FY 2018 Fourth Quarter Earnings Call

Cash flow & debt 1

15

ADIENT

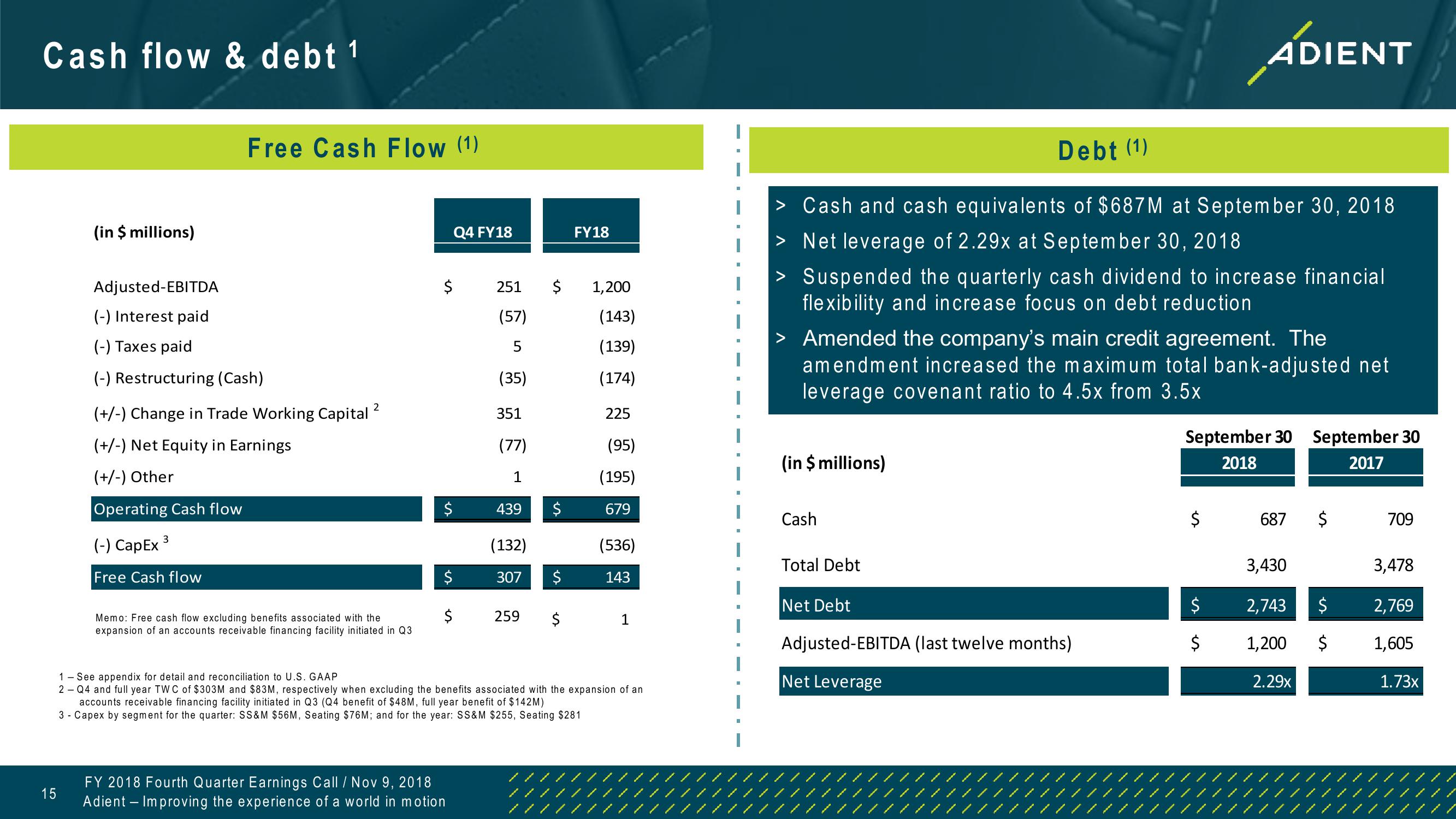

Free Cash Flow (1)

(in $ millions)

Adjusted-EBITDA

Q4 FY18

FY18

$

251

$

(-) Interest paid

(57)

1,200

(143)

(-) Taxes paid

5

(139)

(-) Restructuring (Cash)

(35)

(174)

Debt (1)

> Cash and cash equivalents of $687M at September 30, 2018

> Net leverage of 2.29x at September 30, 2018

> Suspended the quarterly cash dividend to increase financial

flexibility and increase focus on debt reduction

> Amended the company's main credit agreement. The

amendment increased the maximum total bank-adjusted net

leverage covenant ratio to 4.5x from 3.5x

(+/-) Change in Trade Working Capital 2

351

225

(+/-) Net Equity in Earnings

(77)

(95)

(in $ millions)

September 30 September 30

2018

2017

(+/-) Other

1

(195)

Operating Cash flow

$

439

$

679

Cash

$

687 $

709

3

(-) CapEx ³

(132)

(536)

Total Debt

3,430

3,478

Free Cash flow

$

307

$

143

Net Debt

$

2,743

$

2,769

Memo: Free cash flow excluding benefits associated with the

$

259

$

1

expansion of an accounts receivable financing facility initiated in Q3

Adjusted-EBITDA (last twelve months)

$

1,200 $

1,605

1 - See appendix for detail and reconciliation to U.S. GAAP

Net Leverage

2.29x

1.73x

2

Q4 and full year TWC of $303M and $83M, respectively when excluding the benefits associated with the expansion of an

accounts receivable financing facility initiated in Q3 (Q4 benefit of $48M, full year benefit of $142M)

3 Capex by segment for the quarter: SS&M $56M, Seating $76M; and for the year: SS&M $255, Seating $281

FY 2018 Fourth Quarter Earnings Call / Nov 9, 2018

Adient - Improving the experience of a world in motionView entire presentation