Centessa IPO Presentation Deck

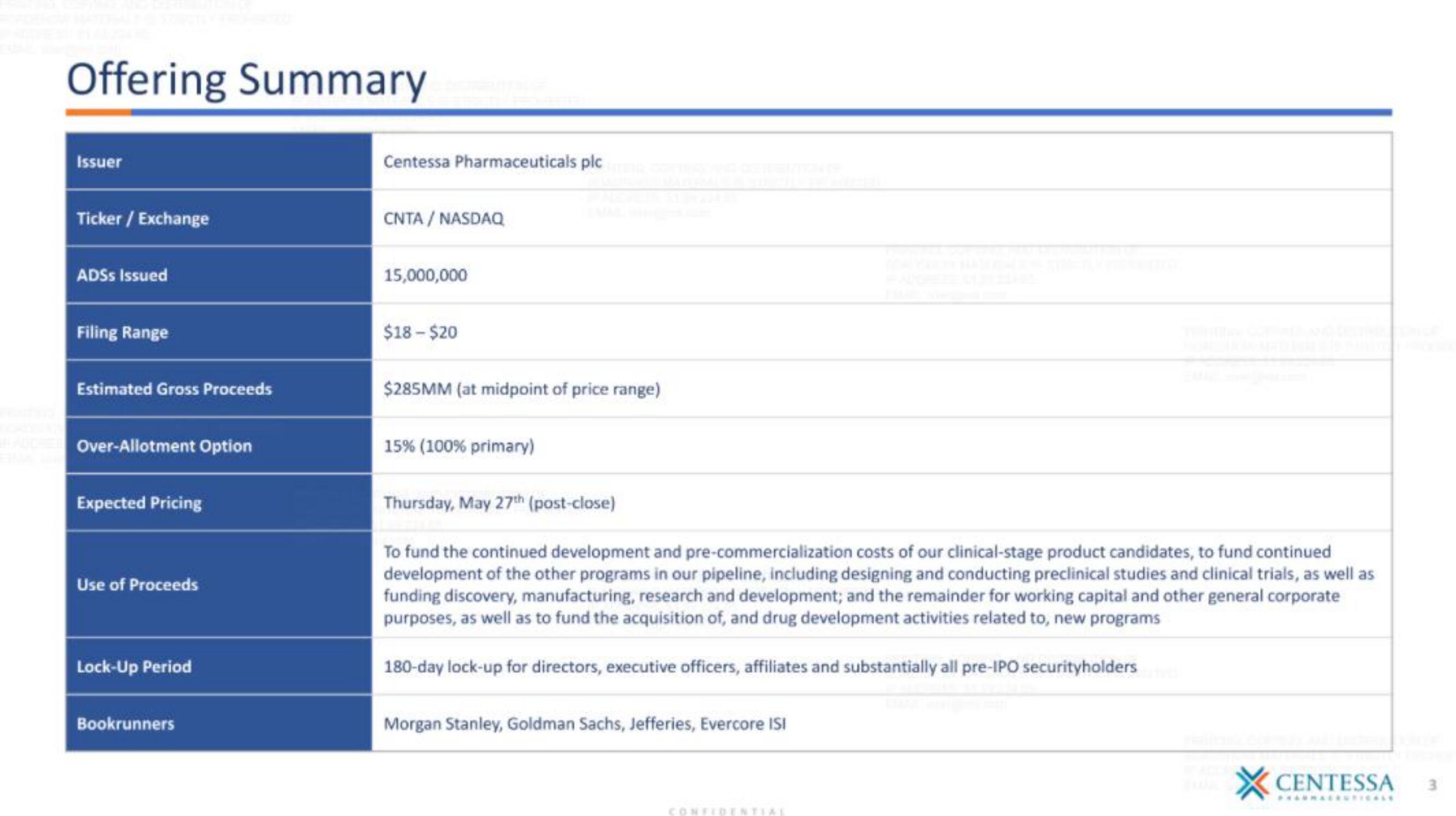

Offering Summary

Issuer

Ticker / Exchange

ADSs Issued

Filing Range

Estimated Gross Proceeds

Over-Allotment Option

Expected Pricing

Use of Proceeds

Lock-Up Period

Bookrunners

Centessa Pharmaceuticals plc

CNTA / NASDAQ

15,000,000

$18 - $20

$285MM (at midpoint of price range)

15% (100% primary)

Thursday, May 27th (post-close)

To fund the continued development and pre-commercialization costs of our clinical-stage product candidates, to fund continued

development of the other programs in our pipeline, including designing and conducting preclinical studies and clinical trials, as well as

funding discovery, manufacturing, research and development; and the remainder for working capital and other general corporate

purposes, as well as to fund the acquisition of, and drug development activities related to, new programs

180-day lock-up for directors, executive officers, affiliates and substantially all pre-IPO securityholders

Morgan Stanley, Goldman Sachs, Jefferies, Evercore ISI

XCENTESSAView entire presentation