Lyft Investor Presentation Deck

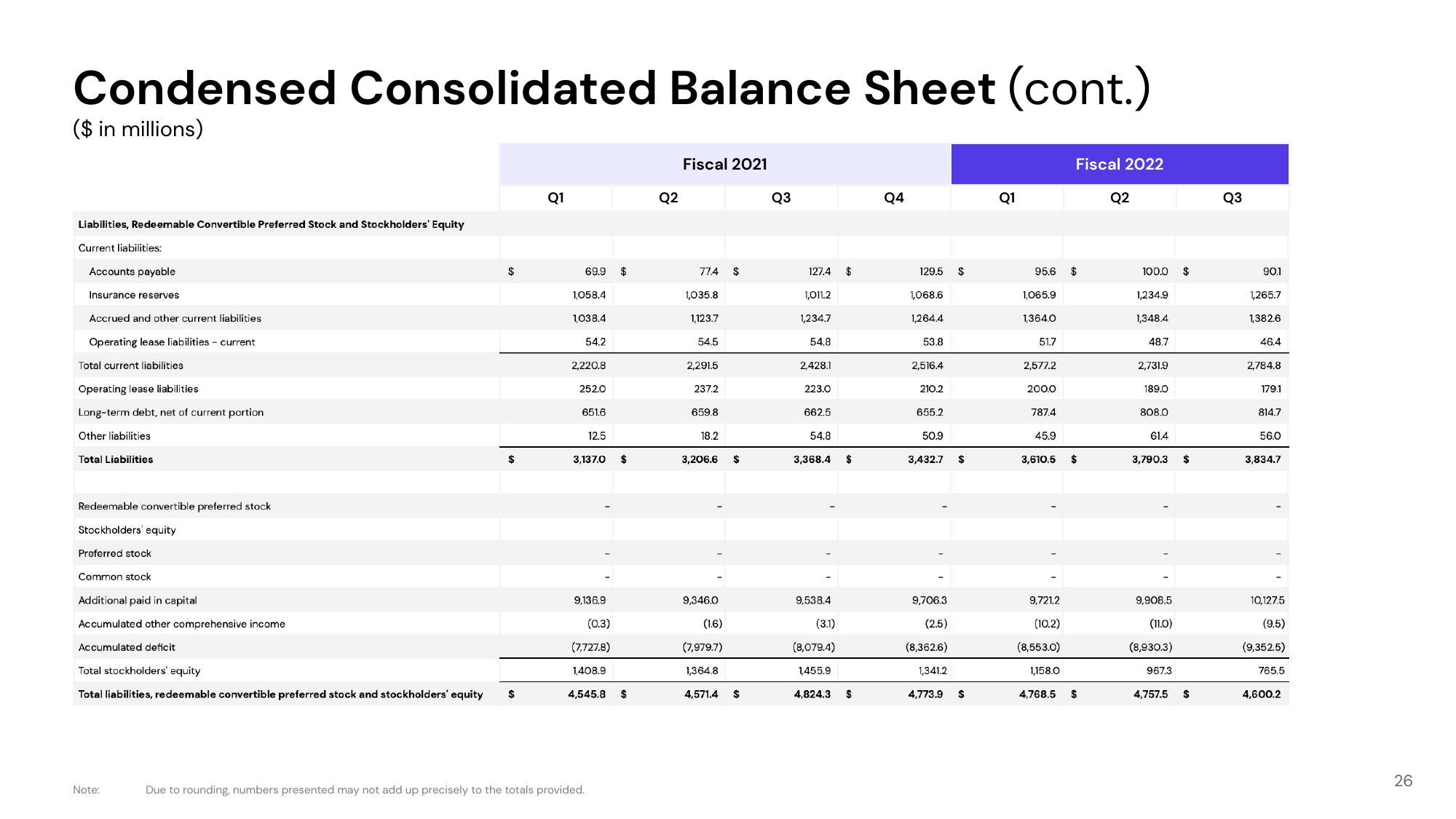

Condensed Consolidated Balance Sheet (cont.)

($ in millions)

Liabilities, Redeemable Convertible Preferred Stock and Stockholders' Equity

Current liabilities:

Accounts payable

Insurance reserves

Accrued and other current liabilities

Operating lease liabilities - current

Total current liabilities

Operating lease liabilities

Long-term debt, net of current portion

Other liabilities.

Total Liabilities

Redeemable convertible preferred stock

Stockholders' equity.

Preferred stock

Common stock

Additional paid in capital

Accumulated other comprehensive income

Accumulated deficit

$

Note:

$

Total stockholders' equity

Total liabilities, redeemable convertible preferred stock and stockholders' equity $

Q1

69.9 $

1,058.4

1038.4

54.2

2,220.8

252.0

651.6

12.5

3,137.0

9,136.9

(0.3)

(7,727.8)

1,408.9

4,545.8

Due to rounding, numbers presented may not add up precisely to the totals provided.

$

$

Q2

Fiscal 2021

774

1,035.8

1,123.7

54.5

2,291.5

237.2

659.8

18.2

3,206.6 $

9,346.0

$

(1.6)

(7,979.7)

1,364.8

4,571.4

$

Q3

127.4 $

1,011.2

1,234.7

54.81

2,428.1

223.0

662.5

54.8

3,368.4 $

9,538.4

(3.1)

(8,079.4)

1,455.9

4,824.3 $

Q4

129.5 $

1,068.6

1,264.4

53.8

2,516.4

210.2

655.2

50.9

3,432.7

9,706.3.

(2.5)

(8,362.6)

1,341.2

4,773.9

$

$

Q1

95.6 $

1,065.9

1,364.0

51.7

2,577.2

200.0

787.4

45.9

Fiscal 2022

3,610.5

$

9,721.2

(10.2)

(8,553.0)

1,158.0

4,768.5 $

Q2

100.0

1,234.9

1,348.4

48.7

2,731.9

189.0

808.0

61.4

3,790.3

9,908.5

(11.0)

(8,930.3)

967.3

4,757.5

$

$

Q3

90.1

1,265.7

1,382.6

46.4

2,784.8

179.1

814.7

56.0

3,834.7

10,127.5

(9.5)

(9,352.5)

765.5

4,600.2

26View entire presentation