Alternus Energy SPAC Presentation Deck

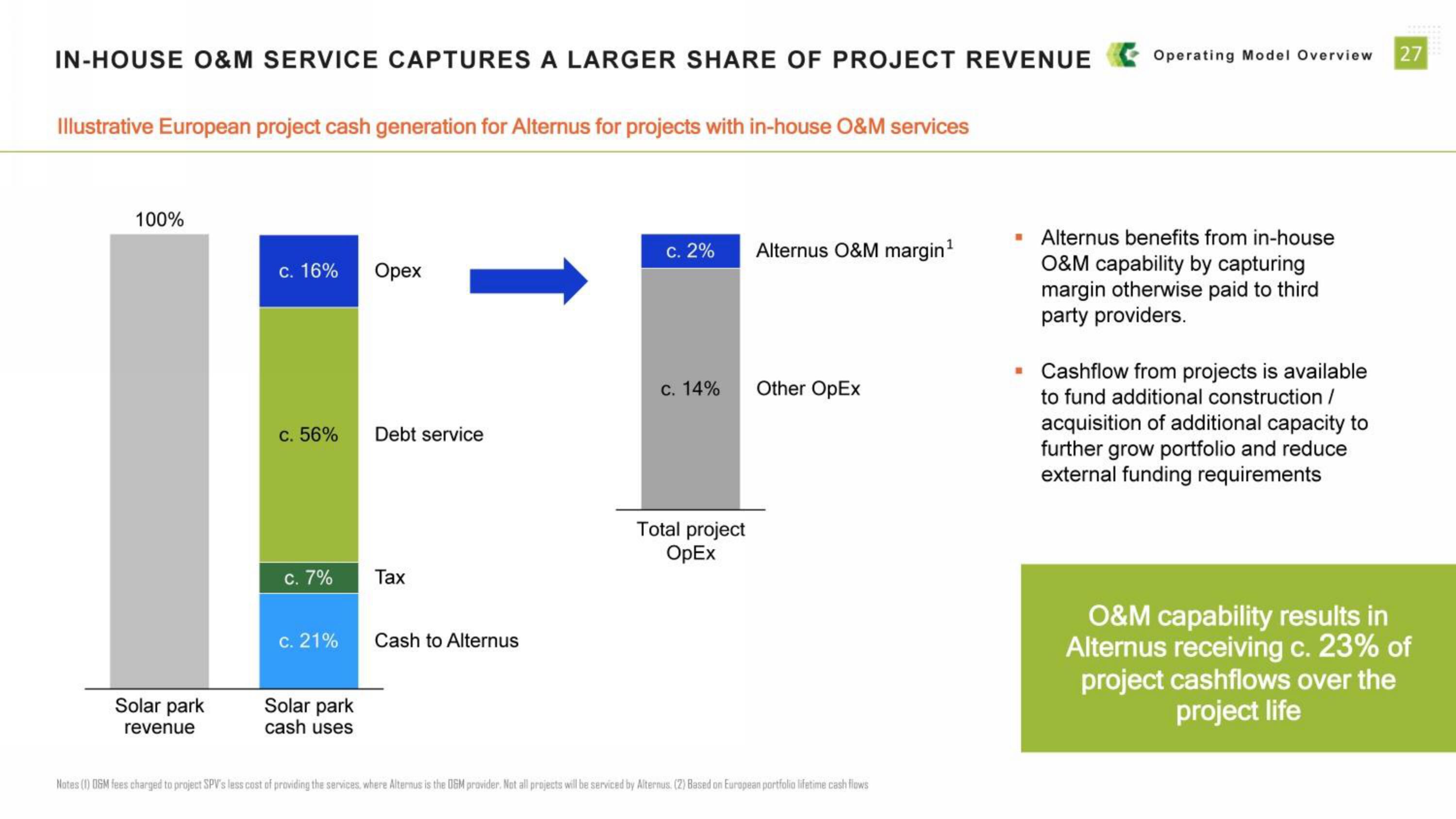

IN-HOUSE O&M SERVICE CAPTURES A LARGER SHARE OF PROJECT REVENUE

Illustrative European project cash generation for Alternus for projects with in-house O&M services

100%

Solar park

revenue

c. 16%

c. 56%

c. 7%

c. 21%

Solar park

cash uses

Opex

↑

Debt service

Tax

Cash to Alternus

c. 2%

c. 14%

Total project

OpEx

Alternus O&M margin¹

Other OpEx

Notes (1) OGM fees charged to project SPV's less cost of providing the services, where Alternus is the OGM provider. Not all projects will be serviced by Alternus. (2) Based on European portfolio lifetime cash flows

Operating Model Overview

Alternus benefits from in-house

O&M capability by capturing

margin otherwise paid to third

party providers.

▪ Cashflow from projects is available

to fund additional construction /

acquisition of additional capacity to

further grow portfolio and reduce

external funding requirements

27

O&M capability results in

Alternus receiving c. 23% of

project cashflows over the

project lifeView entire presentation