FGI Industries Investor Presentation Deck

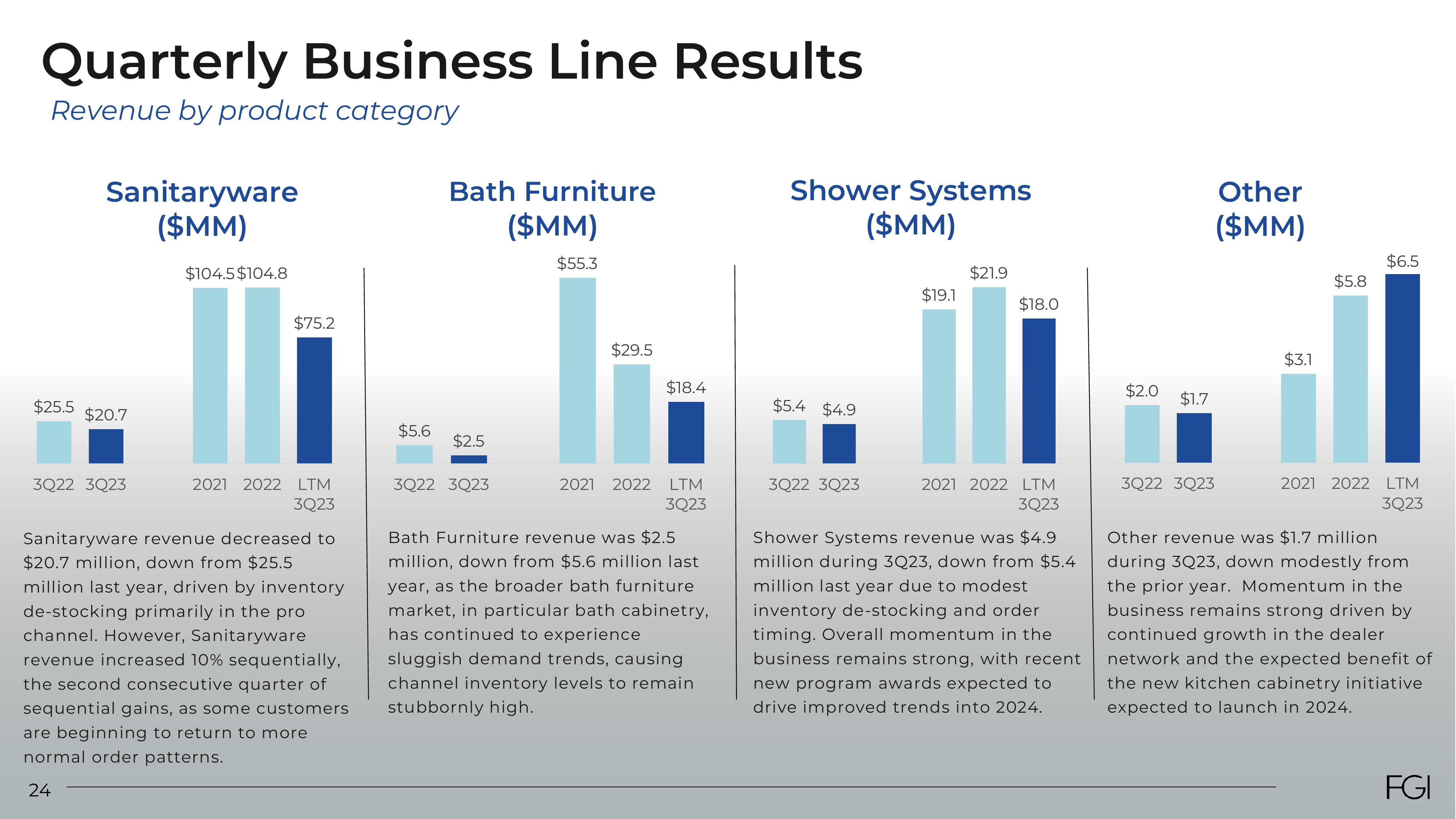

Quarterly Business Line Results

Revenue by product category

$25.5

Sanitaryware

($MM)

$20.7

3Q22 3Q23

$104.5$104.8

$75.2

2021 2022 LTM

3Q23

Sanitaryware revenue decreased to

$20.7 million, down from $25.5

million last year, driven by inventory

de-stocking primarily in the pro

channel. How ever, Sar

yware

revenue increased 10% sequentially,

the second consecutive quarter of

sequential gains, as some customers

are beginning to return to more

normal order patterns.

24

$5.6

Bath Furniture

($MM)

$55.3

$2.5

3Q22 3Q23

$29.5

$18.4

2021 2022 LTM

3Q23

Bath Furniture revenue was $2.5

million, down from $5.6 million last

year, as the broader bath furniture

market, in particular bath cabinetry,

has continued to experience

sluggish demand trends, causing

channel inventory levels to remain

stubbornly high.

Shower Systems

($MM)

$5.4 $4.9

3Q22 3Q23

$19.1

$21.9

$18.0

2021 2022 LTM

3Q23

Shower Systems revenue was $4.9

million during 3Q23, down from $5.4

million last year due to modest

inventory de-stocking and order

timing. Overall momentum in the

business remains strong, with recent

new program awards expected to

drive improved trends into 2024.

$2.0

$1.7

3Q22 3Q23

Other

($MM)

$3.1

$5.8

$6.5

2021 2022 LTM

3Q23

Other revenue was $1.7 million

during 3Q23, down modestly from

the prior year. Momentum in the

business remains strong driven by

continued growth in the dealer

network and the expected benefit of

the new kitchen cabinetry initiative

expected to launch in 2024.

FGIView entire presentation