Dave Results Presentation Deck

Expanding variable

margin

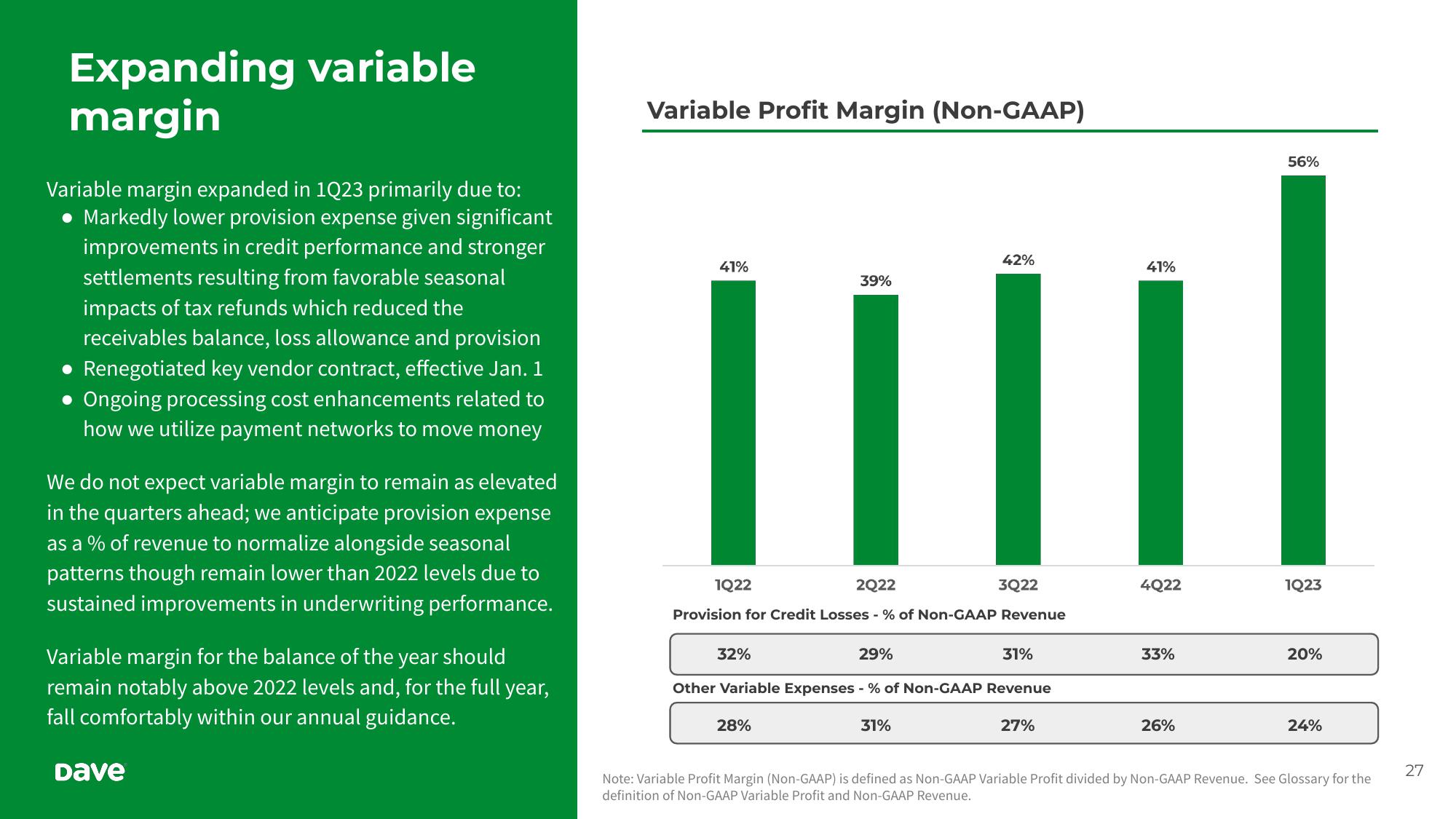

Variable margin expanded in 1Q23 primarily due to:

• Markedly lower provision expense given significant

improvements in credit performance and stronger

settlements resulting from favorable seasonal

impacts of tax refunds which reduced the

receivables balance, loss allowance and provision

• Renegotiated key vendor contract, effective Jan. 1

• Ongoing processing cost enhancements related to

how we utilize payment networks to move money

We do not expect variable margin to remain as elevated

in the quarters ahead; we anticipate provision expense

as a % of revenue to normalize alongside seasonal

patterns though remain lower than 2022 levels due to

sustained improvements in underwriting performance.

Variable margin for the balance of the year should

remain notably above 2022 levels and, for the full year,

fall comfortably within our annual guidance.

Dave

Variable Profit Margin (Non-GAAP)

41%

1Q22

2Q22

3Q22

Provision for Credit Losses - % of Non-GAAP Revenue

32%

39%

28%

29%

42%

41%

|||

4Q22

Other Variable Expenses - % of Non-GAAP Revenue

31%

31%

27%

33%

56%

26%

1Q23

20%

24%

Note: Variable Profit Margin (Non-GAAP) is defined as Non-GAAP Variable Profit divided by Non-GAAP Revenue. See Glossary for the

definition of Non-GAAP Variable Profit and Non-GAAP Revenue.

27View entire presentation