SmileDirectClub Investor Presentation Deck

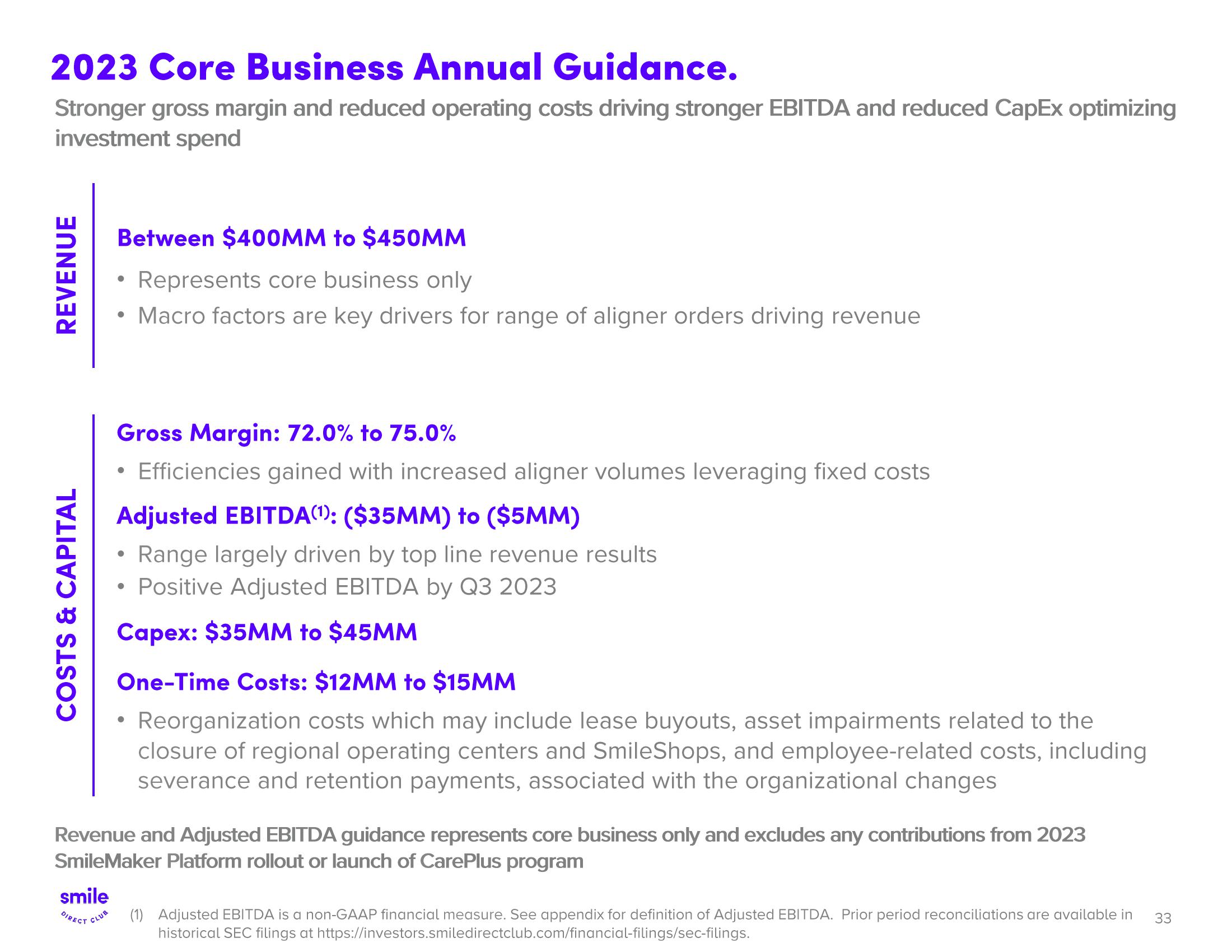

2023 Core Business Annual Guidance.

Stronger gross margin and reduced operating costs driving stronger EBITDA and reduced CapEx optimizing

investment spend

REVENUE

COSTS & CAPITAL

Between $400MM to $450MM

Represents core business only

Macro factors are key drivers for range of aligner orders driving revenue

smile

DIRECT CLUB

Gross Margin: 72.0% to 75.0%

• Efficiencies gained with increased aligner volumes leveraging fixed costs

Adjusted EBITDA(¹1): ($35MM) to ($5MM)

Range largely driven by top line revenue results

Positive Adjusted EBITDA by Q3 2023

Capex: $35MM to $45MM

●

One-Time Costs: $12MM to $15MM

Reorganization costs which may include lease buyouts, asset impairments related to the

closure of regional operating centers and SmileShops, and employee-related costs, including

severance and retention payments, associated with the organizational changes

●

Revenue and Adjusted EBITDA guidance represents core business only and excludes any contributions from 2023

SmileMaker Platform rollout or launch of CarePlus program

(1) Adjusted EBITDA is a non-GAAP financial measure. See appendix for definition of Adjusted EBITDA. Prior period reconciliations are available in 33

historical SEC filings at https://investors.smiledirectclub.com/financial-filings/sec-filings.View entire presentation