Comcast Results Presentation Deck

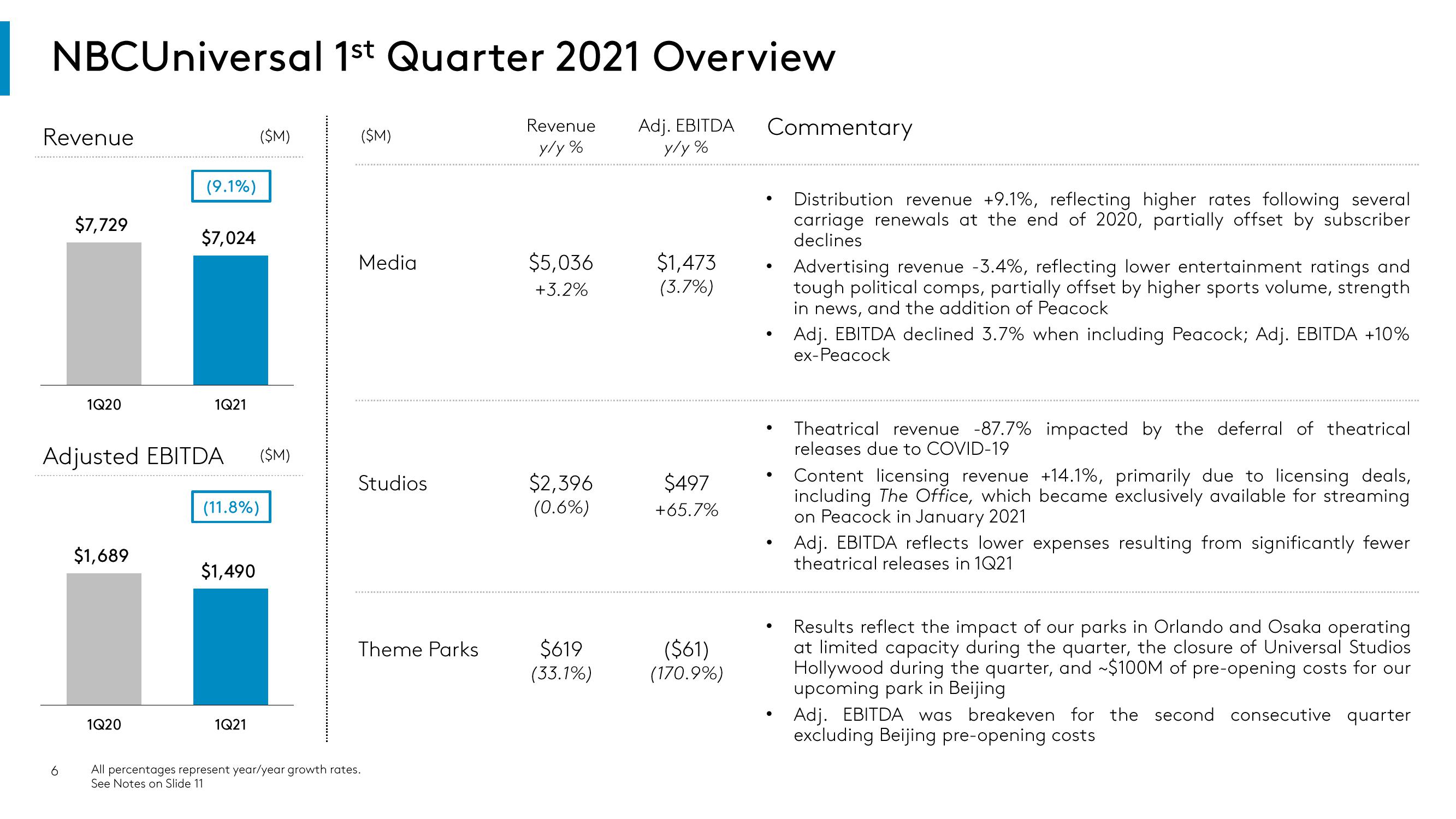

NBCUniversal 1st Quarter 2021 Overview

Revenue

y/y%

Adj. EBITDA

y/y%

Revenue

$7,729

6

1Q20

$1,689

(9.1%)

1Q20

$7,024

Adjusted EBITDA ($M)

1Q21

(11.8%)

$1,490

($M)

1Q21

($M)

Media

Studios

Theme Parks

All percentages represent year/year growth rates.

See Notes on Slide 11

$5,036

+3.2%

$2,396

(0.6%)

$619

(33.1%)

$1,473

(3.7%)

$497

+65.7%

($61)

(170.9%)

Commentary

●

●

●

●

●

●

Distribution revenue +9.1%, reflecting higher rates following several

carriage renewals at the end of 2020, partially offset by subscriber

declines

Advertising revenue -3.4%, reflecting lower entertainment ratings and

tough political comps, partially offset by higher sports volume, strength

in news, and the addition of Peacock

Adj. EBITDA declined 3.7% when including Peacock; Adj. EBITDA +10%

ex-Peacock

Theatrical revenue -87.7% impacted by the deferral of theatrical

releases due to COVID-19

Content licensing revenue +14.1%, primarily due to licensing deals,

including The Office, which became exclusively available for streaming

on Peacock in January 2021

Adj. EBITDA reflects lower expenses resulting from significantly fewer

theatrical releases in 1Q21

Results reflect the impact of our parks in Orlando and Osaka operating

at limited capacity during the quarter, the closure of Universal Studios

Hollywood during the quarter, and ~$100M of pre-opening costs for our

upcoming park in Beijing

Adj. EBITDA was breakeven for the second consecutive quarter

excluding Beijing pre-opening costsView entire presentation