AlTi SPAC Presentation Deck

AITI Serving evolving client priorities

ALVARIUM TIEDEMANN CAPITAL

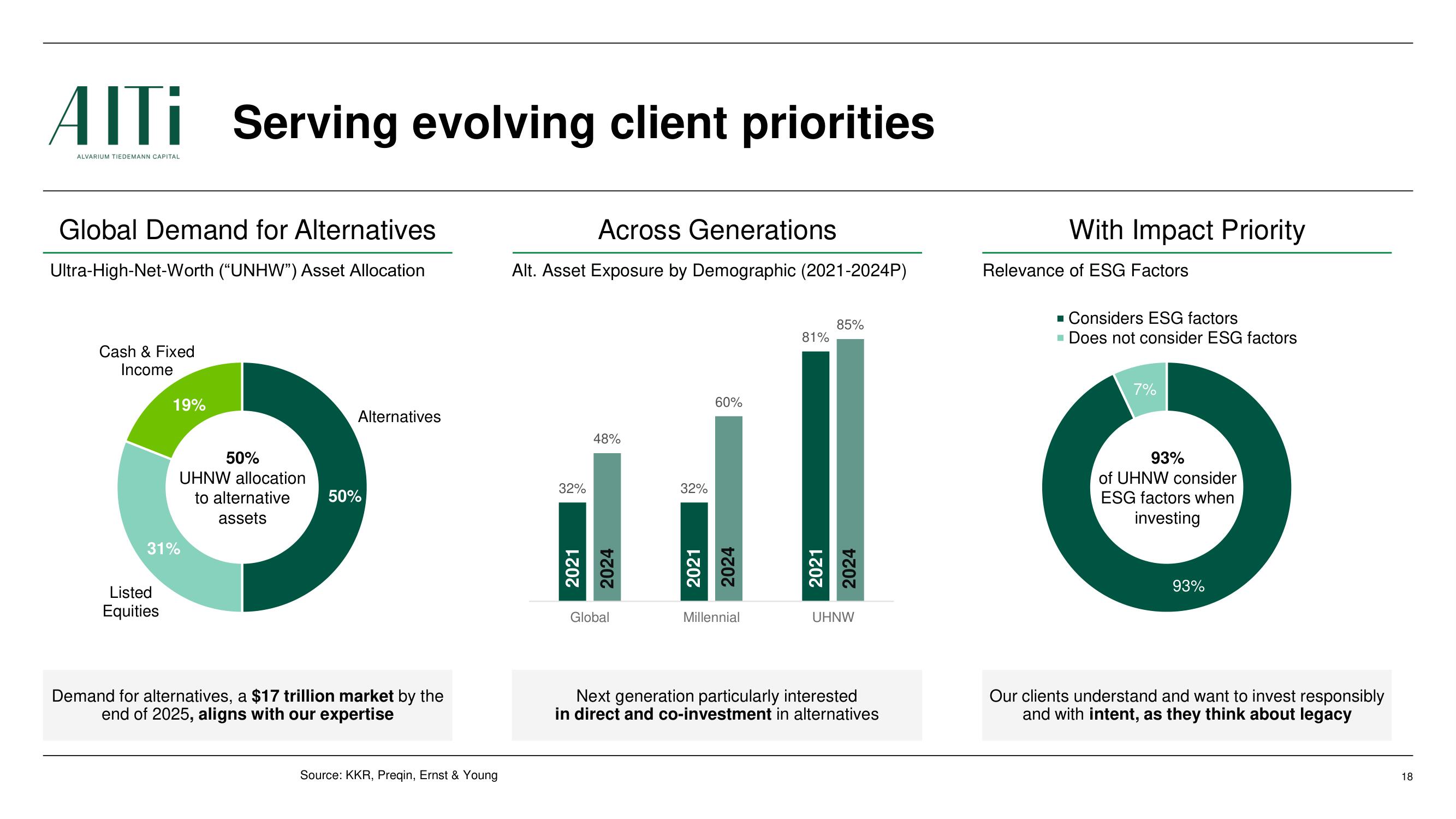

Global Demand for Alternatives

Ultra-High-Net-Worth ("UNHW") Asset Allocation

Cash & Fixed

Income

19%

31%

Listed

Equities

50%

UHNW allocation

to alternative

assets

Alternatives

50%

Demand for alternatives, a $17 trillion market by the

end of 2025, aligns with our expertise

Source: KKR, Preqin, Ernst & Young

Across Generations

Alt. Asset Exposure by Demographic (2021-2024P)

32%

48%

2021

2024

Global

32%

60%

2021

2024

Millennial

81%

85%

2021

2024

UHNW

Next generation particularly interested

in direct and co-investment in alternatives

With Impact Priority

Relevance of ESG Factors

■ Considers ESG factors

■ Does not consider ESG factors

7%

93%

of UHNW consider

ESG factors when

investing

93%

Our clients understand and want to invest responsibly

and with intent, as they think about legacy

18View entire presentation