Deutsche Bank Results Presentation Deck

Asset Management

In € m, unless stated otherwise

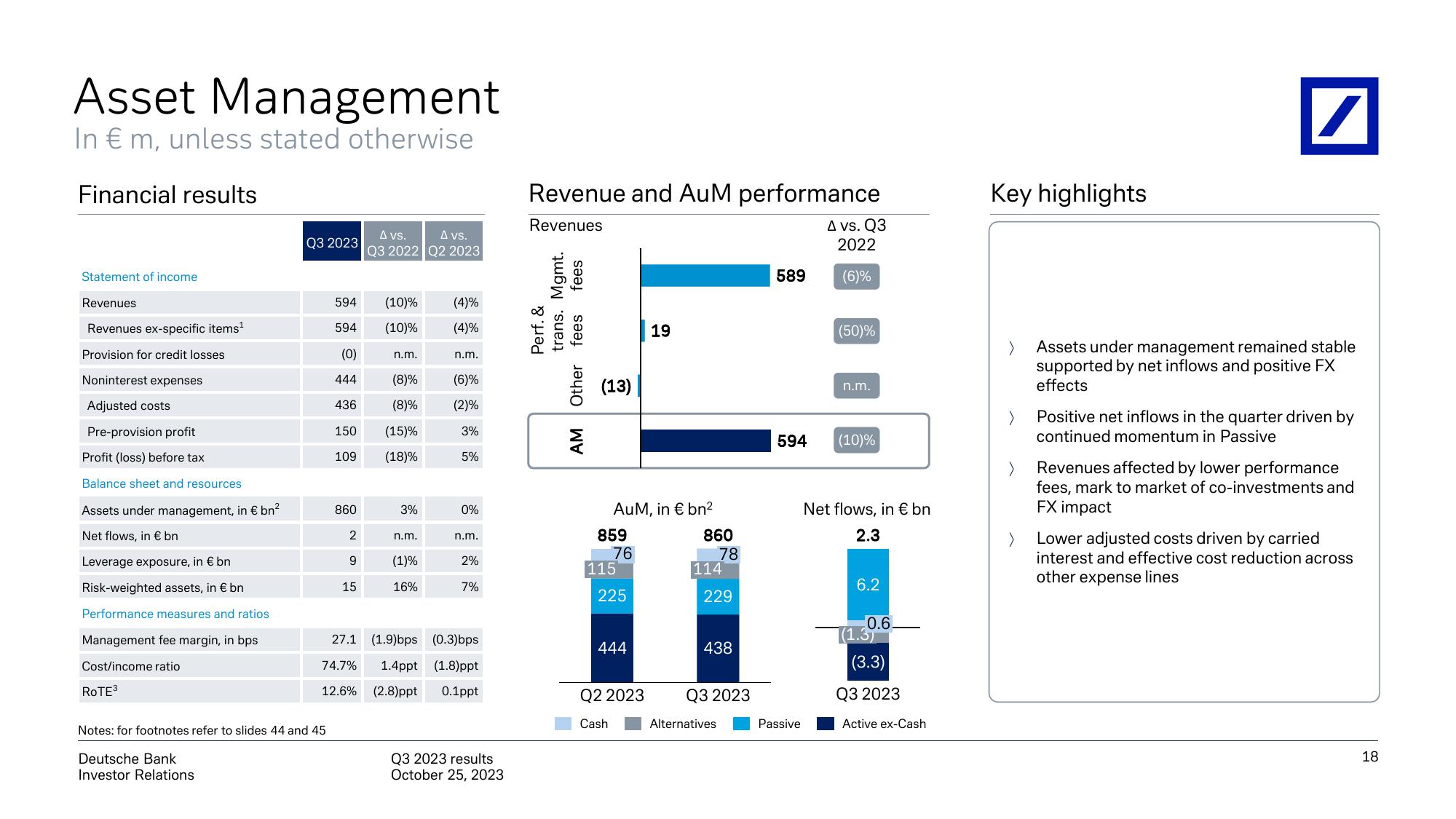

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Assets under management, in € bn²

Net flows, in € bn

Leverage exposure, in € bn

Risk-weighted assets, in € bn

Performance measures and ratios

Management fee margin, in bps

Cost/income ratio

ROTE³

Q3 2023

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

594 (10)%

594 (10)%

(0)

444

436

150

109

860

2

9

15

27.1

74.7%

12.6%

A vs.

A vs.

Q3 2022 Q2 2023

n.m.

(8)%

(8)%

(15)%

(18)%

3%

n.m.

(1)%

16%

(4)%

(4)%

n.m.

(6)%

(2)%

3%

5%

0%

n.m.

2%

7%

(1.9)bps (0.3)bps

1.4ppt (1.8)ppt

(2.8)ppt 0.1ppt

Q3 2023 results

October 25, 2023

Revenue and AuM performance

Revenues

fees

Perf. &

trans. Mgmt.

Other fees

p

AM

(13)

AuM, in € bn²

859

76

115

225

444

19

Q2 2023

Cash

860

78

114

229

438

Q3 2023

Alternatives

589

594

Passive

A vs. Q3

2022

(6)%

(50)%

n.m.

(10)%

Net flows, in € bn

2.3

6.2

0.6.

(1.3)

(3.3)

Q3 2023

Active ex-Cash

Key highlights

/

Assets under management remained stable

supported by net inflows and positive FX

effects

Positive net inflows in the quarter driven by

continued momentum in Passive

Revenues affected by lower performance

fees, mark to market of co-investments and

FX impact

Lower adjusted costs driven by carried

interest and effective cost reduction across

other expense lines

18View entire presentation