SoftBank Results Presentation Deck

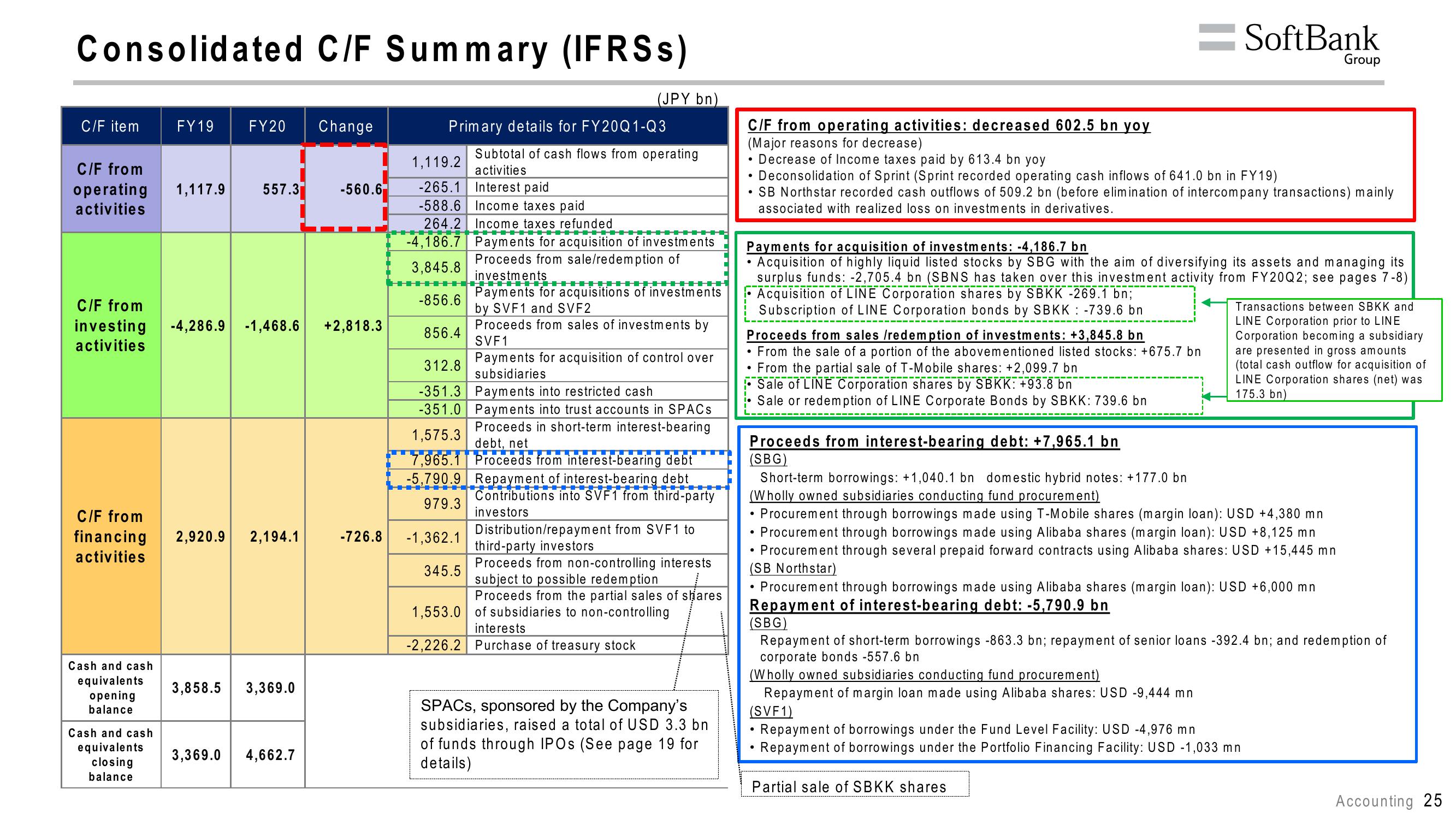

Consolidated C/F Summary (IFRSs)

C/F item

C/F from

operating

activities

FY19

Cash and cash

equivalents

opening

balance

1,117.9

Cash and cash

equivalents

closing

balance

FY20 Change

557.3

C/F from

investing -4,286.9 -1,468.6 +2,818.3

activities

C/F from

financing 2,920.9 2,194.1

activities

3,858.5 3,369.0

-560.6

3,369.0 4,662.7

Primary details for FY20Q1-Q3

1,119.2

-265.1 Interest paid

-588.6

264.2

HHH

-4,186.7

3,845.8

-856.6

Subtotal of cash flows from operating

activities

-726.8 -1,362.1

345.5

(JPY bn)

Income taxes paid

Income taxes refunded

Income taxes

Payments for acquisition of investments

Proceeds from sale/redemption of

investments

Payments for acquisitions of investments

by SVF1 and SVF2

Proceeds from sales of investments by

SVF1

856.4

312.8

-351.3

Payments into restricted cash

-351.0 Payments into trust accounts in SPACs

Proceeds in short-term interest-bearing

1,575.3

debt, net

7,965.1 Proceeds from interest-bearing debt

-5,790.9 Repayment of interest-bearing debt

Contributions into SVF1 from third-party

investors

979.3

Payments for acquisition of control over

subsidiaries

Distribution/repayment from SVF1 to

third-party investors

Proceeds from non-controlling interests

subject to possible redemption

Proceeds from the partial sales of shares

of subsidiaries to non-controlling

interests

1,553.0

-2,226.2 Purchase of treasury stock

SPACS, sponsored by the Company's

subsidiaries, raised a total of USD 3.3 bn

of funds through IPOs (See page 19 for

details)

C/F from operating activities: decreased 602.5 bn yoy

(Major reasons for decrease)

Decrease of Income taxes paid by 613.4 bn yoy

• Deconsolidation of Sprint (Sprint recorded operating cash inflows of 641.0 bn in FY19)

• SB Northstar recorded cash outflows of 509.2 bn (before elimination of intercompany transactions) mainly

associated with realized loss on investments in derivatives.

Proceeds from interest-bearing debt: +7,965.1 bn

(SBG)

Payments for acquisition of investments: -4,186.7 bn

Acquisition of highly liquid listed stocks by SBG with the aim of diversifying its assets and managing its

surplus funds: -2,705.4 bn (SBNS has taken over this investment activity from FY20Q2; see pages 7-8)

Acquisition of LINE Corporation shares by SBKK -269.1 bn;

Subscription of LINE Corporation bonds by SBKK: -739.6 bn

Proceeds from sales /redemption of investments: +3,845.8 bn

From the sale of a portion of the above mentioned listed stocks: +675.7 bn

From the partial sale of T-Mobile shares: +2,099.7 bn

Sale of LINE Corporation shares by SBKK: +93.8 bn

Sale or redemption of LINE Corporate Bonds by SBKK: 739.6 bn

●

Short-term borrowings: +1,040.1 bn domestic hybrid tes: +177.0

(Wholly owned subsidiaries conducting fund procurement)

Procurement through borrowings made using T-Mobile shares (margin loan): USD +4,380 mn

Procurement through borrowings made using Alibaba shares (margin loan): USD +8,125 mn

Procurement through several prepaid forward contracts using Alibaba shares: USD +15,445 mn

(SB Northstar)

●

•

SoftBank

Procurement through borrowings made using Alibaba shares (margin loan): USD +6,000 mn

Repayment of interest-bearing debt: -5,790.9 bn

(SBG)

•

(Wholly owned subsidiaries conducting fund procurement)

Repayment of margin loan made using Alibaba shares: USD -9,444 mn

(SVF1)

Repayment of borrowings under the Fund Level Facility: USD -4,976 mn

Repayment of borrowings under the Portfolio Financing Facility: USD -1,033 mn

●

Group

Transactions between SBKK and

LINE Corporation prior to LINE

Corporation becoming a subsidiary

are presented in gross amounts

(total cash outflow for acquisition of

LINE Corporation shares (net) was

175.3 bn)

Partial sale of SBKK shares

Repayment of short-term borrowings -863.3 bn; repayment of senior loans -392.4 bn; and redemption of

corporate bonds -557.6 bn

Accounting 25View entire presentation