Automotive

Providing the brains

for demanding

computing systems

Footnotes:

1. Source: Arm F-1 Filing. Market share represents market share by segment as of December 31, 2022, with market share growth representing growth between December 31, 2020, and December 31, 2022.

41%

+8%

Cloud

The information herein is provided solely for illustrative purposes, reflects the current beliefs of SBIA as of the date hereof. Certain information was provided by a third party and SBIA makes no representation regarding the accuracy of the information. The Investments

presented herein are solely for illustrative purposes, have been selected in order to demonstrate examples of SoftBank Vision Fund 1 investments, and do not purport to be a complete list thereof. Please refer to visionfund.com/portfolio for a more complete list of SoftBank

Vision Fund 1 Investments. Past performance of specific investments is not indicative of future company or fund results. The metrics regarding select aspects of the company's operations were selected by SBIA on a subjective basis. Such metrics are provided solely for

illustrative purposes to demonstrate elements of the company's business, are incomplete, and are not necessarily indicative of the company's performance or overall operations. There can be no assurance that historical trends will continue throughout the life of SoftBank

Vision Fund 1. As of the date of this presentation, Vision Fund 1 has sold substantially all its holdings in Arm.

Performance-optimized

CPUs driving growth

in the Cloud vertical

10%

Expanding product line-up positions Arm as core to the Al Revolution

+3%

=SoftBank

Investment AdvisersView entire presentation