Nogin SPAC Presentation Deck

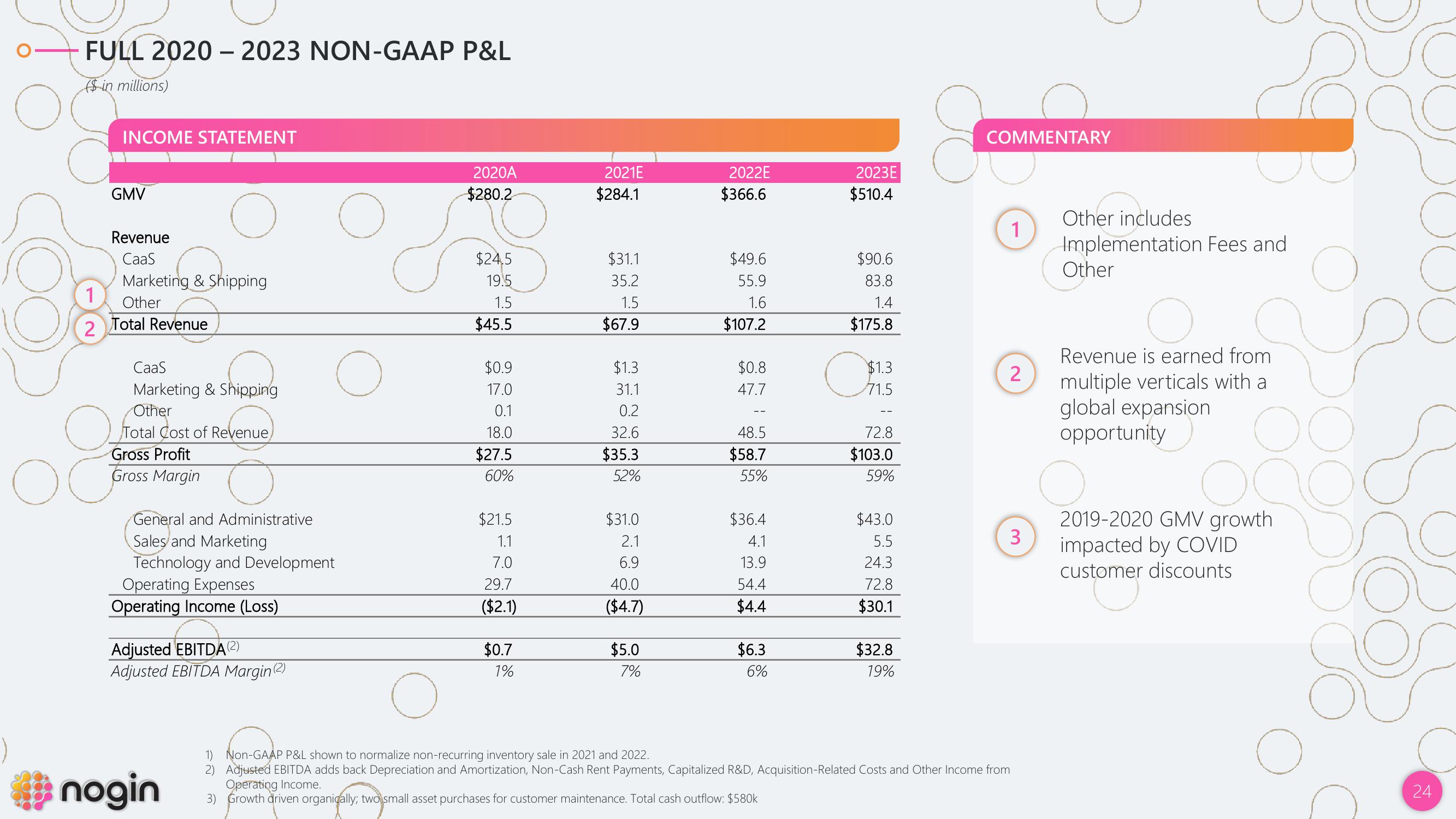

FULL 2020-2023 NON-GAAP P&L

($ in millions)

INCOME STATEMENT

GMV

Revenue

CaaS

O

OG

Marketing & Shipping

1

Other

2 Total Revenue

O

CaaS

Marketing & Shipping

Other

Total Cost of Revenue

Gross Profit

Gross Marge

General and Administrative

Sales and Marketing

Technology and Development

Operating Expenses

Operating Income (Loss)

Adjusted EBITDA (²)

Adjusted EBITDA Margin(2)

nogin

O

2020A

$280.2

$24.5

19.5

1.5

$45.5

$0.9

17.0

0.1

18.0

$27.5

60%

$21.5

1.1

7.0

29.7

($2.1)

$0.7

1%

2021E

$284.1

$31.1

35.2

1.5

$67.9

$1.3

31.1

0.2

32.6

$35.3

52%

$31.0

2.1

6.9

40.0

($4.7)

$5.0

7%

2022E

$366.6

$49.6

55.9

1.6

$107.2

$0.8

47.7

48.5

$58.7

55%

$36.4

4.1

13.9

54.4

$4.4

$6.3

6%

2023E

$510.4

$90.6

83.8

1.4

$175.8

O

$1.3

71.5

72.8

$103.0

59%

$43.0

5.5

24.3

72.8

$30.1

$32.8

19%

COMMENTARY

1

2

1) Non-GAAP P&L shown to normalize non-recurring inventory sale in 2021 and 2022.

2) Adjusted EBITDA adds back Depreciation and Amortization, Non-Cash Rent Payments, Capitalized R&D, Acquisition-Related Costs and Other Income from

Operating Income.

3) Growth driven organically; two small asset purchases for customer maintenance. Total cash outflow: $580k

3

Other includes

Implementation Fees and

Other

Revenue is earned from

multiple verticals with a

global expansion

opportunity OO

O

2019-2020 GMV growth

impacted by COVID

customer discounts

O

24

NView entire presentation