RELX Investor Day Presentation Deck

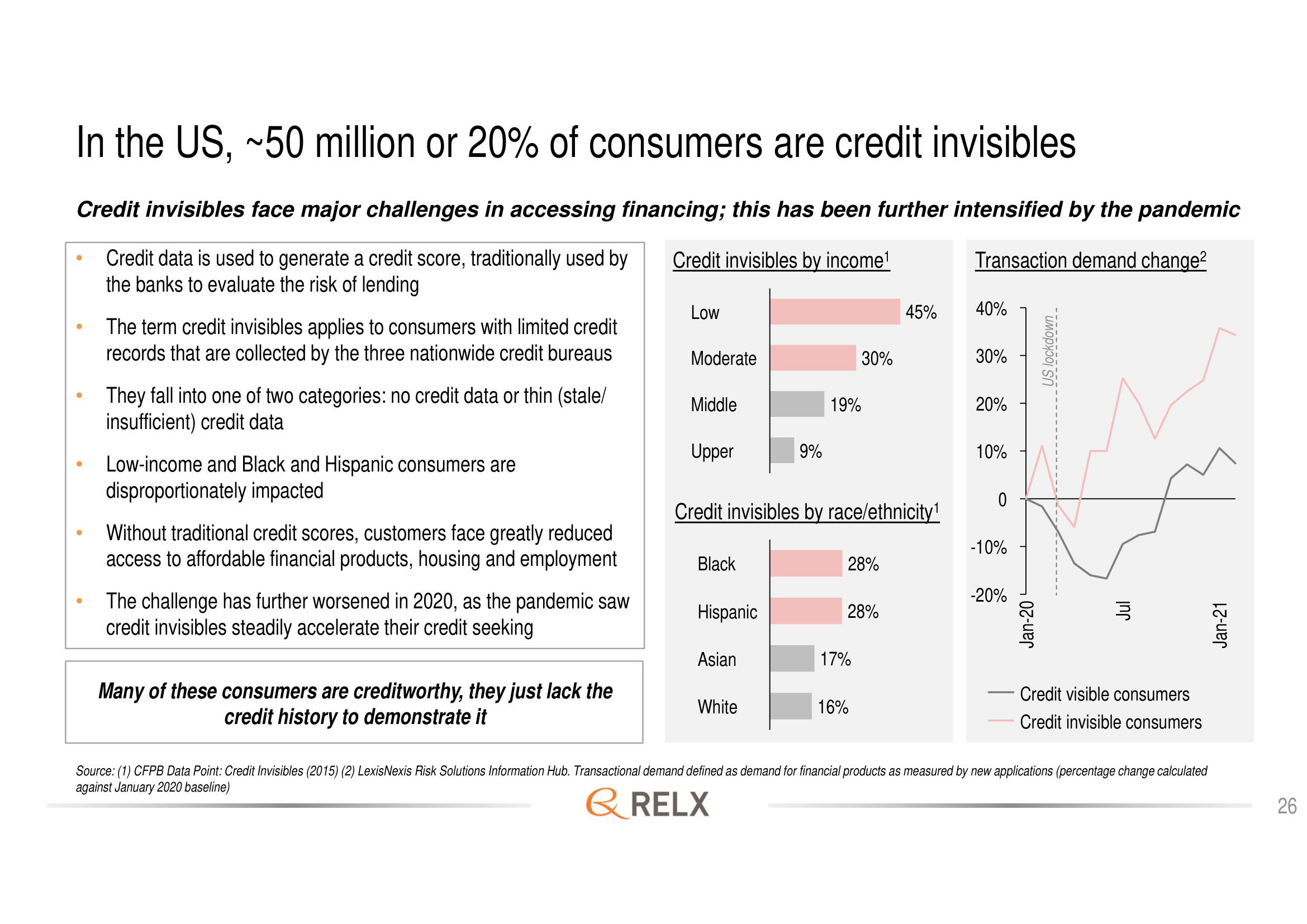

In the US, ~50 million or 20% of consumers are credit invisibles

Credit invisibles face major challenges in accessing financing; this has been further intensified by the pandemic

Credit invisibles by income¹

Transaction demand change²

Credit data is used to generate a credit score, traditionally used by

the banks to evaluate the risk of lending

The term credit invisibles applies to consumers with limited credit

records that are collected by the three nationwide credit bureaus

They fall into one of two categories: no credit data or thin (stale/

insufficient) credit data

Low-income and Black and Hispanic consumers are

disproportionately impacted

Without traditional credit scores, customers face greatly reduced

access to affordable financial products, housing and employment

The challenge has further worsened in 2020, as the pandemic saw

credit invisibles steadily accelerate their credit seeking

Many of these consumers are creditworthy, they just lack the

credit history to demonstrate it

Low

Moderate

Middle

Upper

Black

Hispanic

Asian

9%

Credit invisibles by race/ethnicity¹

White

19%

30%

28%

28%

17%

16%

45%

40%

30%

20%

10%

0

-10%

-20%

Jan-20

US lockdown

Jul

Credit visible consumers

Credit invisible consumers

Source: (1) CFPB Data Point: Credit Invisibles (2015) (2) LexisNexis Risk Solutions Information Hub. Transactional demand defined as demand for financial products as measured by new applications (percentage change calculated

against January 2020 baseline)

& RELX

Jan-21

26View entire presentation