Doma SPAC Presentation Deck

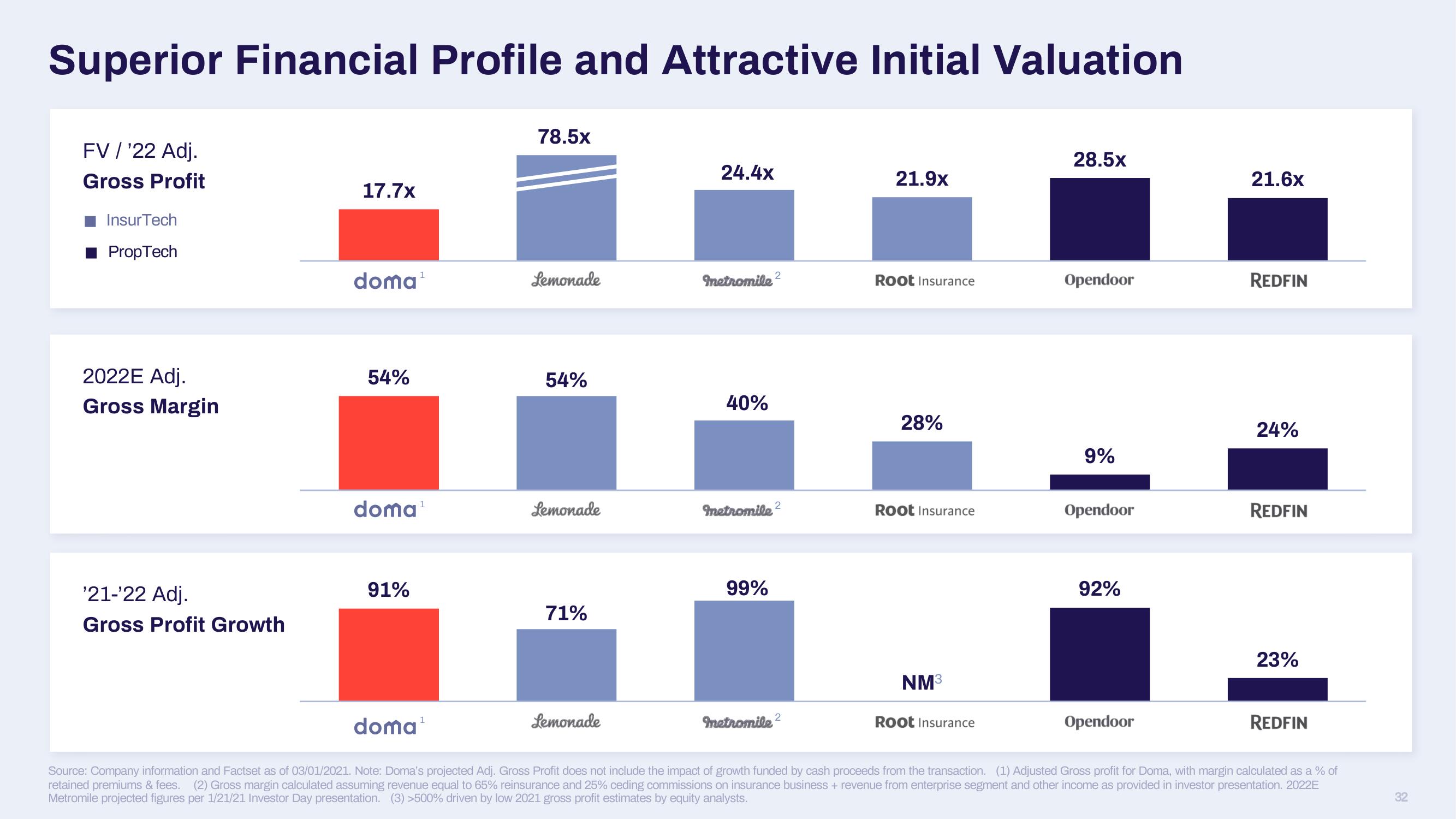

Superior Financial Profile and Attractive Initial Valuation

FV / '22 Adj.

Gross Profit

Insur Tech

Tech

2022E Adj.

Gross Margin

'21-'22 Adj.

Gross Profit Growth

17.7x

doma¹

54%

doma¹

91%

78.5x

Lemonade

54%

Lemonade

71%

Lemonade

24.4x

metromile ²

40%

metromile 2

99%

metromile²

21.9x

Root Insurance

28%

Root Insurance

NM³

Root Insurance

28.5x

Opendoor

9%

Opendoor

92%

Opendoor

21.6x

REDFIN

24%

REDFIN

23%

REDFIN

doma¹

Source: Company information and Factset as of 03/01/2021. Note: Doma's projected Adj. Gross Profit does not include the impact of growth funded by cash proceeds from the transaction. (1) Adjusted Gross profit for Doma, with margin calculated as a % of

retained premiums & fees. (2) Gross margin calculated assuming revenue equal to 65% reinsurance and 25% ceding commissions on insurance business + revenue from enterprise segment and other income as provided in investor presentation. 2022E

Metromile projected figures per 1/21/21 Investor Day presentation. (3) >500% driven by low 2021 gross profit estimates by equity analysts.

32View entire presentation