Baird Investment Banking Pitch Book

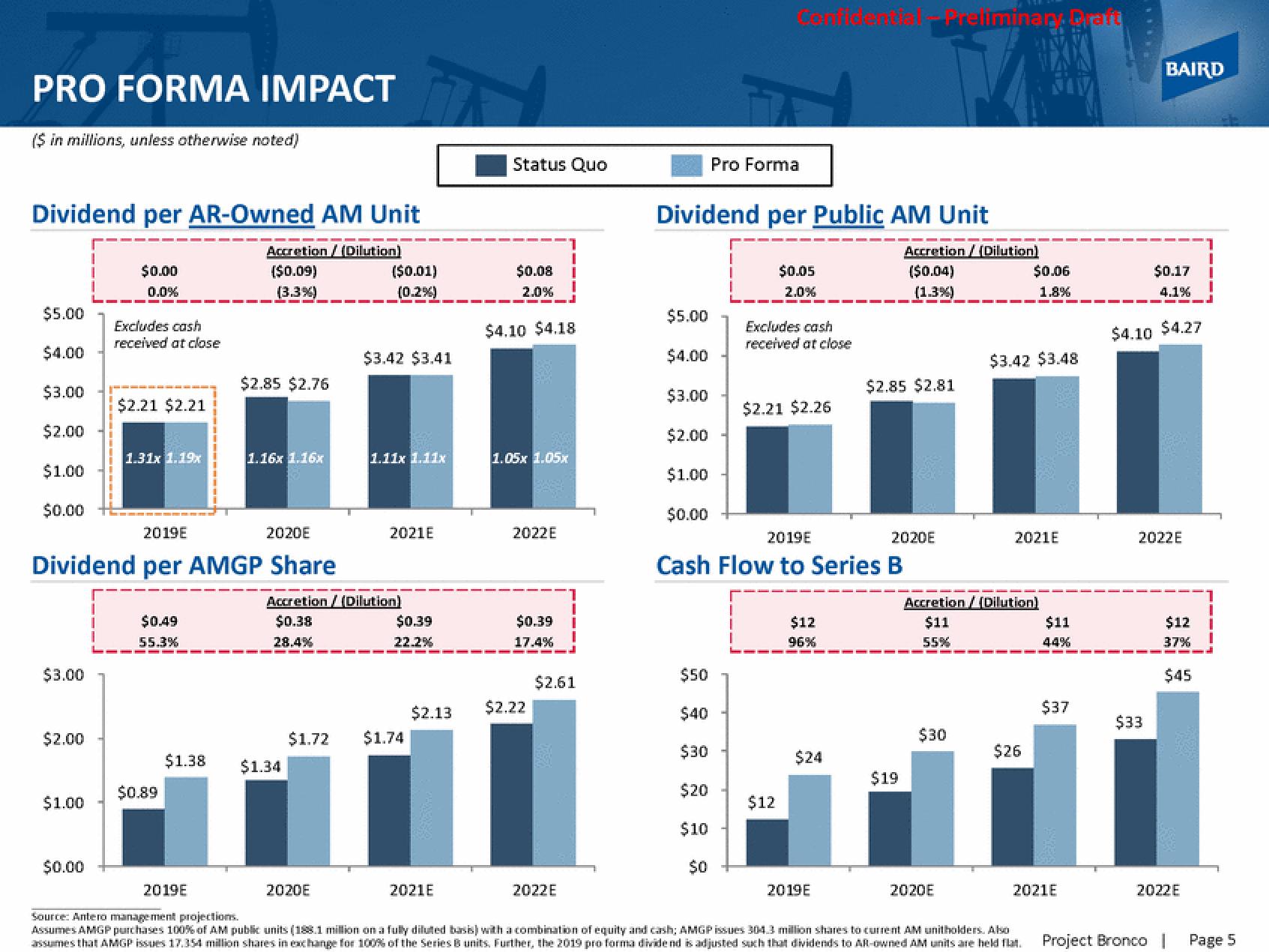

PRO FORMA IMPACT

($ in millions, unless otherwise noted)

Dividend per AR-Owned AM Unit

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

$3.00

$2.00

$1.00

$0.00

0.0%

$0.00

Excludes cash

received at close

$2.21 $2.21

1.31x 1.19x

2019E

2020E

Dividend per AMGP Share

$0.49

55.3%

$0.89

Accretion/ (Dilution)

($0.09)

(3.3%)

$1.38

$2.85 $2.76

1.16x 1.16x

$0.38

28.4%

$1.34

($0.01)

(0.2%)

$3.42 $3.41

Accretion/(Dilution)

1.11x 1.11x

2020E

2021E

$0.39

22.2%

$1.72 $1.74

$2.13

Status Quo

2021E

$0.08

2.0%

$4.10 $4.18

1.05x 1.05x

2022E

$0.39

17.4%

$2.22

$2.61

2022E

$5.00

$4.00

$3.00

$2.00

$1.00

Dividend per Public AM Unit

$0.00

$50

$40

$30

$20

$10

Cantide Clerreliminary. Praft

Pro Forma

$0

$0.05

2.0%

Excludes cash

received at close

$2.21 $2.26

2019E

Cash Flow to Series B

$12

$12

96%

$24

2019E

Accretion/(Dilution)

$2.85 $2.81

($0.04)

(1.3%)

2020E

$19

$11

55%

$30

2019E

Source: Antero management projections.

Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with a combination of equity and cash; AMGP issues 304.3 million shares to current AM unitholders. Also

assumes that AMGP issues 17.354 million shares in exchange for 100% of the Series B units. Further, the 2019 pro forma dividend is adjusted such that dividends to AR-owned AM units are held flat.

Accretion/(Dilution)

$3.42 $3.48

2020E

$0.06

1.8%

2021E

$26

$11

44%

$37

2021E

$4.10

$33

BAIRD

$0.17

4.1%

2022E

Project Bronco

$4.27

$12

37%

$45

2022E

Page 5View entire presentation