AngloAmerican Results Presentation Deck

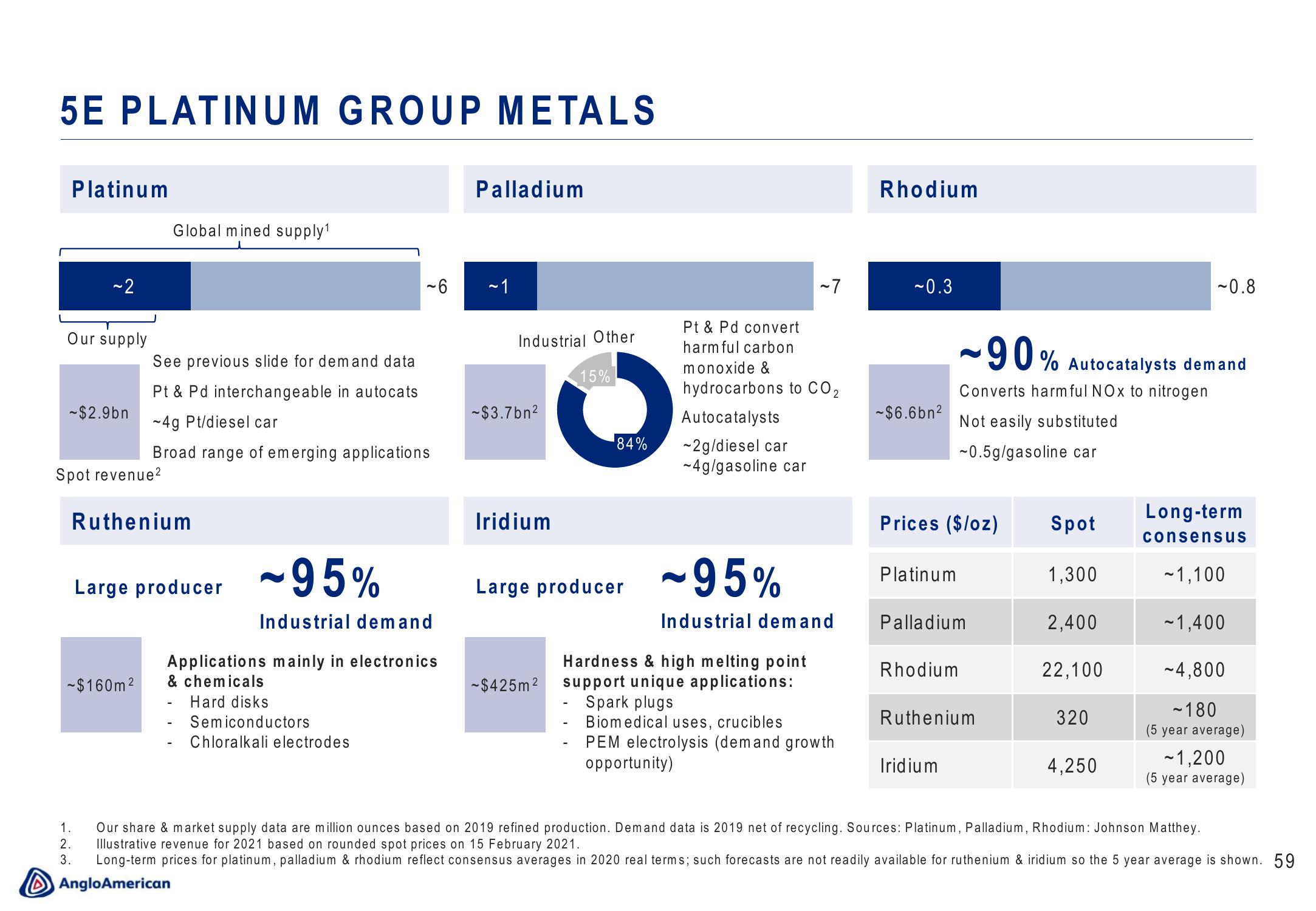

5E PLATINUM GROUP METALS

Platinum

~2

Our supply

~$2.9bn

Global mined supply¹

See previous slide for dem and data

Pt & Pd interchangeable in autocats

-4g Pt/diesel car

Spot revenue ²

~$160m2

Broad range of emerging applications

Ruthenium

Large producer

9

~95%

Industrial demand

Applications mainly in electronics

& chemicals

Hard disks

Semiconductors

Chloralkali electrodes

Palladium

~1

Industrial Other

-$3.7bn²

Iridium

15%

O

¹84%

~$425m²

Pt & Pd convert

harmful carbon

monoxide &

hydrocarbons to CO₂

Autocatalysts

~2g/diesel car

-4g/gasoline car

Large producer ~95%

Industrial demand

Hardness & high melting point

support unique applications:

Spark plugs

Biomedical uses, crucibles

PEM electrolysis (demand growth

opportunity)

Rhodium

~0.3

~$6.6bn²

Platinum

Prices ($/oz)

Rhodium

~90% Autocatalysts demand

Converts harmful NOx to nitrogen

Not easily substituted

~0.5g/gasoline car

Palladium

Iridium

Ruthenium

Spot

1,300

2,400

22,100

320

~0.8

4,250

Long-term

consensus

~1,100

~1,400

-4,800

-180

(5 year average)

~1,200

(5 year average)

1.

Our share & market supply data are million ounces based on 2019 refined production. Demand data is 2019 net of recycling. Sources: Platinum, Palladium, Rhodium: Johnson Matthey.

Illustrative revenue for 2021 based on rounded spot prices on 15 February 2021.

2.

3. Long-term prices for platinum, palladium & rhodium reflect consensus averages in 2020 real terms; such forecasts are not readily available for ruthenium & iridium so the 5 year average is shown. 59

Anglo AmericanView entire presentation