Sonos Results Presentation Deck

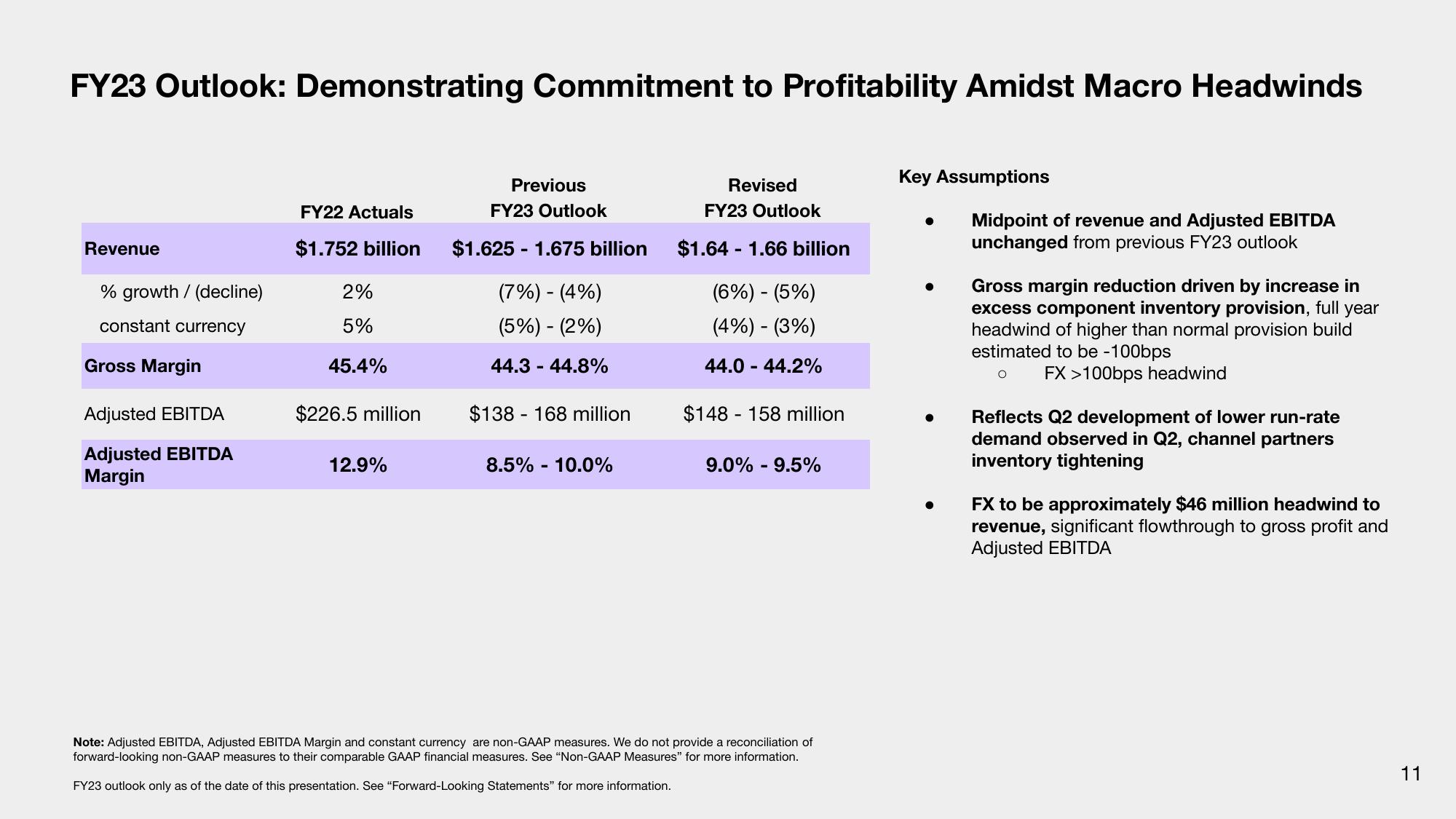

FY23 Outlook: Demonstrating Commitment to Profitability Amidst Macro Headwinds

Revenue

% growth / (decline)

constant currency

Gross Margin

Adjusted EBITDA

Adjusted EBITDA

Margin

FY22 Actuals

$1.752 billion

2%

5%

45.4%

$226.5 million

12.9%

Previous

FY23 Outlook

$1.625 1.675 billion

-

(7%) - (4%)

(5%) - (2%)

44.3 - 44.8%

$138 168 million

8.5% - 10.0%

Revised

FY23 Outlook

$1.641.66 billion

(6%) - (5%)

(4%) - (3%)

44.0 - 44.2%

$148 158 million

9.0% - 9.5%

Note: Adjusted EBITDA, Adjusted EBITDA Margin and constant currency are non-GAAP measures. We do not provide a reconciliation of

forward-looking non-GAAP measures to their comparable GAAP financial measures. See "Non-GAAP Measures" for more information.

FY23 outlook only as of the date of this presentation. See "Forward-Looking Statements" for more information.

Key Assumptions

Midpoint of revenue and Adjusted EBITDA

unchanged from previous FY23 outlook

Gross margin reduction driven by increase in

excess component inventory provision, full year

headwind of higher than normal provision build

estimated to be -100bps

O

FX >100bps headwind

Reflects Q2 development of lower run-rate

demand observed in Q2, channel partners

inventory tightening

FX to be approximately $46 million headwind to

revenue, significant flowthrough to gross profit and

Adjusted EBITDA

11View entire presentation