Deutsche Bank Results Presentation Deck

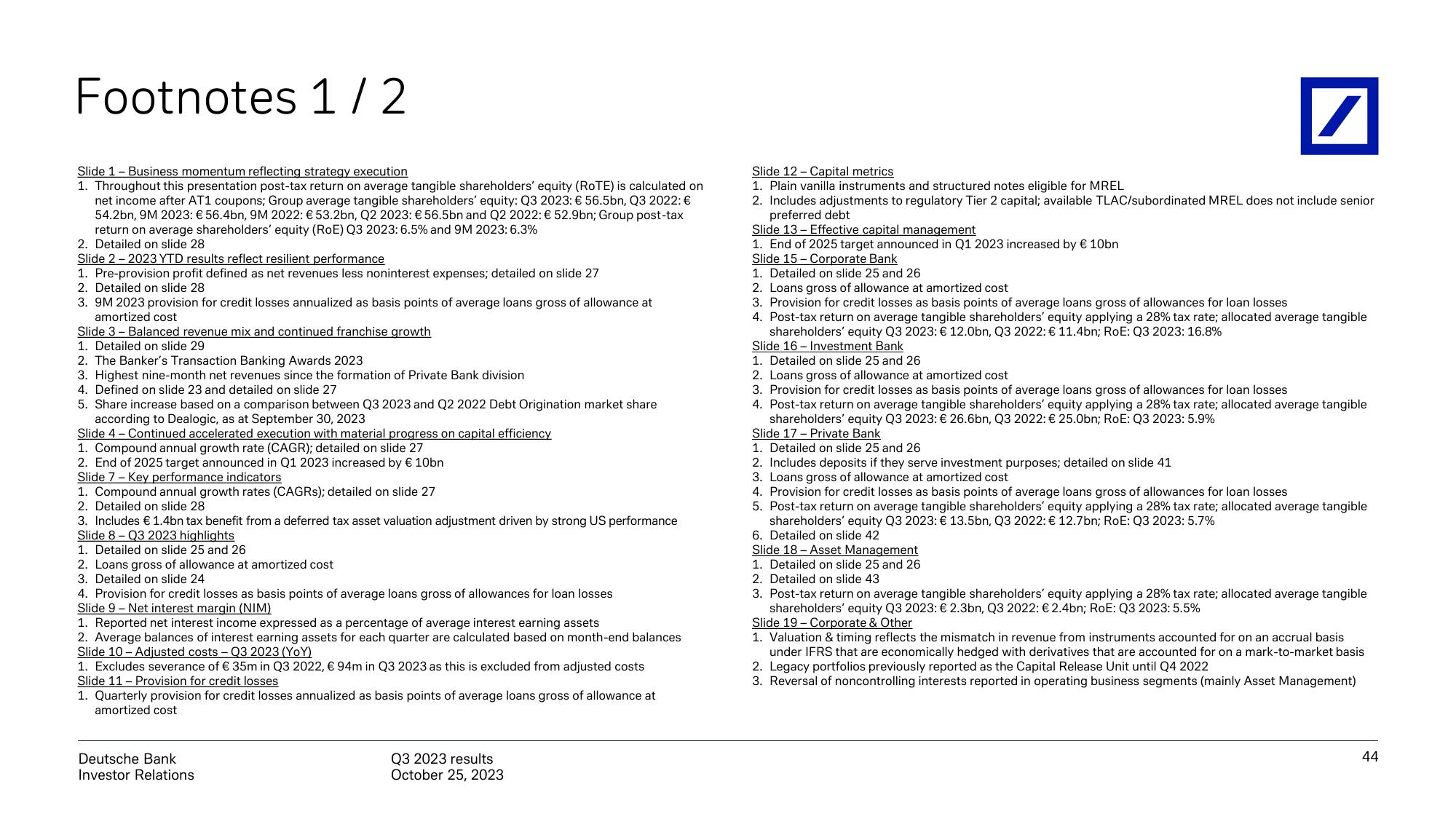

Footnotes 1/2

Slide 1 Business momentum reflecting strategy execution

1. Throughout this presentation post-tax return on average tangible shareholders' equity (RoTE) is calculated on

net income after AT1 coupons; Group average tangible shareholders' equity: Q3 2023: € 56.5bn, Q3 2022: €

54.2bn, 9M 2023: € 56.4bn, 9M 2022: €53.2bn, Q2 2023: € 56.5bn and Q2 2022: € 52.9bn; Group post-tax

return on average shareholders' equity (RoE) Q3 2023: 6.5% and 9M 2023: 6.3%

2. Detailed on slide 28

Slide 2-2023 YTD results reflect resilient performance

1. Pre-provision profit defined as net revenues less noninterest expenses; detailed on slide 27

2. Detailed on slide 28

3. 9M 2023 provision for credit losses annualized as basis points of average loans gross of allowance at

amortized cost

Slide 3 Balanced revenue mix and continued franchise growth

1. Detailed on slide 29

2. The Banker's Transaction Banking Awards 2023

3. Highest nine-month net revenues since the formation of Private Bank division

4. Defined on slide 23 and detailed on slide 27

5. Share increase based on a comparison between Q3 2023 and Q2 2022 Debt Origination market share

according to Dealogic, as at September 30, 2023

Slide 4 - Continued accelerated execution with material progress on capital efficiency

1. Compound annual growth rate (CAGR); detailed on slide 27

2. End of 2025 target announced in Q1 2023 increased by € 10bn

Slide 7- Key performance indicators

1. Compound annual growth rates (CAGRS); detailed on slide 27

2. Detailed on slide 28

3. Includes € 1.4bn tax benefit from a deferred tax asset valuation adjustment driven by strong US performance

Slide 8-Q3 2023 highlights

1. Detailed on slide 25 and 26

2. Loans gross of allowance at amortized cost

3. Detailed on slide 24

4. Provision for credit losses as basis points of average loans gross of allowances for loan losses

Slide 9 Net interest margin (NIM)

1. Reported net interest income expressed as a percentage of average interest earning assets

2. Average balances of interest earning assets for each quarter are calculated based on month-end

Slide 10-Adjusted costs - Q3 2023 (YoY)

1. Excludes severance of € 35m in Q3 2022, € 94m in Q3 2023 as this is excluded from adjusted costs

Slide 11 Provision for credit losses

1. Quarterly provision for credit losses annualized as basis points of average loans gross of allowance at

amortized cost

Deutsche Bank

Investor Relations

Q3 2023 results

October 25, 2023

Slide 12- Capital metrics

1. Plain vanilla instruments and structured notes eligible for MREL

2. Includes adjustments to regulatory Tier 2 capital; available TLAC/subordinated MREL does not include senior

preferred debt

Slide 13 Effective capital management

1. End of 2025 target announced in Q1 2023 increased by € 10bn

Slide 15- Corporate Bank

1. Detailed on slide 25 and 26

2. Loans gross of allowance at amortized cost

3. Provision for credit losses as basis points of average loans gross of allowances for loan losses

4. Post-tax return on average tangible shareholders' equity applying a 28% tax rate; allocated average tangible

shareholders' equity Q3 2023: € 12.0bn, Q3 2022: € 11.4bn; RoE: Q3 2023: 16.8%

Slide 16- Investment Bank

1. Detailed on slide 25 and 26

2. Loans gross of allowance at amortized cost

3. Provision for credit losses as basis points of average loans gross of allowances for loan losses

4. Post-tax return on average tangible shareholders' equity applying a 28% tax rate; allocated average tangible

shareholders' equity Q3 2023: € 26.6bn, Q3 2022: € 25.0bn; RoE: Q3 2023: 5.9%

Slide 17 - Private Bank

1. Detailed on slide 25 and 26

2. Includes deposits if they serve investment purposes; detailed on slide 41

3. Loans gross of allowance at amortized cost

4. Provision for credit losses as basis points of average loans gross of allowances for loan losses

5. Post-tax return on average tangible shareholders' equity applying a 28% tax rate; allocated average tangible

shareholders' equity Q3 2023: € 13.5bn, Q3 2022: € 12.7bn; RoE: Q3 2023: 5.7%

6. Detailed on slide 42

Slide 18-Asset Management

1. Detailed on slide 25 and 26

2. Detailed on slide 43

3. Post-tax return on average tangible shareholders' equity applying a 28% tax rate; allocated average tangible

shareholders' equity Q3 2023: € 2.3bn, Q3 2022: € 2.4bn; RoE: Q3 2023: 5.5%

Slide 19 Corporate & Other

1. Valuation & timing reflects the mismatch in revenue from instruments accounted for on an accrual basis

under IFRS that are economically hedged with derivatives that are accounted for on a mark-to-market basis

2. Legacy portfolios previously reported as the Capital Release Unit until Q4 2022

3. Reversal of noncontrolling interests reported in operating business segments (mainly Asset Management)

44View entire presentation