Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

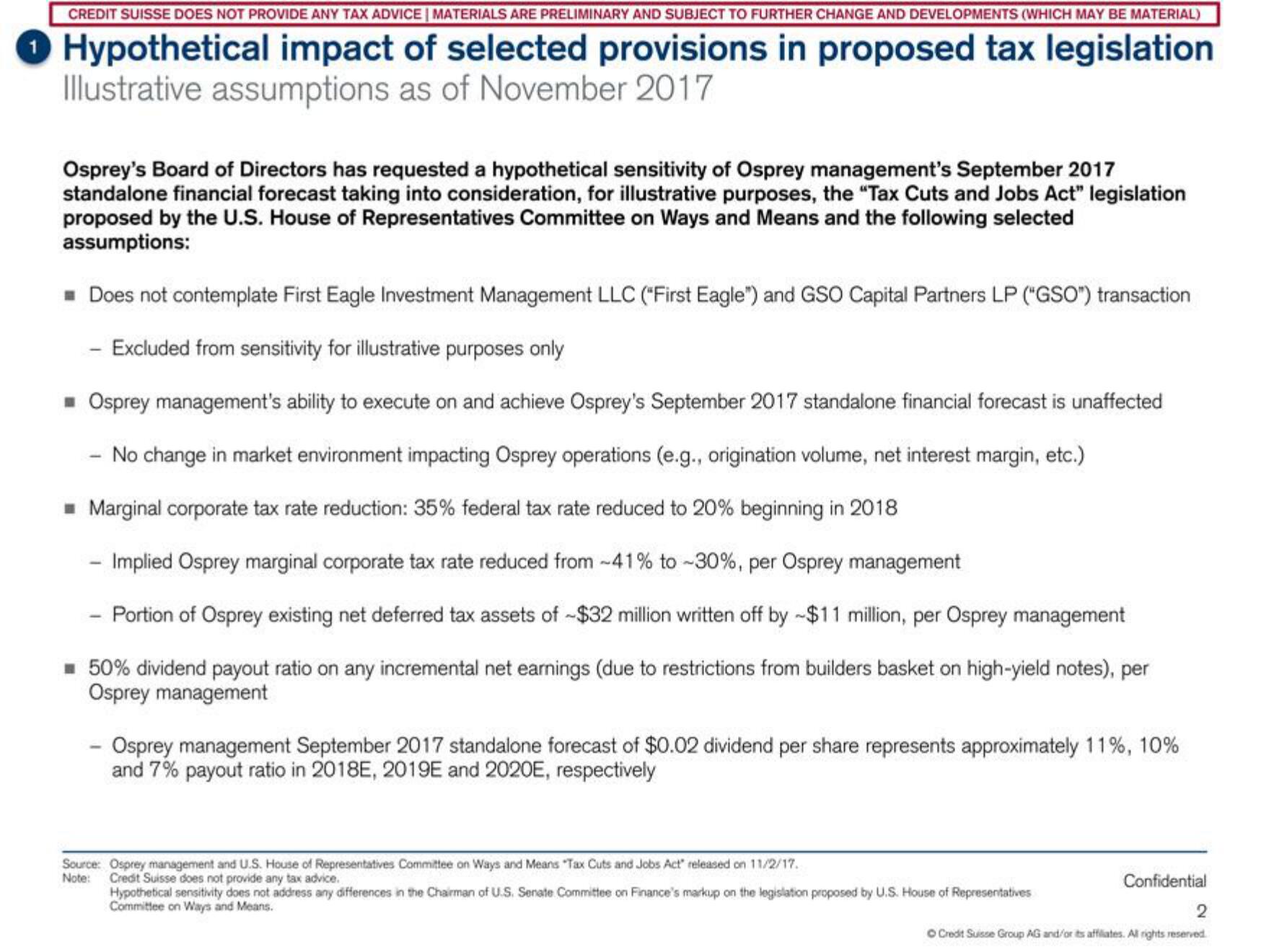

Hypothetical impact of selected provisions in proposed tax legislation

Illustrative assumptions as of November 2017

Osprey's Board of Directors has requested a hypothetical sensitivity of Osprey management's September 2017

standalone financial forecast taking into consideration, for illustrative purposes, the "Tax Cuts and Jobs Act" legislation

proposed by the U.S. House of Representatives Committee on Ways and Means and the following selected

assumptions:

■ Does not contemplate First Eagle Investment Management LLC ("First Eagle") and GSO Capital Partners LP ("GSO") transaction

Excluded from sensitivity for illustrative purposes only

■ Osprey management's ability to execute on and achieve Osprey's September 2017 standalone financial forecast is unaffected

- No change in market environment impacting Osprey operations (e.g., origination volume, net interest margin, etc.)

■ Marginal corporate tax rate reduction: 35% federal tax rate reduced to 20% beginning in 2018

- Implied Osprey marginal corporate tax rate reduced from -41% to -30%, per Osprey management

- Portion of Osprey existing net deferred tax assets of $32 million written off by ~$11 million, per Osprey management

■ 50% dividend payout ratio on any incremental net earnings (due to restrictions from builders basket on high-yield notes), per

Osprey management

Osprey management September 2017 standalone forecast of $0.02 dividend per share represents approximately 11%, 10%

and 7% payout ratio in 2018E, 2019E and 2020E, respectively

Source: Osprey management and U.S. House of Representatives Committee on Ways and Means "Tax Cuts and Jobs Act" released on 11/2/17.

Note: Credit Suisse does not provide any tax advice.

Hypothetical sensitivity does not address any differences in the Chairman of U.S. Senate Committee on Finance's markup on the legislation proposed by U.S. House of Representatives

Committee on Ways and Means.

Confidential

2

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation