Tradeweb Investor Presentation Deck

1.

2.

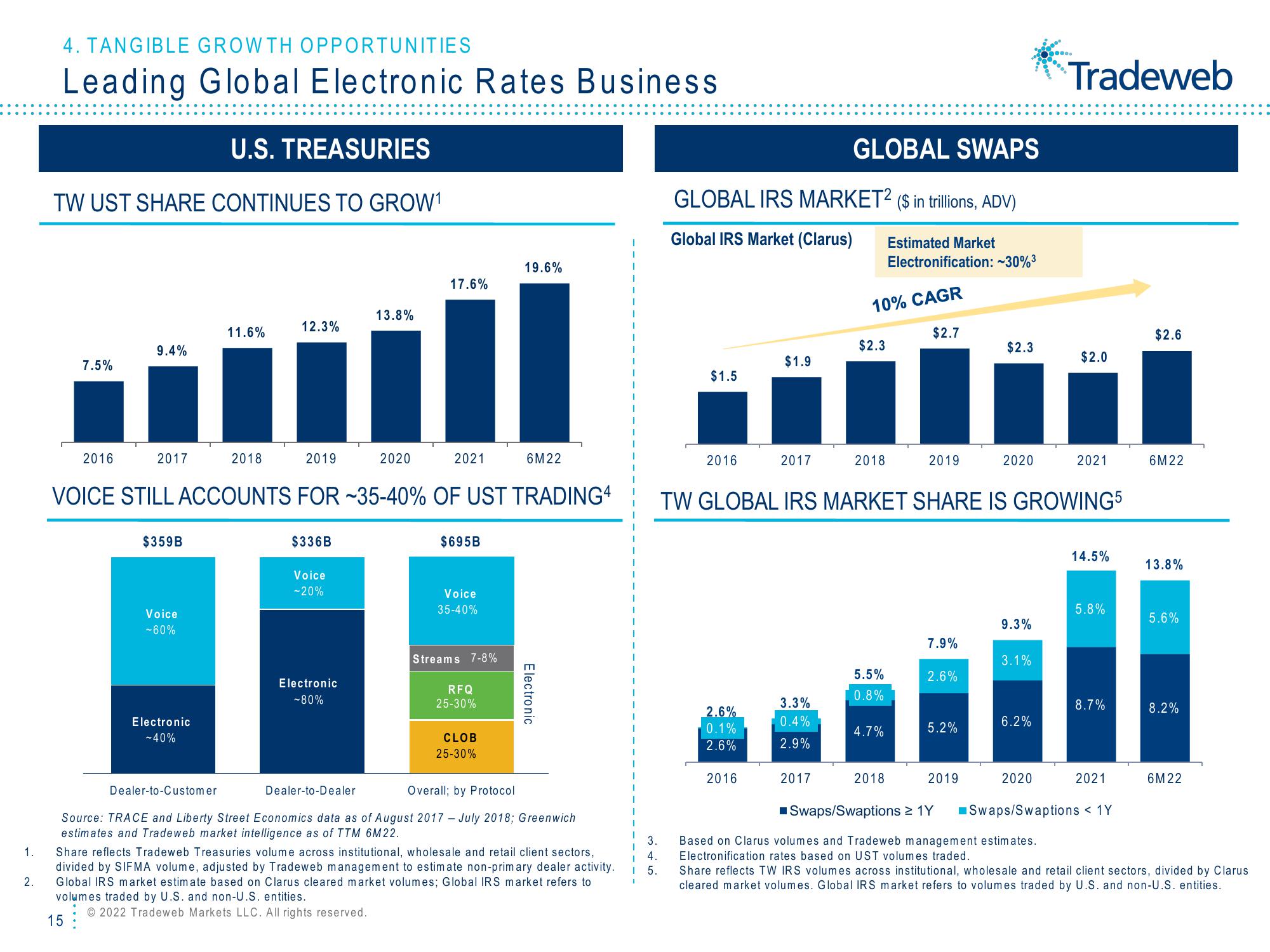

4. TANGIBLE GROWTH OPPORTUNITIES

Leading Global Electronic Rates Business

U.S. TREASURIES

TW UST SHARE CONTINUES TO GROW¹

7.5%

2016

9.4%

2017

$359B

Voice

-60%

11.6%

Electronic

-40%

2018

12.3%

2019

$336B

Voice

-20%

VOICE STILL ACCOUNTS FOR -35-40% OF UST TRADING4

Electronic

-80%

13.8%

2020

Dealer-to-Dealer

17.6%

2021

$695B

Voice

35-40%

Streams 7-8%

RFQ

25-30%

19.6%

CLOB

25-30%

6M22

Electronic

Dealer-to-Customer

Overall; by Protocol

Source: TRACE and Liberty Street Economics data as of August 2017 July 2018; Greenwich

estimates and Tradeweb market intelligence as of TTM 6M22.

Share reflects Tradeweb Treasuries volume across institutional, wholesale and retail client sectors,

divided by SIFMA volume, adjusted by Tradeweb management to estimate non-primary dealer activity.

Global IRS market estimate based on Clarus cleared market volumes; Global IRS market refers to

volumes traded by U.S. and non-U.S. entities.

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

15

1

I

3.

1

T 4.

I 5.

GLOBAL SWAPS

GLOBAL IRS MARKET2 ($ in trillions, ADV)

Global IRS Market (Clarus)

$1.5

2016

2.6%

0.1%

2.6%

$1.9

2016

2017

3.3%

0.4%

2.9%

2017

10% CAGR

$2.3

2018

5.5%

0.8%

Estimated Market

Electronification: -30%³

4.7%

2018

$2.7

2019

TW GLOBAL IRS MARKET SHARE IS GROWING5

7.9%

2.6%

5.2%

$2.3

2019

2020

9.3%

3.1%

6.2%

2020

....

Tradeweb

■Swaps/Swaptions ≥ 1Y

Based on Clarus volumes and Tradeweb management estimates.

Electronification rates based on UST volumes traded.

$2.0

2021

14.5%

5.8%

8.7%

2021

Swaps/Swaptions < 1Y

$2.6

6M22

13.8%

5.6%

8.2%

6M22

Share reflects TW IRS volumes across institutional, wholesale and retail client sectors, divided by Clarus

cleared market volumes. Global IRS market refers to volumes traded by U.S. and non-U.S. entities.View entire presentation