Vroom Results Presentation Deck

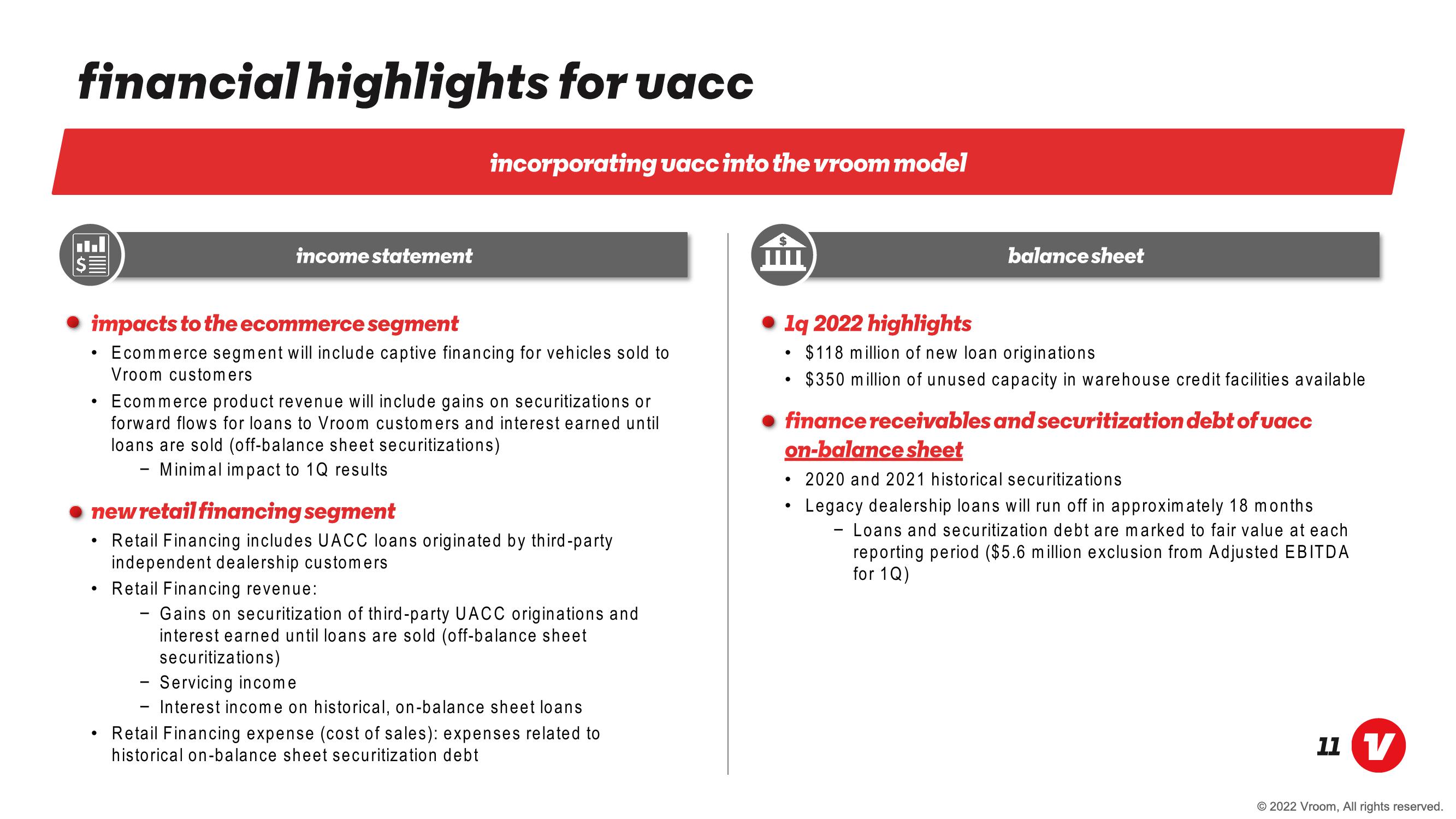

financial highlights for uacc

$

●

impacts to the ecommerce segment

Ecommerce segment will include captive financing for vehicles sold to

Vroom customers

●

income statement

●

incorporating uacc into the vroom model

new retail financing segment

Retail Financing includes UACC loans originated by third-party

independent dealership customers

●

Ecommerce product revenue will include gains on securitizations or

forward flows for loans to Vroom customers and interest earned until

loans are sold (off-balance sheet securitizations)

Minimal impact to 10 results

Retail Financing revenue:

- Gains on securitization of third-party UACC originations and

interest earned until loans are sold (off-balance sheet

securitizations)

- Servicing income

- Interest income on historical, on-balance sheet loans

Retail Financing expense (cost of sales): expenses related to

historical on-balance sheet securitization debt

mim

1q 2022 highlights

$118 million of new loan originations

$350 million of unused capacity in warehouse credit facilities available

●

balance sheet

finance receivables and securitization debt of uacc

on-balance sheet

●

2020 and 2021 historical securitizations

Legacy dealership loans will run off in approximately 18 months

Loans and securitization debt are marked to fair value at each

reporting period ($5.6 million exclusion from Adjusted EBITDA

for 1Q)

-

11 V

© 2022 Vroom, All rights reserved.View entire presentation