Accelerating Value Creation for Shareholders

Establishment of new business model

Consumer finance: Loan business model by alliance with Promise

SMBC's business franchise + Promise's expertise

Target loan balance of approx. 500 billion yen* after 3 years

Interest rate

8%

Channel

15%

18%

SMBC marketing channels

→ Install loan processing machines developed by Promise

SMIFG

FY04:

Book

SMBC

SMBC Consumer

Finance**

Promise

<<Cascade Method>>

<<Cascade Method>>

Approx. 100

channels

FY05:

Marketing

Promise's expertise in marketing

Guarantee

Collection

Credit monitoring

Promise's expertise in

credit monitoring and collection

Target loan balance

after 3 years

¥200 bn

¥200 bn

¥100 bn

* Jointly by SMFG and Promise. ** Tentative name.

Expand

sequentially

11

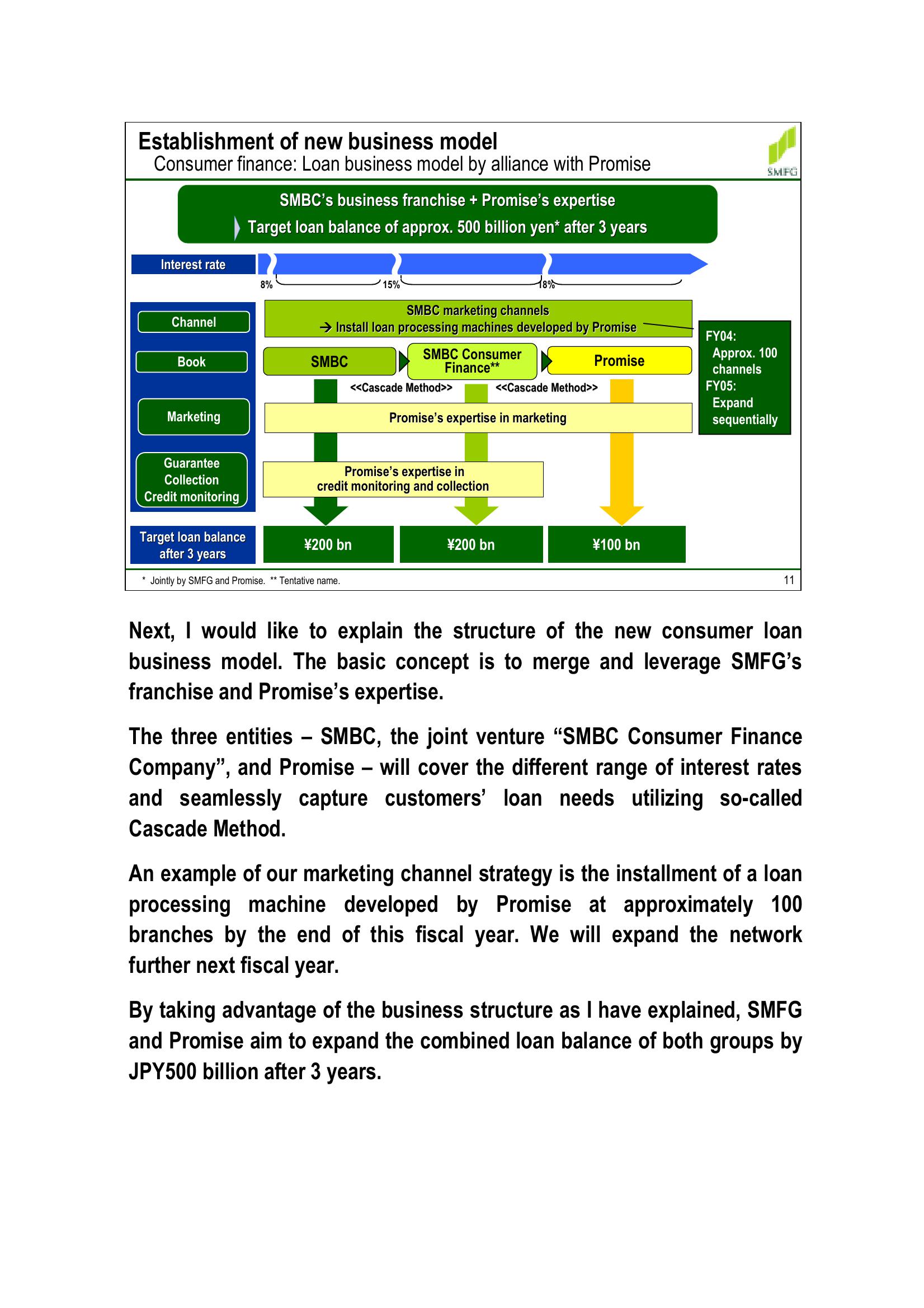

Next, I would like to explain the structure of the new consumer loan

business model. The basic concept is to merge and leverage SMFG's

franchise and Promise's expertise.

The three entities - SMBC, the joint venture "SMBC Consumer Finance

Company", and Promise - will cover the different range of interest rates

and seamlessly capture customers' loan needs utilizing so-called

Cascade Method.

An example of our marketing channel strategy is the installment of a loan.

processing machine developed by Promise at approximately 100

branches by the end of this fiscal year. We will expand the network

further next fiscal year.

By taking advantage of the business structure as I have explained, SMFG

and Promise aim to expand the combined loan balance of both groups by

JPY500 billion after 3 years.View entire presentation