Sonos Results Presentation Deck

Q3 Financial Summary

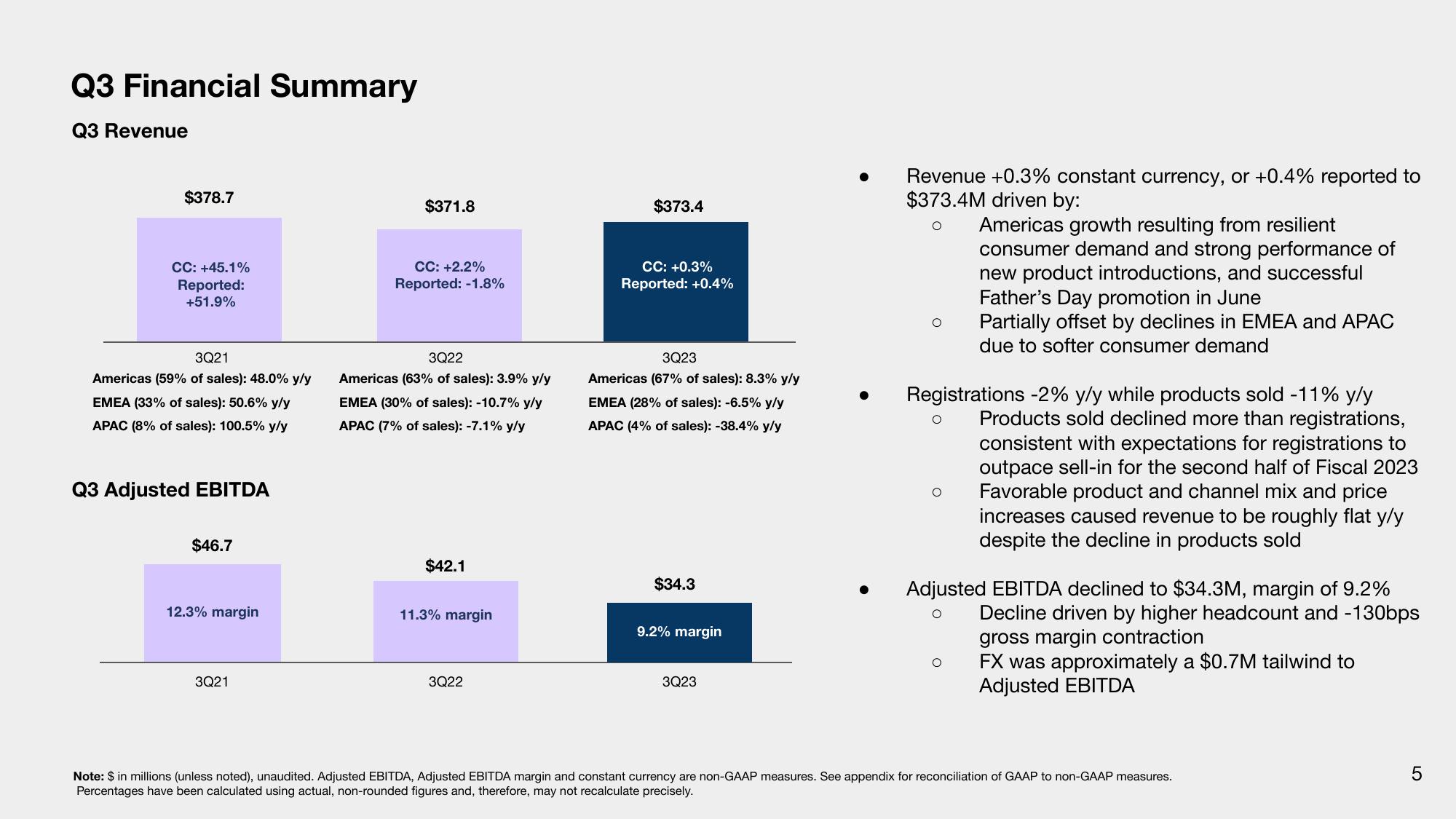

Q3 Revenue

$378.7

CC: +45.1%

Reported:

+51.9%

3Q21

Americas (59% of sales): 48.0% y/y

EMEA (33% of sales): 50.6% y/y

APAC (8% of sales): 100.5% y/y

Q3 Adjusted EBITDA

$46.7

12.3% margin

3Q21

$371.8

CC: +2.2%

Reported: -1.8%

3Q22

Americas (63% of sales): 3.9% y/y

EMEA (30% of sales): -10.7% y/y

APAC (7% of sales): -7.1% y/y

$42.1

11.3% margin

3Q22

$373.4

CC: +0.3%

Reported: +0.4%

3Q23

Americas (67% of sales): 8.3% y/y

EMEA (28% of sales): -6.5% y/y

APAC (4% of sales): -38.4% y/y

$34.3

9.2% margin

3Q23

Revenue +0.3% constant currency, or +0.4% reported to

$373.4M driven by:

Americas growth resulting from resilient

consumer demand and strong performance of

new product introductions, and successful

Father's Day promotion in June

Partially offset by declines in EMEA and APAC

due to softer consumer demand

O

Registrations -2% y/y while products sold -11% y/y

Products sold declined more than registrations,

consistent with expectations for registrations to

outpace sell-in for the second half of Fiscal 2023

Favorable product and channel mix and price

increases caused revenue to be roughly flat y/y

despite the decline in products sold

O

Adjusted EBITDA declined to $34.3M, margin of 9.2%

Decline driven by higher headcount and -130bps

gross margin contra tion

O

FX was approximately a $0.7M tailwind to

Adjusted EBITDA

Note: $ in millions (unless noted), unaudited. Adjusted EBITDA, Adjusted EBITDA margin and constant currency are non-GAAP measures. See appendix for reconciliation of GAAP to non-GAAP measures.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

5View entire presentation