Cooper Standard Third Quarter 2023 Earnings Presentation

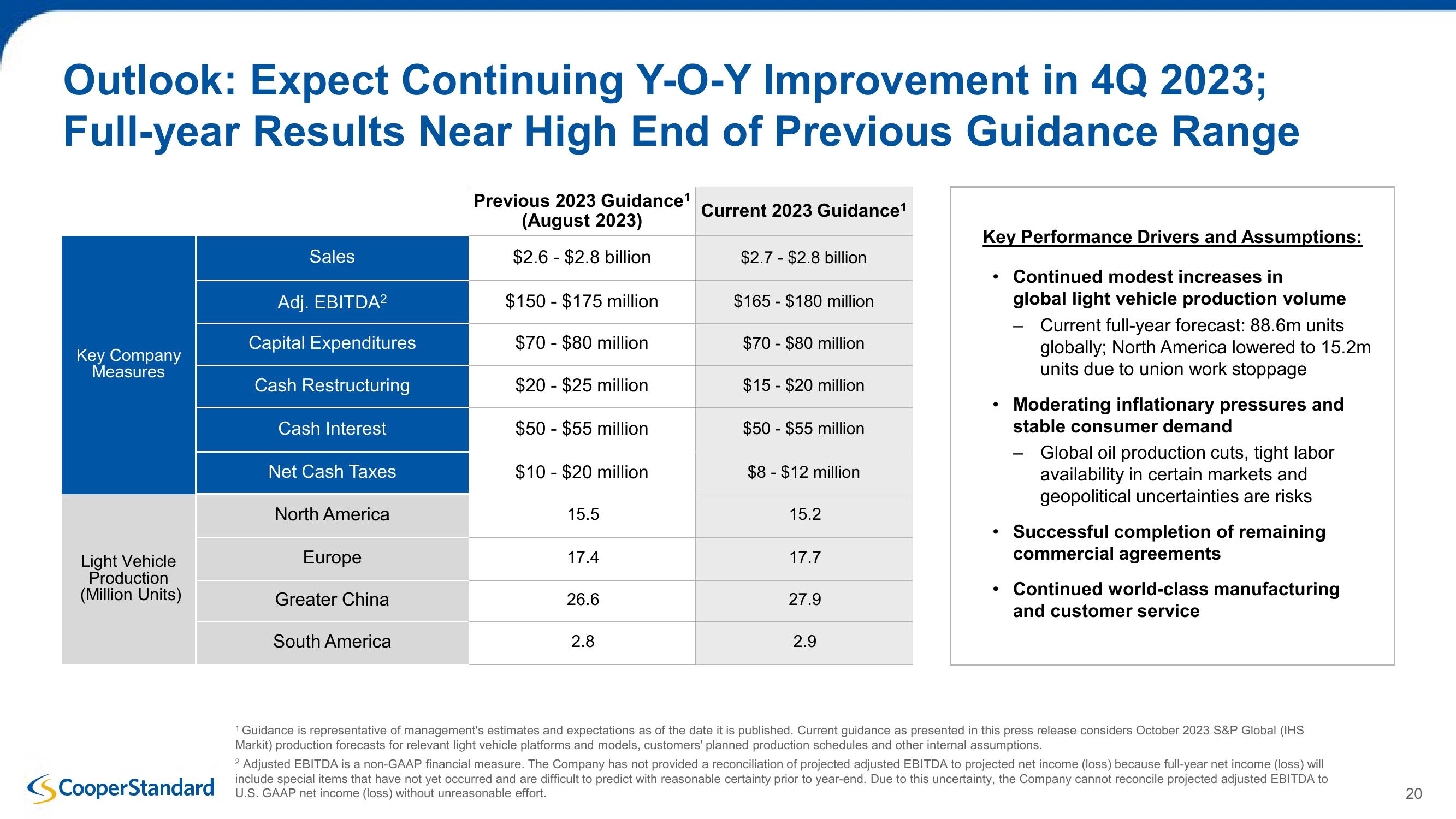

Outlook: Expect Continuing Y-O-Y Improvement in 4Q 2023;

Full-year Results Near High End of Previous Guidance Range

Previous 2023 Guidance¹

(August 2023)

Current 2023 Guidance¹

Sales

$2.6 $2.8 billion

$2.7 $2.8 billion

•

Adj. EBITDA²

$150 $175 million

$165 $180 million

Capital Expenditures

$70 $80 million

$70 - $80 million

Key Company

Measures

Cash Restructuring

$20 $25 million

$15 $20 million

.

Cash Interest

$50 $55 million

$50 $55 million

Net Cash Taxes

$10 - $20 million

$8 - $12 million

North America

15.5

15.2

•

Light Vehicle

Production

(Million Units)

Europe

17.4

17.7

•

Greater China

26.6

27.9

South America

2.8

2.9

Cooper Standard

Key Performance Drivers and Assumptions:

Continued modest increases in

global light vehicle production volume

-

Current full-year forecast: 88.6m units

globally; North America lowered to 15.2m

units due to union work stoppage

Moderating inflationary pressures and

stable consumer demand

Global oil production cuts, tight labor

availability in certain markets and

geopolitical uncertainties are risks

Successful completion of remaining

commercial agreements

Continued world-class manufacturing

and customer service

1 Guidance is representative of management's estimates and expectations as of the date it is published. Current guidance as presented in this press release considers October 2023 S&P Global (IHS

Markit) production forecasts for relevant light vehicle platforms and models, customers' planned production schedules and other internal assumptions.

2 Adjusted EBITDA is a non-GAAP financial measure. The Company has not provided a reconciliation of projected adjusted EBITDA to projected net income (loss) because full-year net income (loss) will

include special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end. Due to this uncertainty, the Company cannot reconcile projected adjusted EBITDA to

U.S. GAAP net income (loss) without unreasonable effort.

20

20View entire presentation