Silicon Valley Bank Results Presentation Deck

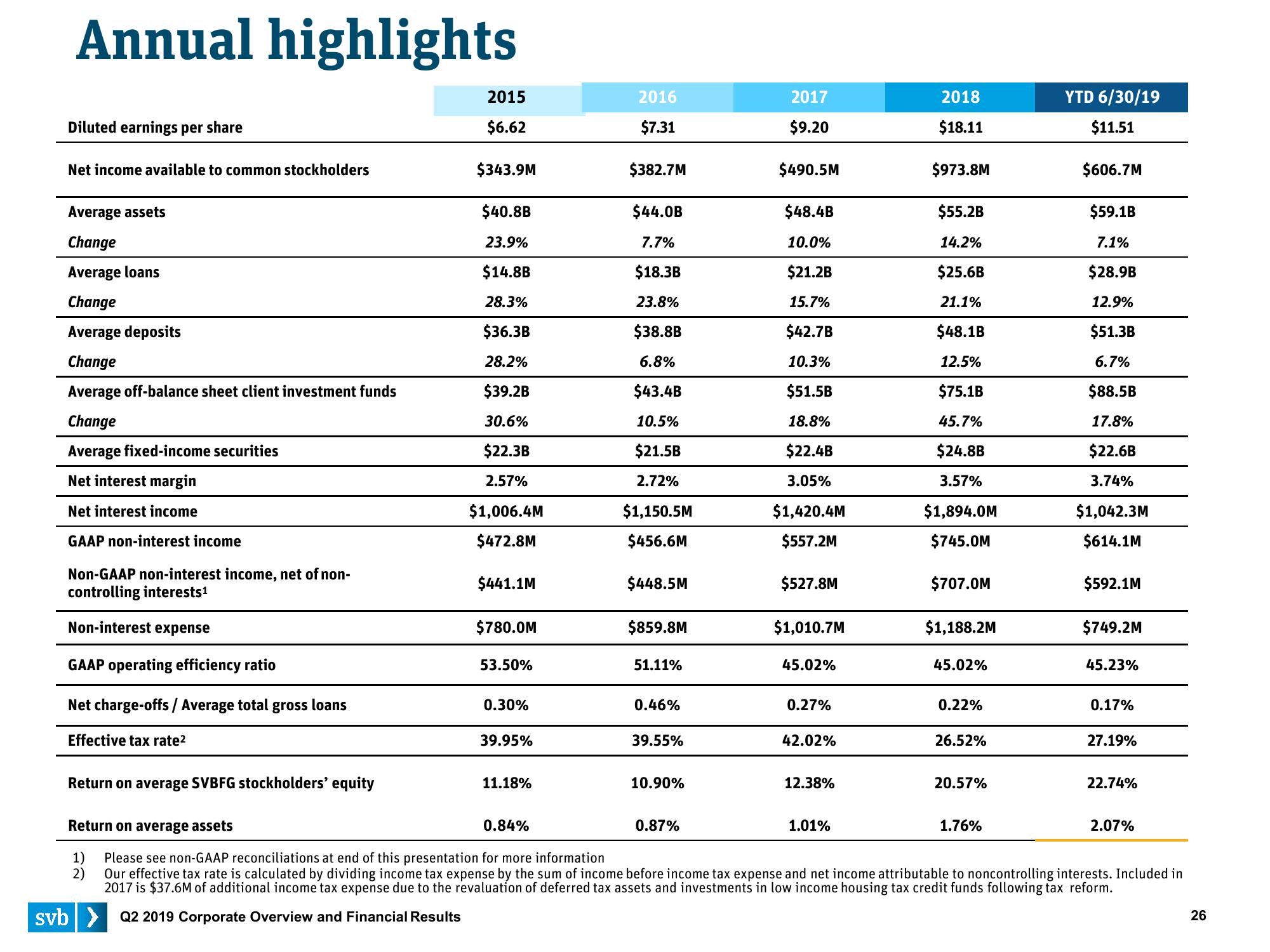

Annual highlights

Diluted earnings per share

Net income available to common stockholders

Average assets

Change

Average loans

Change

Average deposits

Change

Average off-balance sheet client investment funds

Change

Average fixed-income securities

Net interest margin

Net interest income

GAAP non-interest income

Non-GAAP non-interest income, net of non-

controlling interests¹

Non-interest expense

GAAP operating efficiency ratio

Net charge-offs / Average total gross loans

Effective tax rate²

Return on average SVBFG stockholders' equity

2015

$6.62

$343.9M

$40.8B

23.9%

$14.8B

28.3%

$36.3B

28.2%

$39.2B

30.6%

$22.3B

2.57%

$1,006.4M

$472.8M

$441.1M

$780.0M

53.50%

0.30%

39.95%

11.18%

2016

$7.31

$382.7M

$44.0B

7.7%

$18.3B

23.8%

$38.8B

6.8%

$43.4B

10.5%

$21.5B

2.72%

$1,150.5M

$456.6M

$448.5M

$859.8M

51.11%

0.46%

39.55%

10.90%

2017

$9.20

$490.5M

$48.4B

10.0%

$21.2B

15.7%

$42.7B

10.3%

$51.5B

18.8%

$22.4B

3.05%

$1,420.4M

$557.2M

$527.8M

0.87%

$1,010.7M

45.02%

0.27%

42.02%

12.38%

2018

$18.11

1.01%

$973.8M

$55.2B

14.2%

$25.6B

21.1%

$48.1B

12.5%

$75.1B

45.7%

$24.8B

3.57%

$1,894.0M

$745.0M

$707.0M

$1,188.2M

45.02%

0.22%

26.52%

20.57%

YTD 6/30/19

$11.51

1.76%

$606.7M

$59.1B

7.1%

$28.9B

12.9%

$51.3B

6.7%

$88.5B

17.8%

$22.6B

3.74%

$1,042.3M

$614.1M

$592.1M

$749.2M

45.23%

0.17%

Return on average assets

0.84%

1)

2)

Please see non-GAAP reconciliations at end of this presentation for more information

Our effective tax rate is calculated by dividing income tax expense by the sum of income before income tax expense and net income attributable to noncontrolling interests. Included in

2017 is $37.6M of additional income tax expense due to the revaluation of deferred tax assets and investments in low income housing tax credit funds following tax reform.

svb> Q2 2019 Corporate Overview and Financial Results

27.19%

22.74%

2.07%

26View entire presentation