LSE Mergers and Acquisitions Presentation Deck

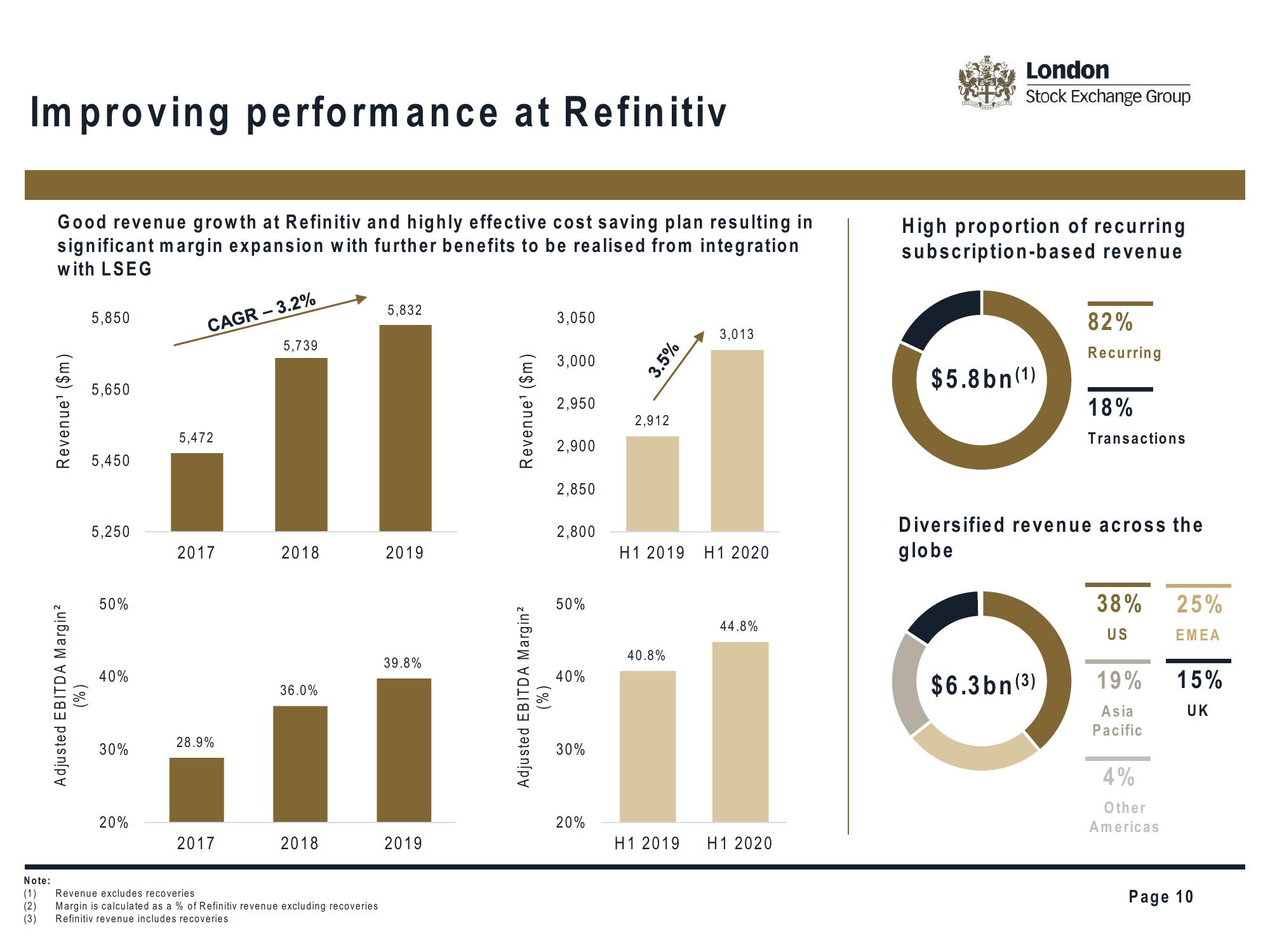

Improving performance at Refinitiv

Good revenue growth at Refinitiv and highly effective cost saving plan resulting in

significant margin expansion with further benefits to be realised from integration

with LSEG

Revenue¹ ($m)

Adjusted EBITDA Margin²

(%)

5,850

5,650

5,450

5,250

50%

40%

30%

20%

CAGR - 3.2%

5,472

2017

28.9%

5,739

2017

2018

36.0%

5,832

Note:

(1)

Revenue excludes recoveries

(2) Margin is calculated as a % of Refinitiv revenue excluding recoveries

(3) Refinitiv revenue includes recoveries

2019

7 2018

18 2 2019

39.8%

Revenue¹ ($m)

Adjusted EBITDA Margin²

(%)

3,050

3,000

2,950

2,900

2,850

2,800

50%

40%

30%

20%

3.5%

2,912

40.8%

3,013

H1 2019 H1 2020

44.8%

H1 2019 H1 2020

London

Stock Exchange Group

High proportion of recurring

subscription-based revenue

$5.8bn (1)

82%

Recurring

$6.3bn (3)

18%

Transactions

Diversified revenue across the

globe

38%

US

19%

Asia

Pacific

4%

Other

Americas

25%

ΕΜΕΑ

15%

UK

Page 10View entire presentation