Morgan Stanley Investor Presentation Deck

Morgan Stanley

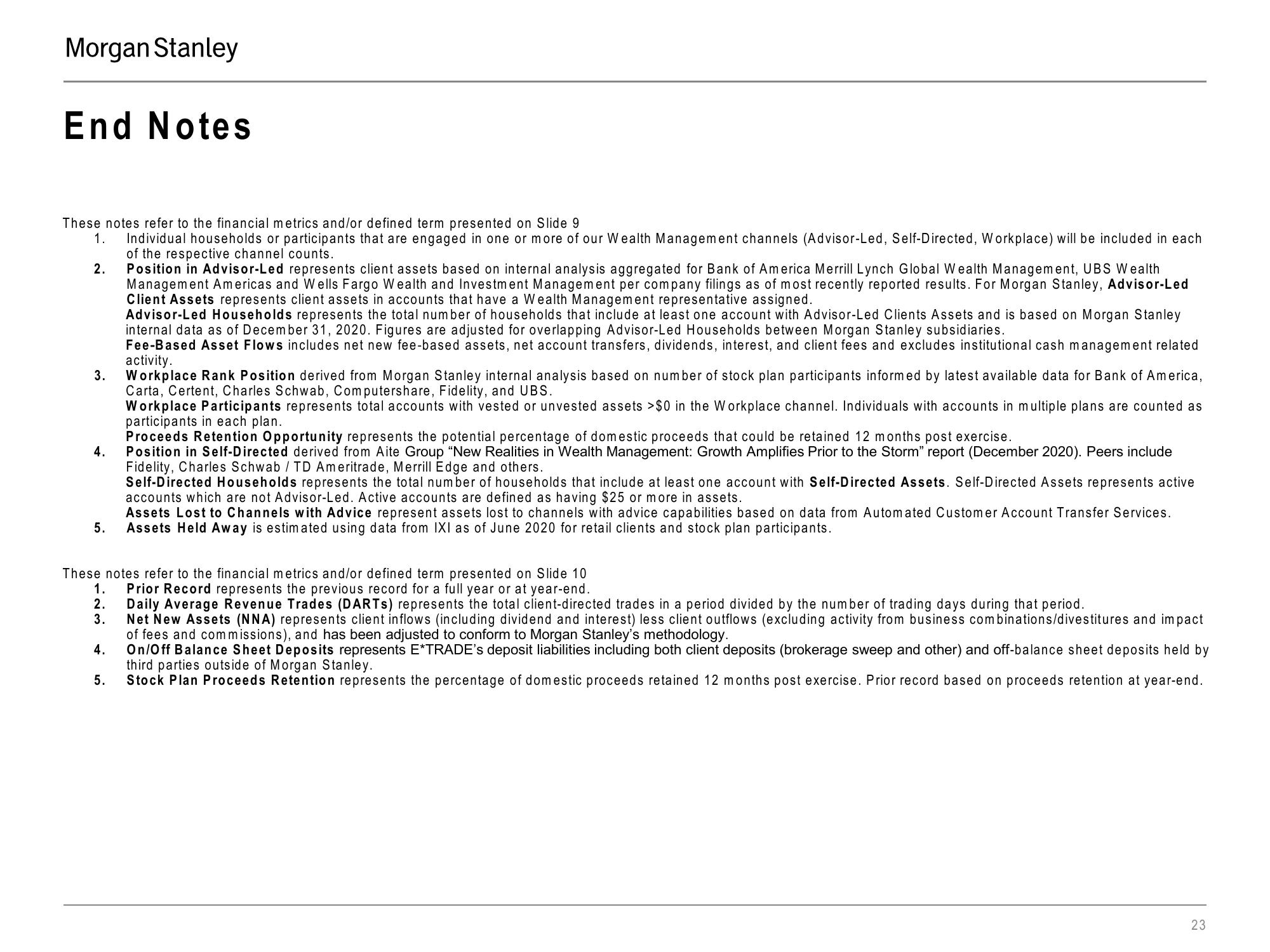

End Notes

These notes refer to the financial metrics and/or defined term presented on Slide 9

1.

Individual households or participants that are engaged in one or more of our Wealth Management channels (Advisor-Led, Self-Directed, Workplace) will be included in each

of the respective channel counts.

Position in Advisor-Led represents client assets based on internal analysis aggregated for Bank of America Merrill Lynch Global Wealth Management, UBS Wealth

Management Americas and Wells Fargo Wealth and Investment Management per company filings as of most recently reported results. For Morgan Stanley, Advisor-Led

Client Assets represents client assets in accounts that have a Wealth Management representative assigned.

Advisor-Led Households represents the total number of households that include at least one account with Advisor-Led Clients Assets and is based on Morgan Stanley

internal data as of December 31, 2020. Figures are adjusted for overlapping Advisor-Led Households between Morgan Stanley subsidiaries.

Fee-Based Asset Flows includes net new fee-based assets, net account transfers, dividends, interest, and client fees and excludes institutional cash management related

activity.

2.

3. Workplace Rank Position derived from Morgan Stanley internal analysis based on number of stock plan participants informed by latest available data for Bank of America,

Carta, Certent, Charles Schwab, Computershare, Fidelity, and UBS.

Workplace Participants represents total accounts with vested or unvested assets >$0 in the Workplace channel. Individuals with accounts in multiple plans are counted as

participants in each plan.

4.

5.

These notes refer to the financial metrics and/or defined term presented on Slide 10

Prior Record represents the previous record for a full year or at year-end.

Daily Average Revenue Trades (DARTS) represents the total client-directed trades in a period divided by the number of trading days during that period.

Net New Assets (NNA) represents client inflows (including dividend and interest) less client outflows (excluding activity from business combinations/divestitures and impact

of fees and commissions), and has been adjusted to conform to Morgan Stanley's methodology.

On/Off Balance Sheet Deposits represents E*TRADE's deposit liabilities including both client deposits (brokerage sweep and other) and off-balance sheet deposits held by

third parties outside of Morgan Stanley.

Stock Plan Proceeds Retention represents the percentage of domestic proceeds retained 12 months post exercise. Prior record based on proceeds retention at year-end.

1.

2.

3.

4.

Proceeds Retention Opportunity represents the potential percentage of domestic proceeds that could be retained 12 months post exercise.

Position in Self-Directed derived from Aite Group "New Realities in Wealth Management: Growth Amplifies Prior to the Storm" report (December 2020). Peers include

Fidelity, Charles Schwab / TD Ameritrade, Merrill Edge and others.

Self-Directed Households represents the total number of households that include at least one account with Self-Directed Assets. Self-Directed Assets represents active

accounts which are not Advisor-Led. Active accounts are defined as having $25 or more in assets.

Assets Lost to Channels with Advice represent assets lost to channels with advice capabilities based on data from Automated Customer Account Transfer Services.

Assets Held Away is estimated using data from IXI as of June 2020 for retail clients and stock plan participants.

5.

23View entire presentation