Aeva Investor Presentation Deck

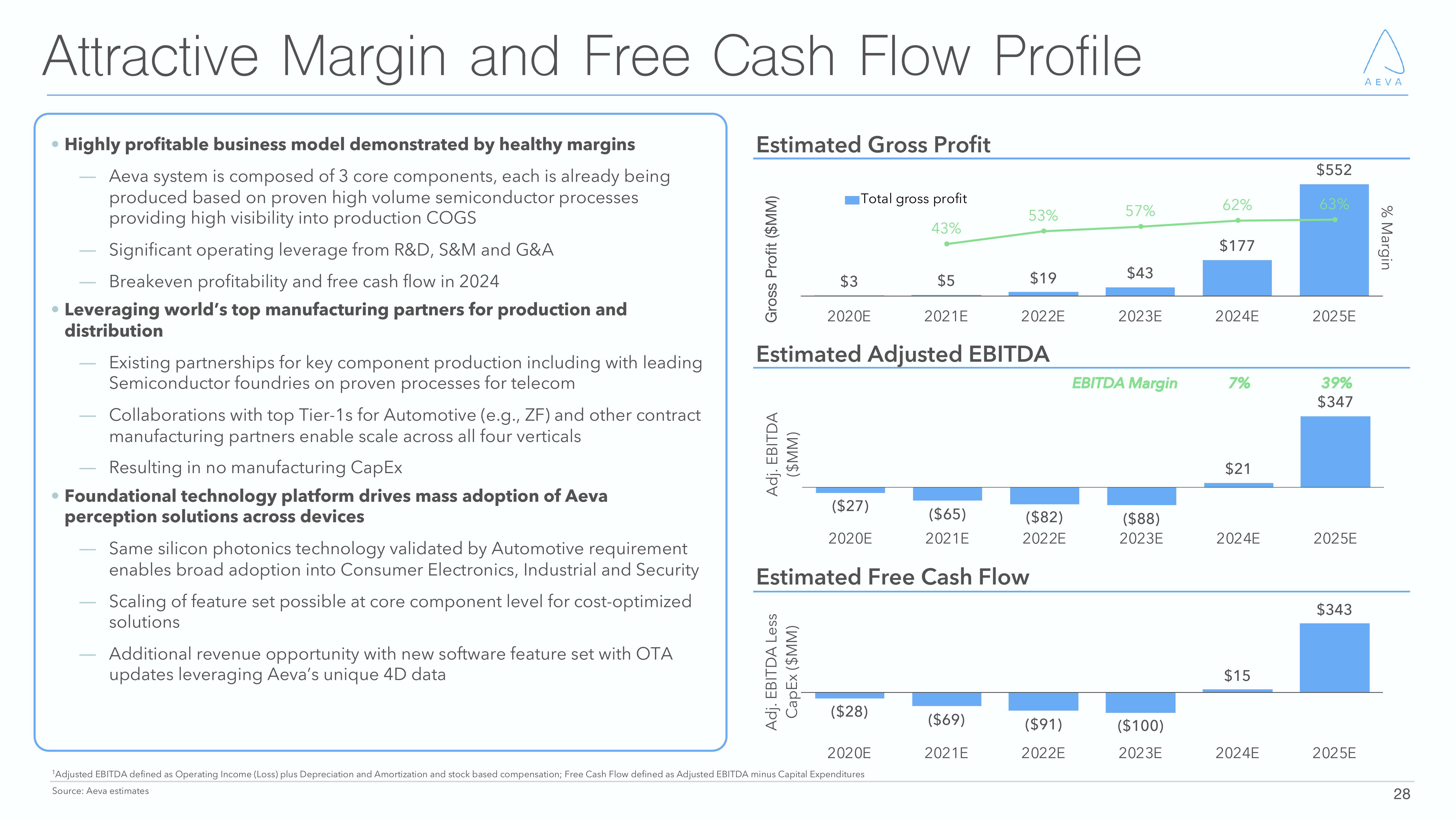

Attractive Margin and Free Cash Flow Profile

Highly profitable business model demonstrated by healthy margins

Aeva system is composed of 3 core components, each is already being

produced based on proven high volume semiconductor processes

providing high visibility into production COGS

Significant operating leverage from R&D, S&M and G&A

Breakeven profitability and free cash flow in 2024

●

• Leveraging world's top manufacturing partners for production and

distribution

●

Existing partnerships for key component production including with leading

Semiconductor foundries on proven processes for telecom

Collaborations with top Tier-1s for Automotive (e.g., ZF) and other contract

manufacturing partners enable scale across all four verticals

Resulting in no manufacturing CapEx

• Foundational technology platform drives mass adoption of Aeva

perception solutions across devices

Same silicon photonics technology validated by Automotive requirement

enables broad adoption into Consumer Electronics, Industrial and Security

Scaling of feature set possible at core component level for cost-optimized

solutions

Additional revenue opportunity with new software feature set with OTA

updates leveraging Aeva's unique 4D data

Estimated Gross Profit

Gross Profit ($MM)

Adj. EBITDA

($MM)

$3

Total gross profit

43%

Adj. EBITDA Less

CapEx ($MM)

2020E

($27)

2020E

$5

Estimated Adjusted EBITDA

($28)

2021E

2020E

¹Adjusted EBITDA defined as Operating Income (Loss) plus Depreciation and Amortization and stock based compensation; Free Cash Flow defined as Adjusted EBITDA minus Capital Expenditures

Source: Aeva estimates

($65)

2021E

Estimated Free Cash Flow

53%

($69)

2021E

$19

2022E

($82)

2022E

($91)

2022E

57%

$43

2023E

EBITDA Margin

($88)

2023E

($100)

2023E

62%

$177

2024E

7%

$21

2024E

$15

2024E

$552

63%

2025E

39%

$347

2025E

$343

2025E

AEVA

% Margin

28View entire presentation