Barclays Investment Banking Pitch Book

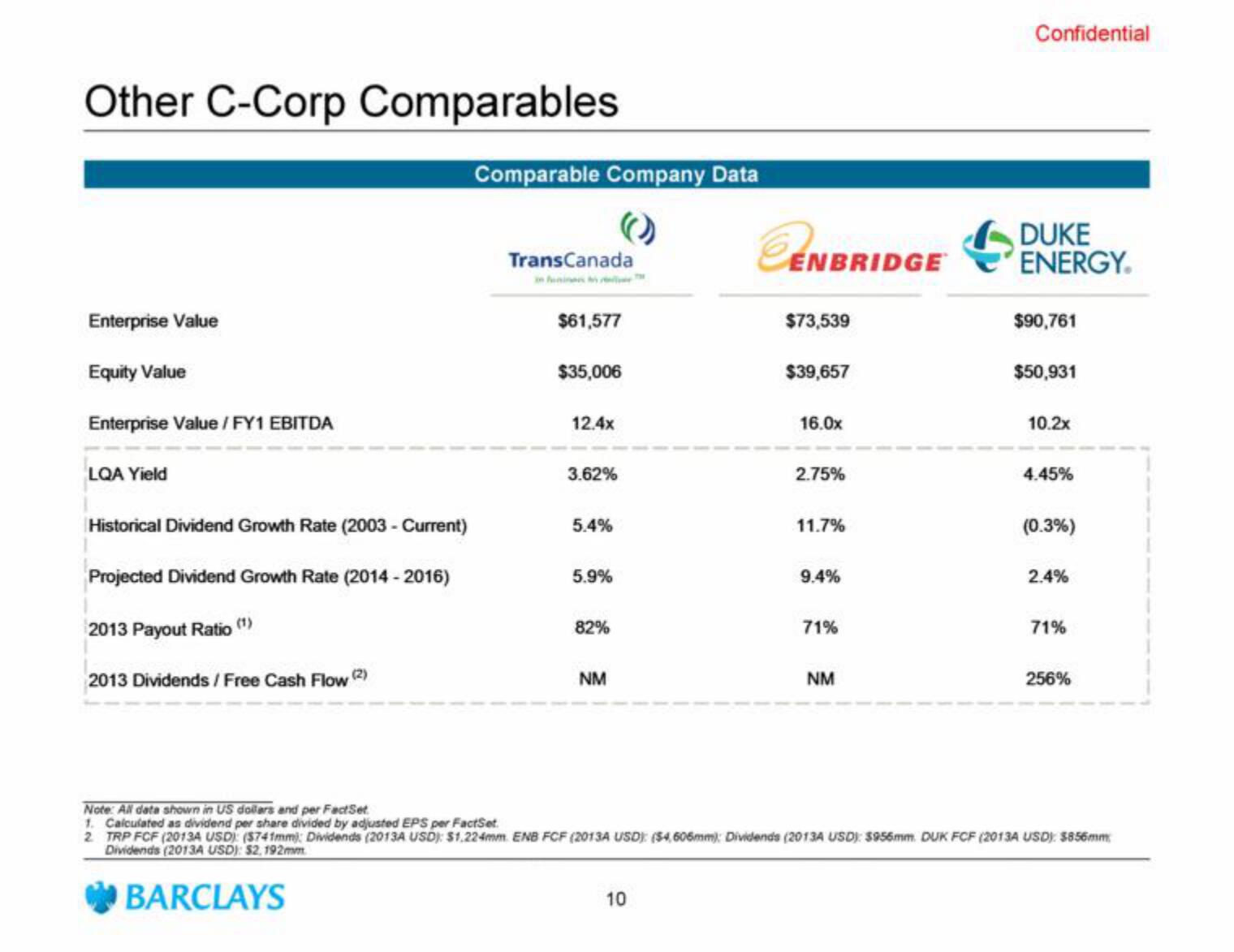

Other C-Corp Comparables

Enterprise Value

Equity Value

Enterprise Value /FY1 EBITDA

LQA Yield

Historical Dividend Growth Rate (2003- Current)

Projected Dividend Growth Rate (2014-2016)

2013 Payout Ratio (¹)

2013 Dividends / Free Cash Flow (2)

Comparable Company Data

TransCanada

$61,577

$35,006

12.4x

3.62%

5.4%

5.9%

82%

NM

ENBRIDGE

10

$73,539

$39,657

16.0x

2.75%

11.7%

9.4%

71%

NM

Confidential

DUKE

ENERGY.

$90,761

$50,931

10.2x

4.45%

(0.3%)

2.4%

71%

256%

Note: All data shown in US dollars and per FactSet

1. Calculated as dividend per share divided by adjusted EPS per FactSet

2. TRP FCF (2013A USD) ($741mm): Dividends (2013A USD): $1,224mm ENB FCF (2013A USD): ($4,606mm): Dividends (2013A USD): $956mm DUK FCF (2013A USD) $856mm

Dividends (2013A USD): $2,192mm

BARCLAYSView entire presentation