Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

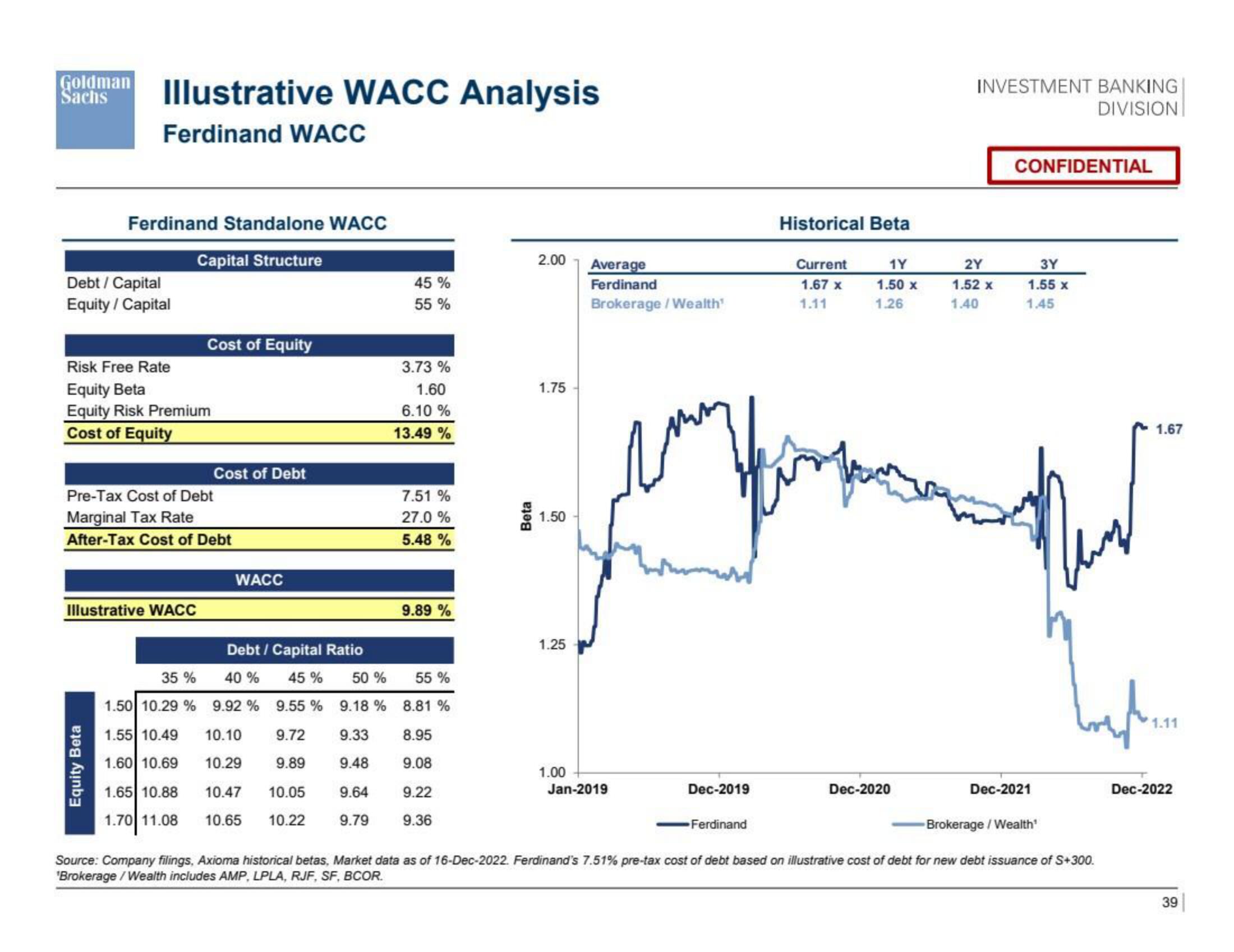

Illustrative WACC Analysis

Ferdinand WACC

Ferdinand Standalone WACC

Capital Structure

Debt / Capital

Equity / Capital

Risk Free Rate

Equity Beta

Equity Risk Premium

Cost of Equity

Equity Beta

Illustrative WACC

Cost of Equity

Pre-Tax Cost of Debt

Marginal Tax Rate

After-Tax Cost of Debt

35 %

1.50 10.29 %

1.55 10.49

1.60 10.69

1.65 10.88

1.70 11.08

Cost of Debt

WACC

Debt/ Capital Ratio

40 %

9.92 %

45 % 50 %

9.18%

9.55%

10.10

9.72

10.29

9.89

10.47 10.05

10.65 10.22

9.33

9.48

9.64

9.79

45 %

55 %

3.73%

1.60

6.10 %

13.49%

7.51 %

27.0%

5.48%

9.89%

55 %

8.81%

8.95

9.08

9.22

9.36

Beta

2.00

1.75

1.50

1.25

1.00

Average

Ferdinand

Brokerage /Wealth'

Jan-2019

Dec-2019

Historical Beta

Current

1.67 x

1.11

1Y

1.50 x

1.26

Dec-2020

INVESTMENT BANKING

DIVISION

2Y

1.52 x

1.40

CONFIDENTIAL

3Y

1.55 X

1.45

Mus

Dec-2021

Ferdinand

-Brokerage / Wealth'

Source: Company filings, Axioma historical betas, Market data as of 16-Dec-2022. Ferdinand's 7.51% pre-tax cost of debt based on illustrative cost of debt for new debt issuance of S+300.

'Brokerage / Wealth includes AMP, LPLA, RJF, SF, BCOR.

1.67

1.11

Dec-2022

39View entire presentation