Coppersmith Presentation to Alere Inc Stockholders

PAGE 23 |

COPPERSMITH

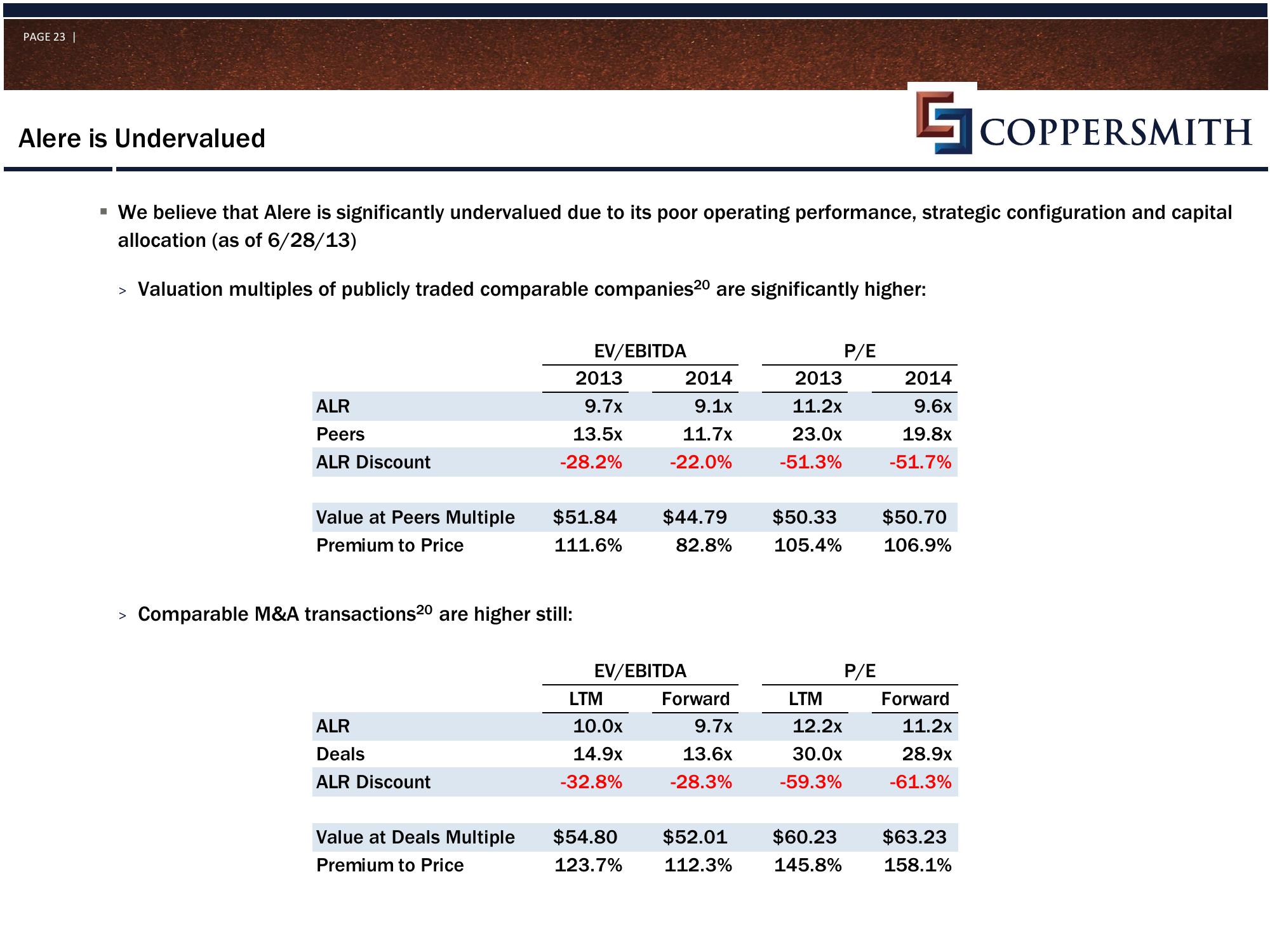

▪ We believe that Alere is significantly undervalued due to its poor operating performance, strategic configuration and capital

allocation (as of 6/28/13)

> Valuation multiples of publicly traded comparable companies 20 are significantly higher:

Alere is Undervalued

ALR

Peers

ALR Discount

Value at Peers Multiple

Premium to Price

ALR

Deals

ALR Discount

Comparable M&A transactions 20 are higher still:

Value at Deals Multiple

Premium to Price

EV/EBITDA

2013

9.7x

13.5x

-28.2%

$51.84

111.6%

LTM

10.0x

14.9x

-32.8%

2014

9.1x

11.7x

-22.0%

EV/EBITDA

$54.80

123.7%

$44.79 $50.33

82.8%

105.4%

2013

11.2x

23.0x

-51.3%

Forward

9.7x

13.6x

-28.3%

LTM

12.2x

30.0x

-59.3%

P/E

P/E

2014

9.6x

19.8x

-51.7%

$50.70

106.9%

Forward

11.2x

28.9x

-61.3%

$52.01 $60.23 $63.23

112.3%

145.8%

158.1%View entire presentation