CorpAcq SPAC Presentation Deck

8

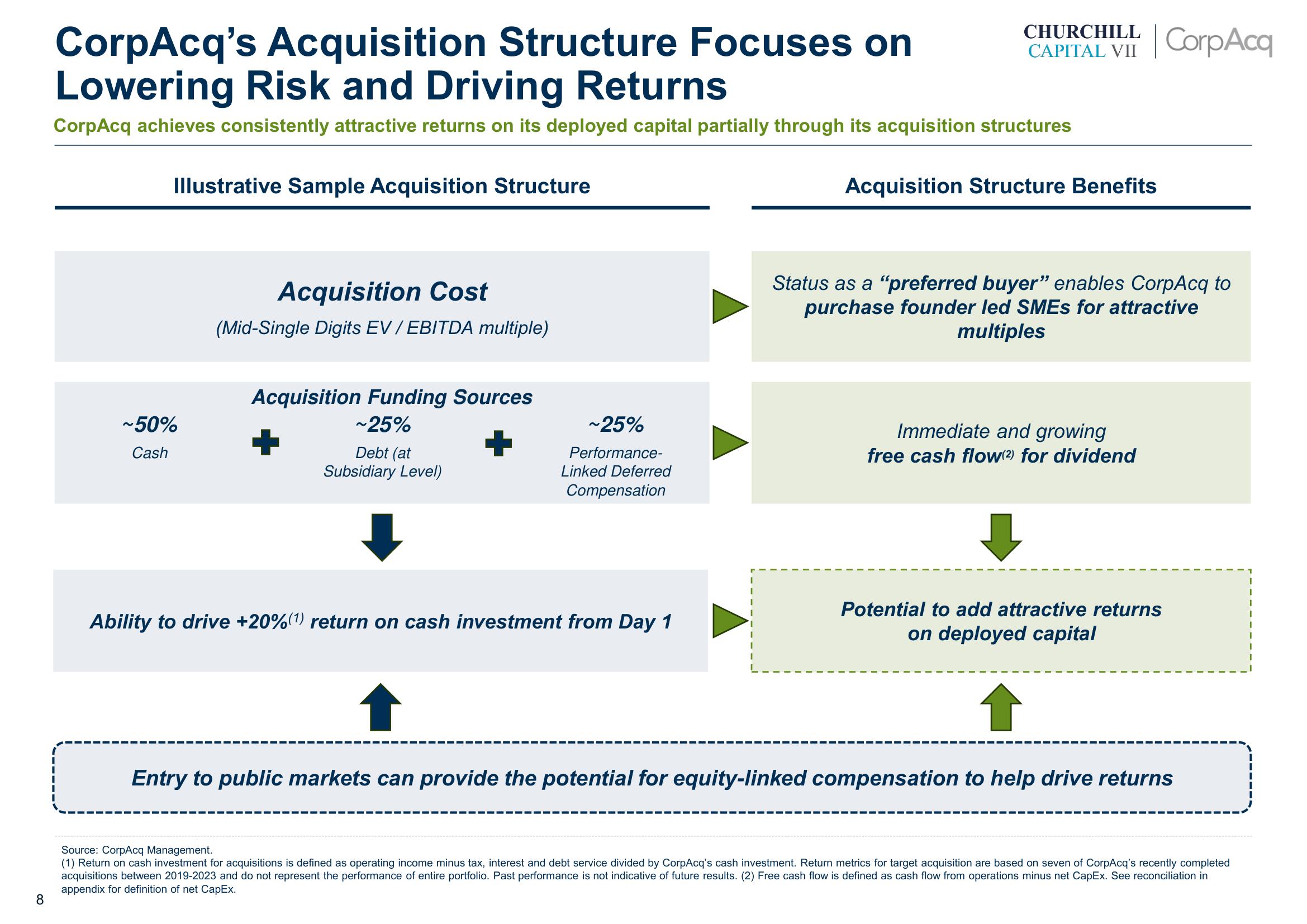

CorpAcq's Acquisition Structure Focuses on

Lowering Risk and Driving Returns

CorpAcq achieves consistently attractive returns on its deployed capital partially through its acquisition structures

Illustrative Sample Acquisition Structure

~50%

Cash

Acquisition Cost

(Mid-Single Digits EV / EBITDA multiple)

Acquisition Funding Sources

~25%

Debt (at

Subsidiary Level)

~25%

Performance-

Linked Deferred

Compensation

Ability to drive +20%(1) return on cash investment from Day 1

CHURCHILL

CAPITAL VII

Acquisition Structure Benefits

Status as a "preferred buyer" enables CorpAcq to

purchase founder led SMEs for attractive

multiples

Immediate and growing

free cash flow(2) for dividend

CorpAcq

Potential to add attractive returns

on deployed capital

Entry to public markets can provide the potential for equity-linked compensation to help drive returns

Source: CorpAcq Management.

(1) Return on cash investment for acquisitions is defined as operating income minus tax, interest and debt service divided by CorpAcq's cash investment. Return metrics for target acquisition are based on seven of CorpAcq's recently completed

acquisitions between 2019-2023 and do not represent the performance of entire portfolio. Past performance is not indicative of future results. (2) Free cash flow is defined as cash flow from operations minus net CapEx. See reconciliation in

appendix for definition of net CapEx.

I

1

1

IView entire presentation