Melrose Results Presentation Deck

Highlights

Melrose

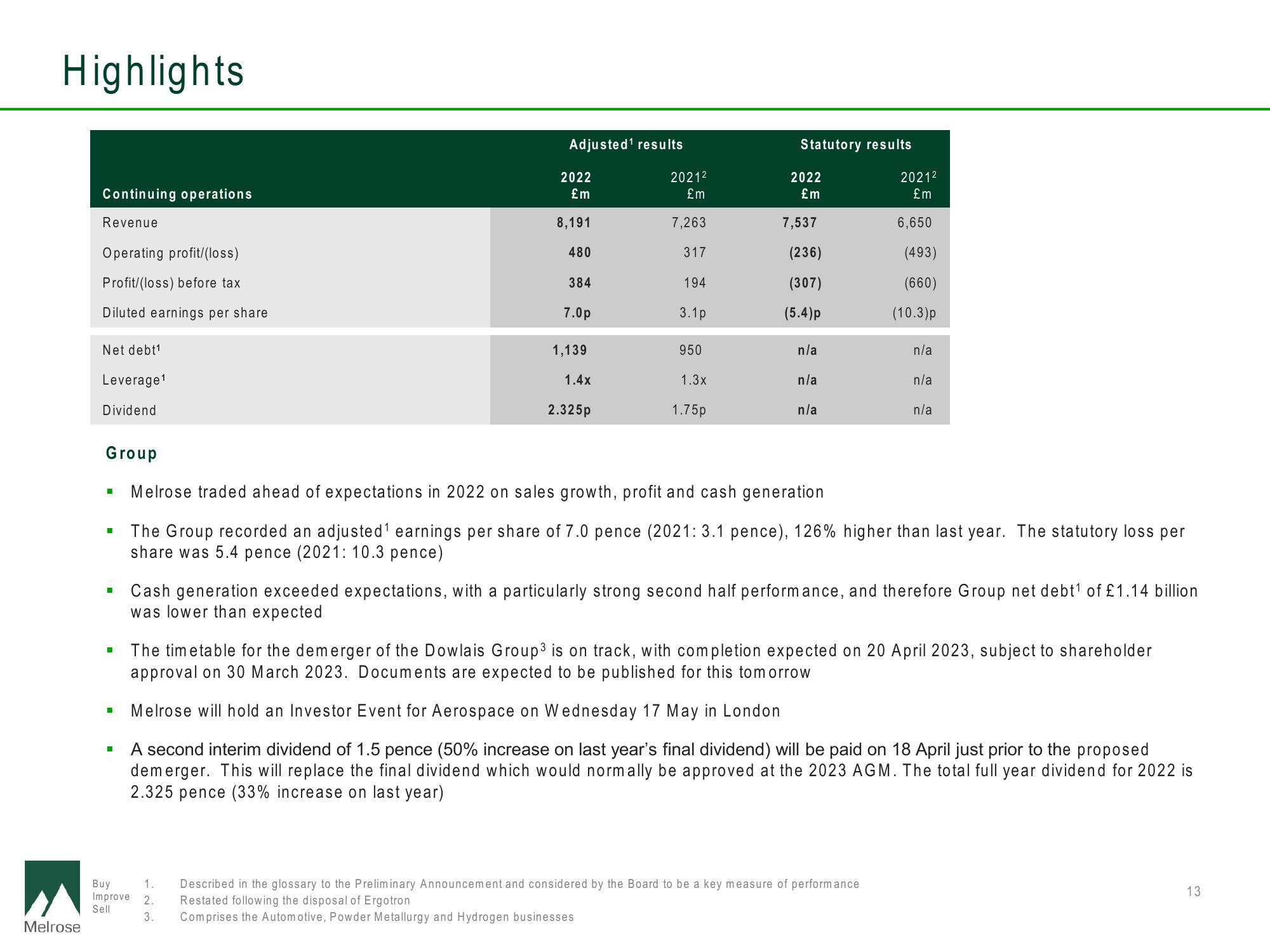

Continuing operations

Revenue

Operating profit/(loss)

Profit/(loss) before tax

Diluted earnings per share

Net debt¹

Leverage ¹

Dividend

Group

■

I

■

Adjusted¹ results

2022

£m

8,191

480

384

7.0p

1.

Buy

Improve 2.

Sell

3.

1,139

1.4x

2.325p

2021²

£m

7,263

317

194

3.1p

950

1.3x

1.75p

Statutory results

2022

£m

7,537

(236)

(307)

(5.4)p

n/a

n/a

n/a

2021²

£m

6,650

(493)

(660)

(10.3)p

n/a

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Restated following the disposal of Ergotron

Comprises the Automotive, Powder Metallurgy and Hydrogen businesses

n/a

Melrose traded ahead of expectations in 2022 on sales growth, profit and cash generation

The Group recorded an adjusted¹ earnings per share of 7.0 pence (2021: 3.1 pence), 126% higher than last year. The statutory loss per

share was 5.4 pence (2021: 10.3 pence)

n/a

Cash generation exceeded expectations, with a particularly strong second half performance, and therefore Group net debt¹ of £1.14 billion

was lower than expected

The timetable for the demerger of the Dowlais Group 3 is on track, with completion expected on 20 April 2023, subject to shareholder

approval on 30 March 2023. Documents are expected to be published for this tomorrow

Melrose will hold an Investor Event for Aerospace on Wednesday 17 May in London

A second interim dividend of 1.5 pence (50% increase on last year's final dividend) will be paid on 18 April just prior to the proposed

demerger. This will replace the final dividend which would normally be approved at the 2023 AGM. The total full year dividend for 2022 is

2.325 pence (33% increase on last year)

13View entire presentation