Fort Capital Investment Banking Pitch Book

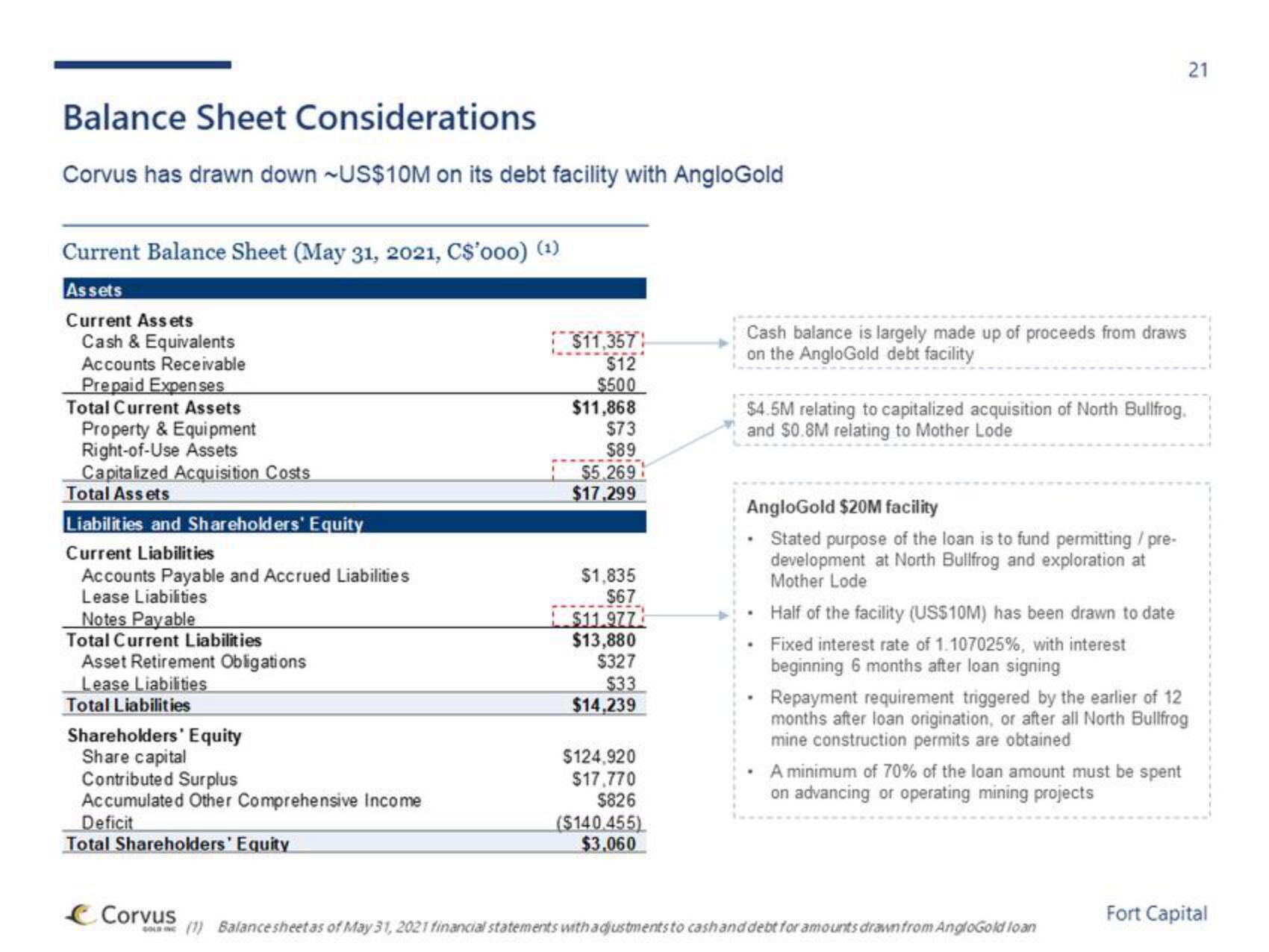

Balance Sheet Considerations

Corvus has drawn down ~US$10M on its debt facility with AngloGold

Current Balance Sheet (May 31, 2021, C$'000) (¹)

Assets

Current Assets

Cash & Equivalents

Accounts Receivable

Prepaid Expenses

Total Current Assets

Property & Equipment

Right-of-Use Assets

Capitalized Acquisition Costs

Total Assets

Liabilities and Shareholders' Equity

Current Liabilities

Accounts Payable and Accrued Liabilities

Lease Liabilities

Notes Payable

Total Current Liabilities

Asset Retirement Obligations

Lease Liabilities

Total Liabilities

Shareholders Equity

Share capital

Contributed Surplus

Accumulated Other Comprehensive Income

Deficit

Total Shareholders' Equity

Corvus

$11,357

$12

$500

$11,868

$73

$89

$5.269

$17,299

$1,835

$67

$11.977

$13,880

$327

$33

$14,239

$124,920

$17,770

$826

($140.455)

$3,060

Cash balance is largely made up of proceeds from draws

on the AngloGold debt facility

$4.5M relating to capitalized acquisition of North Bullfrog.

and $0.8M relating to Mother Lode

AngloGold $20M facility

Stated purpose of the loan is to fund permitting/pre-

development at North Bullfrog and exploration at

Mother Lode

Half of the facility (US$10M) has been drawn to date

. Fixed interest rate of 1.107025%, with interest

beginning 6 months after loan signing

21

Repayment requirement triggered by the earlier of 12

months after loan origination, or after all North Bullfrog

mine construction permits are obtained

A minimum of 70% of the loan amount must be spent

on advancing or operating mining projects

(1) Balancesheet as of May 31, 2021 financial statements with adjustments to cash and debt for amounts drawn from AngloGold loan

Fort CapitalView entire presentation