First Foundation Investor Presentation Deck

Loyal Clients and Growing Assets

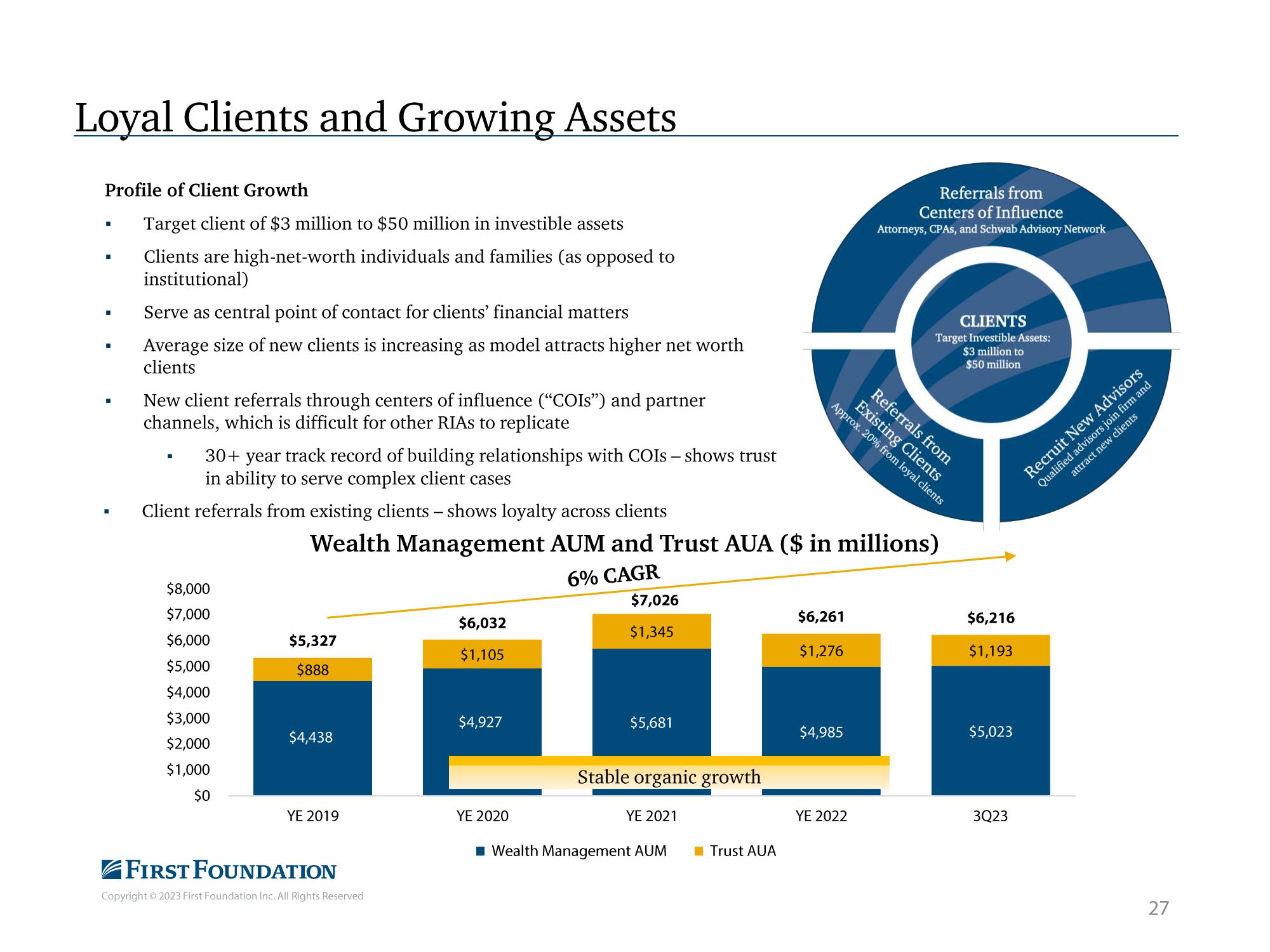

Profile of Client Growth

Target client of $3 million to $50 million in investible assets

Clients are high-net-worth individuals and families (as opposed to

institutional)

■

■

Serve as central point of contact for clients' financial matters

Average size of new clients is increasing as model attracts higher net worth

clients

New client referrals through centers of influence ("COIS") and partner

channels, which is difficult for other RIAS to replicate

30+ year track record of building relationships with COIS - shows trust

in ability to serve complex client cases

Client referrals from existing clients - shows loyalty across clients

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

$5,327

$888

$4,438

Wealth Management AUM and Trust AUA ($ in millions)

6% CAGR

YE 2019

FIRST FOUNDATION

Copyright © 2023 First Foundation Inc. All Rights Reserved

$6,032

$1,105

$4,927

YE 2020

$7,026

$1,345

$5,681

Stable organic growth

YE 2021

■ Wealth Management AUM ■Trust AUA

$6,261

$1,276

$4,985

Referrals from

Centers of Influence

Attorneys, CPAs, and Schwab Advisory Network

YE 2022

CLIENTS

Target Investible Assets:

$3 million to

$50 million

Referrals from

Approx. 20% from loyal clients

Existing Clients

$6,216

$1,193

$5,023

3Q23

Recruit New Advisors

Qualified advisors join firm and

attract new clients

27View entire presentation